Livent Corporation Investor Presentation

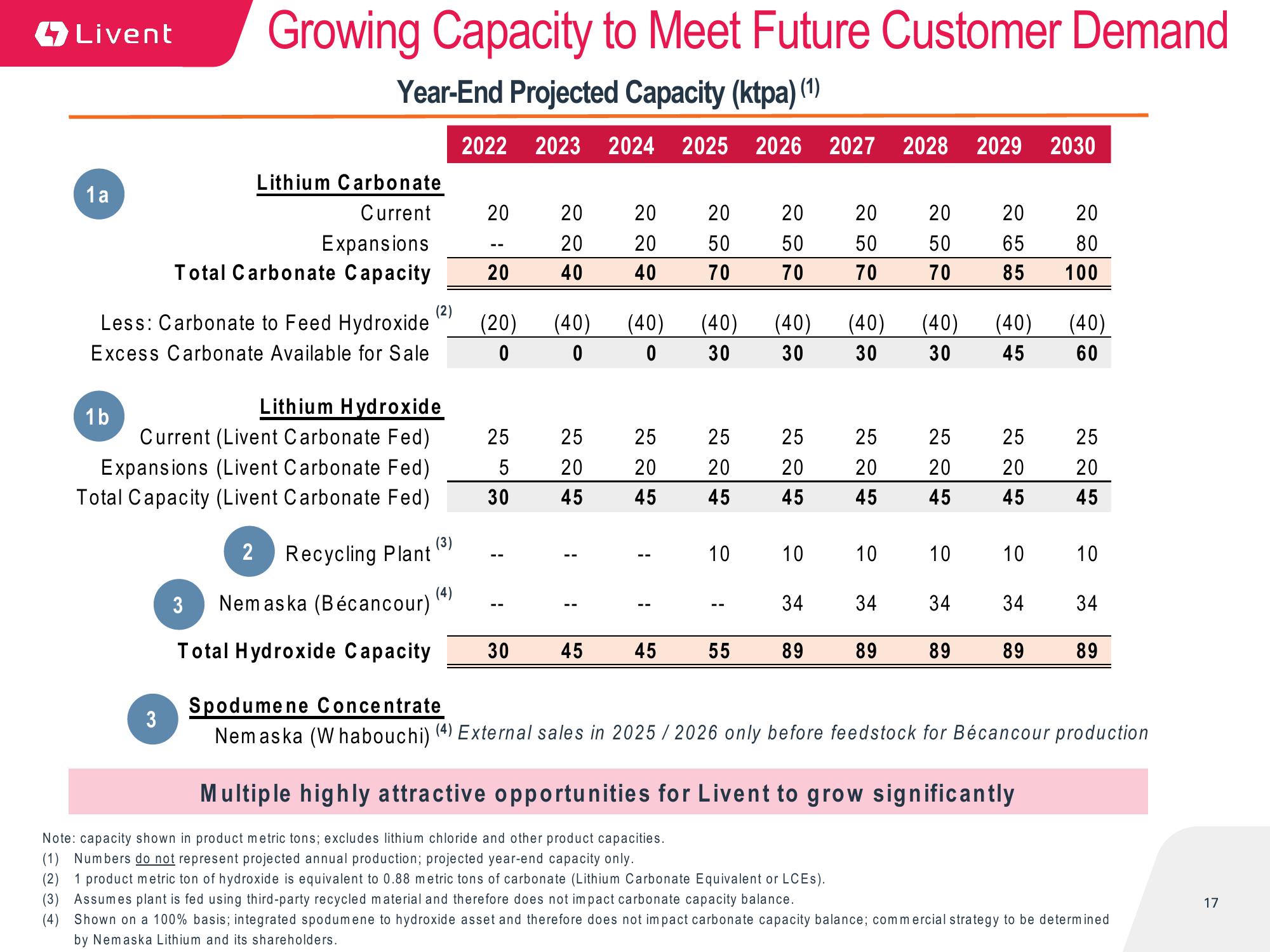

Livent Growing Capacity to Meet Future Customer Demand

Year-End Projected Capacity (ktpa) (1)

1a

Lithium Carbonate

Current

Less: Carbonate to Feed Hydroxide

Excess Carbonate Available for Sale

1b

Expansions

Total Carbonate Capacity

Lithium Hydroxide

Current (Livent Carbonate Fed)

Expansions (Livent Carbonate Fed)

Total Capacity (Livent Carbonate Fed)

3

2 Recycling Plant

(3)

(4)

2022 2023 2024 2025 2026 2027

20

--

20

(20) (40)

0

0

25

5

30

20

20

40

30

224

25

20

45

1

20

20

40

45

(40)

0

224

20

1

20

50

70

45

(40)

30

25

20

45

10

20

50

70

55

(40) (40)

30

30

25

20

45

10

34

20

50

70

89

25

20

45

Note: capacity shown in product metric tons; excludes lithium chloride and other product capacities.

(1) Numbers do not represent projected annual production; projected year-end capacity only.

(2) 1 product metric ton of hydroxide is equivalent to 0.88 metric tons of carbonate (Lithium Carbonate Equivalent or LCES).

10

2028 2029 2030

20

50

70

34

(40)

30

25

20

45

10

34

89 89

20

65

85

(40)

45

2246

25

20

45

3 Nemaska (Bécancour)

Total Hydroxide Capacity

Spodumene Concentrate

Nemaska (W habouchi) (4) External sales in 2025 2026 only before feedstock for Bécancour production

10

34

89

Multiple highly attractive opportunities for Livent to grow significantly

20

80

100

(40)

60

224

25

20

45

10

34

89

(3) Assumes plant is fed using third-party recycled material and therefore does not impact carbonate capacity balance.

(4) Shown on a 100% basis; integrated spodumene to hydroxide asset and therefore does not impact carbonate capacity balance; commercial strategy to be determined

by Nemaska Lithium and its shareholders.

17View entire presentation