Bank of America Investment Banking Pitch Book

Appendix

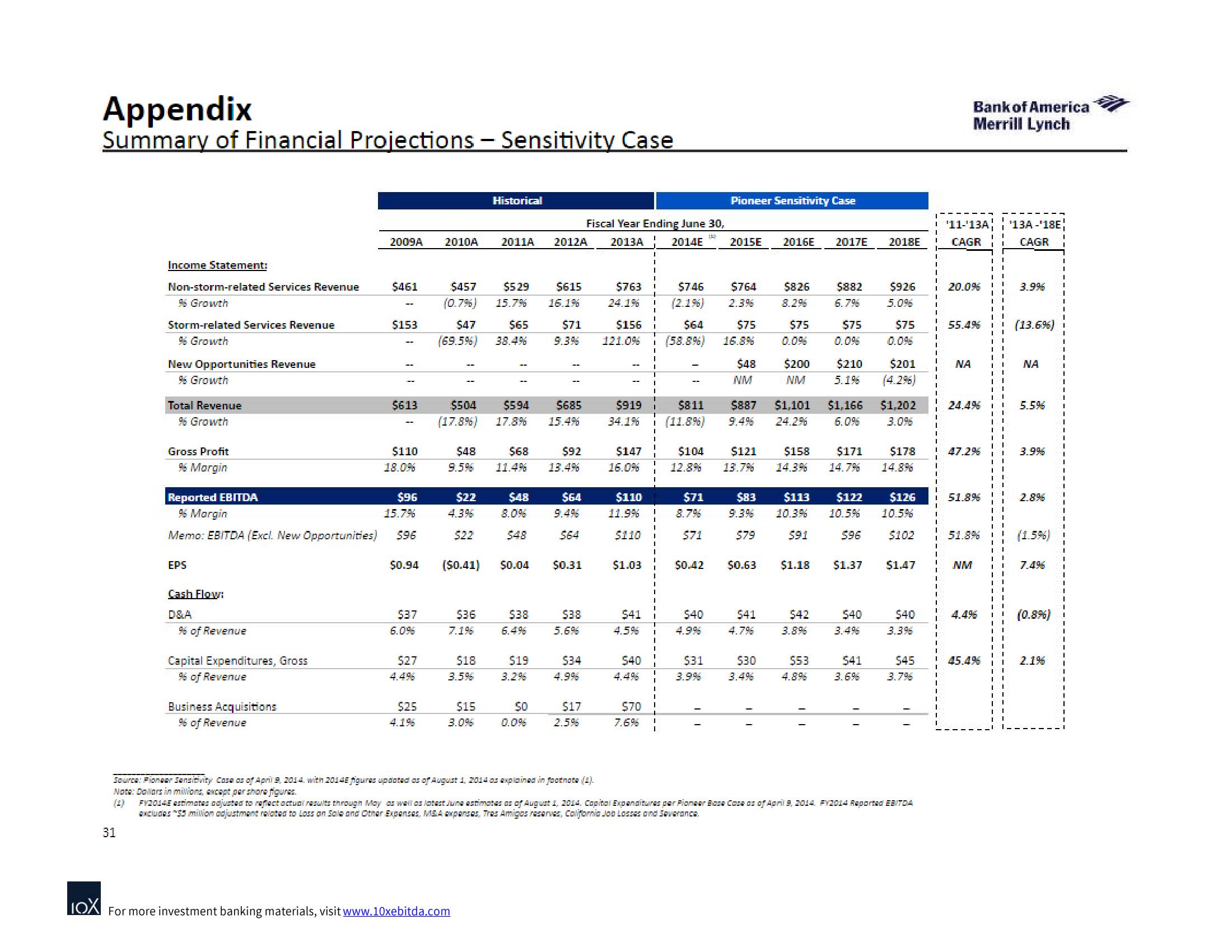

Summary of Financial Projections - Sensitivity Case

Income Statement:

Non-storm-related Services Revenue

96 Growth

31

Storm-related Services Revenue

96 Growth

New Opportunities Revenue

% Growth

Total Revenue

96 Growth

Gross Profit

96 Margin

EPS

Cash Flow:

D&A

96 of Revenue

Capital Expenditures, Gross

96 of Revenue

2009A 2010A

Reported EBITDA

96 Margin

Memo: EBITDA (Excl. New Opportunities) 596

Business Acquisitions

96 of Revenue

$461

$153

$613

$110

18.0%

$96

15.7%

$0.94

$37

6.0%

$27

4.496

$25

4.196

$457 $5.29

(0.7%) 15.7%

$504

(17.896)

$47 $65

(69.5%) 38.4%

$22

4.3%

$22

($0.41)

$48

$68 $92

9.595 11.4% 13.4%

$36

7.196

Historical

$18

3.5%6

LOX For more investment banking materials, visit www.10xebitda.com

2011A

$15

3.096

$594 $685

17.8% 15.4%

$48

8.0%

$48

$0.04

$38

6.4%

$19

3.2%

Fiscal Year Ending June 30,

2012A 2013A 2014E

12

I

50

$615

16.1%

$71

0.0%

$64

$64

$0.31

$38

5.6%

$34

4.9%

$17

Source: Pioneer Sensitivity Cosa as of April 9, 2014. with 2014 figuras updated as of August 1, 2014 as explained in footnote (1).

Note: Dollars in milions, except per share figures.

2.5%

$763

24.1%

$156

121.0%

$919

34.1%

$147

16.0%

$110

11.9%

$110

$1.03

$41

4.5%

$40

$70

I

1

I

I

I

$811

(11.8%6)

$7.46

(2.1%)

$64 $75

(58.896) 16.8%

$71

8.7%

$71

$0.42

$40

4.9%

Pioneer Sensitivity Case

$31

2015E

3.9%

$764

2.3%

$104

$121 $158 $171

12.8% 13.7% 14.3% 14.7%

$48

NM

$887

$83

9.3%

$79

$0.63

$41

4.7%

$30

2016E 2017E 2018E

3.4%

$826

8.296

$75

$200

NM

$1,101 $1,166

24.2% 6.0%

$882

6.7%

$75

$210

5.1%

$42

3.896

$53

$113 $122 $126

10.3% 10.5% 10.5%

$91

596

$102

$40

$926

5.096

$1.18 $1.37 $1.47

3.4%

$75

0.096

$201

$41

$1,202

3.0%

$178

14.8%

$40

3.3%

(4) FY2014E estimates adjusted to reflect actual results through May as well as latest June estimates as of August 1, 2014. Capital Expenditures par Pioneer Bose Cose as of April 9, 2014. FY2014 Reported EBITDA

excludes "$3 million adjustment related to Loss on Sale and Other Expenses, M&A expenses, Tres Amigos reserves, California Job Losses and Saverance.

$45

3.796

I

I

'11-'13A

CAGR

Bank of America

Merrill Lynch

20.0%

55.4%

ΝΑ

47.2%

51.8%

51.8%

NM

45.4%

'13A-'18E

CAGR

3.996

(13.6%)

ΝΑ

5.5%

3.9%

2.8%

(1.5%)

7.4%

(0.8%)

2.1%View entire presentation