Astra SPAC Presentation Deck

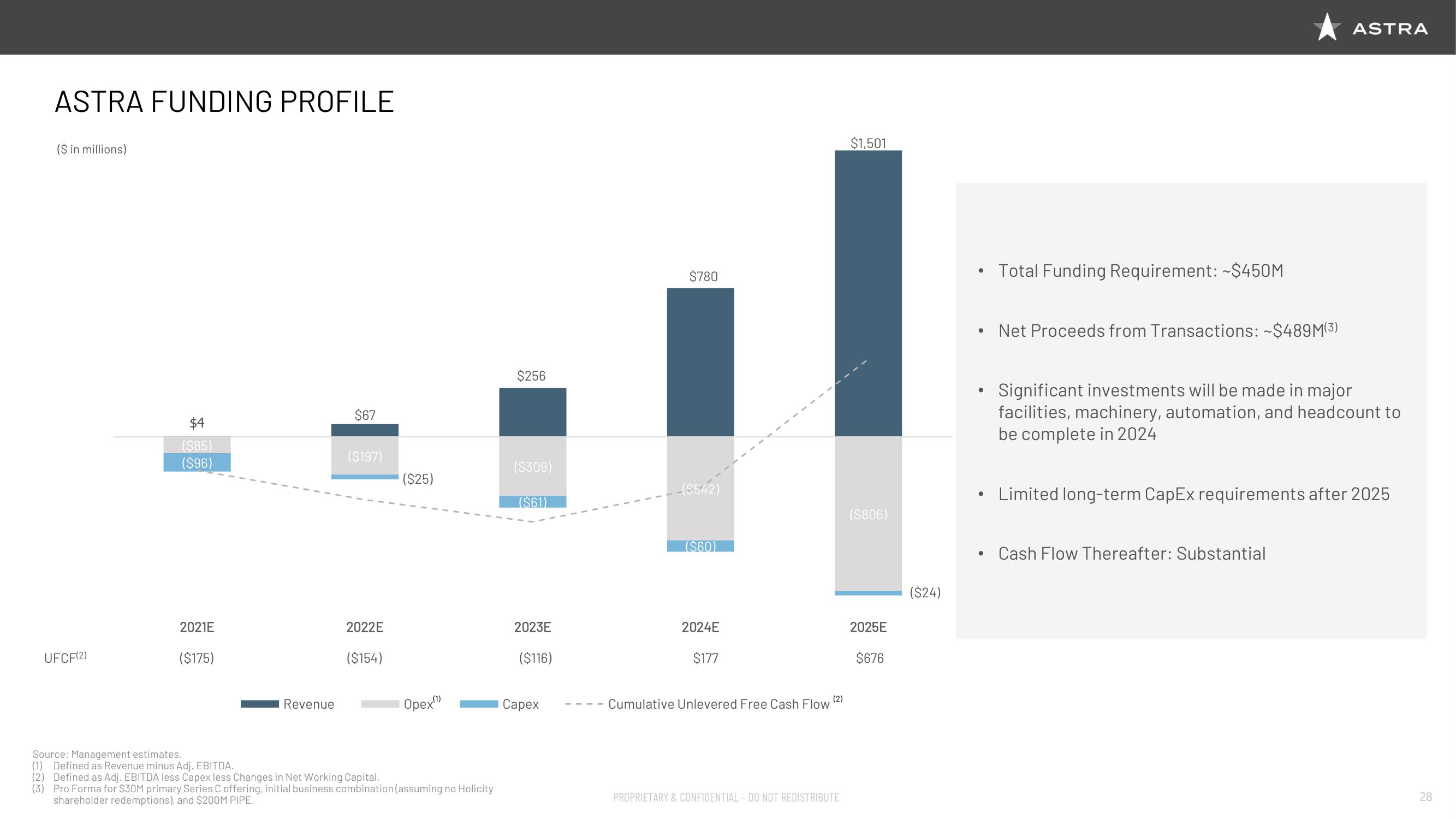

ASTRA FUNDING PROFILE

($ in millions)

UFCF(2)

$4

($85)

($96)

2021E

($175)

Revenue

$67

($197)

2022E

($154)

($25)

Opex(¹)

Source: Management estimates.

(1) Defined as Revenue minus Adj. EBITDA.

(2) Defined as Adj. EBITDA less Capex less Changes in Net Working Capital.

(3) Pro Forma for $30M primary Series C offering, initial business combination (assuming no Holicity

shareholder redemptions), and $200M PIPE.

$256

($309)

($61)

2023E

($116)

Capex

$780

-($542)

($60)

2024E

$177

Cumulative Unlevered Free Cash Flow

(2)

PROPRIETARY & CONFIDENTIAL - DO NOT REDISTRIBUTE

$1,501

($806)

2025E

$676

($24)

●

●

●

●

Total Funding Requirement: ~$450M

Net Proceeds from Transactions: ~$489M(3)

ASTRA

Significant investments will be made in major

facilities, machinery, automation, and headcount to

be complete in 2024

Limited long-term CapEx requirements after 2025

Cash Flow Thereafter: Substantial

28View entire presentation