J.P.Morgan Results Presentation Deck

Asset & Wealth Management¹

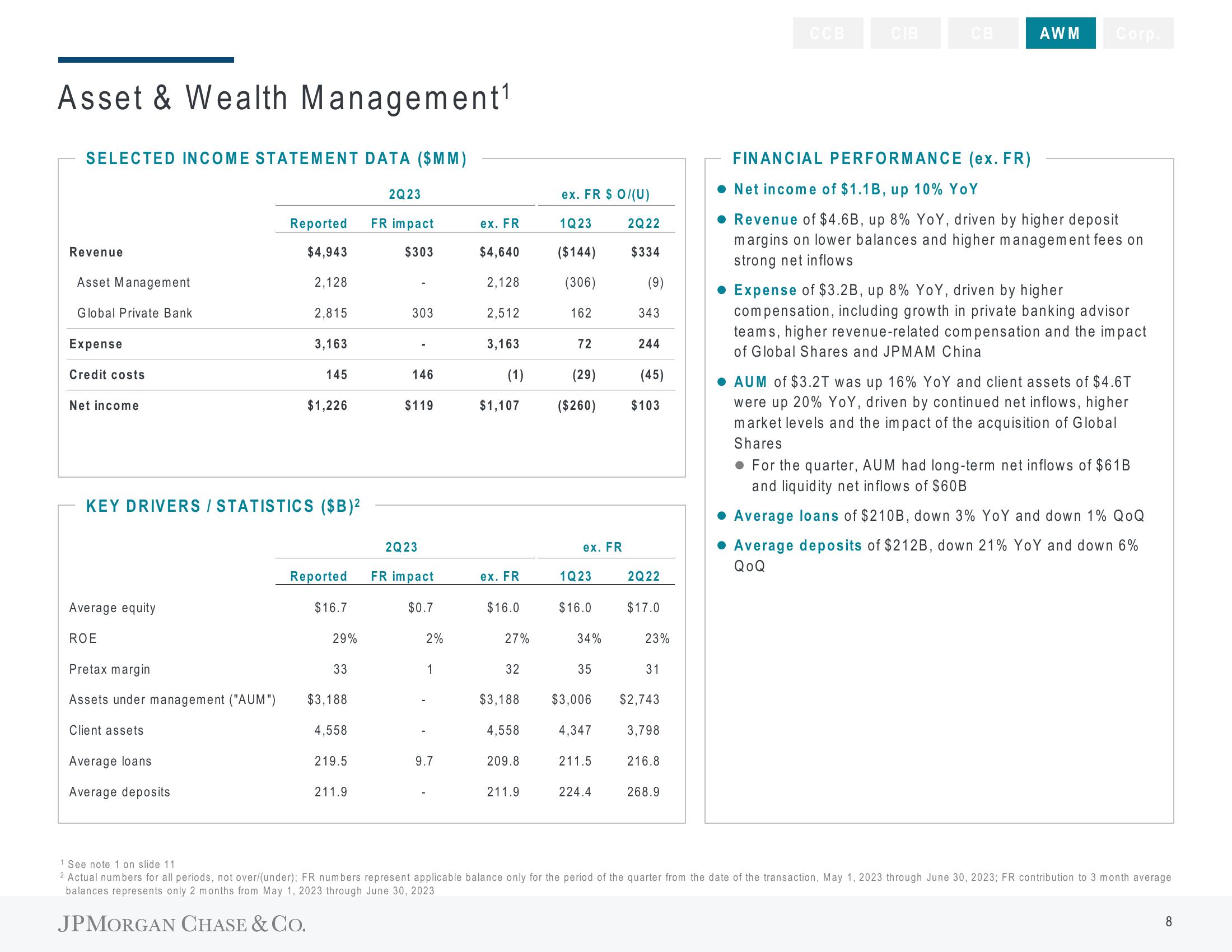

SELECTED INCOME STATEMENT DATA ($MM)

Revenue

Asset Management

Global Private Bank

Expense

Credit costs

Net income

Average equity

ROE

Pretax margin

Assets under management ("AUM")

Client assets

Reported

$4,943

2,128

Average loans

Average deposits

2,815

KEY DRIVERS / STATISTICS ($B)²

3,163

145

$1,226

Reported

$16.7

29%

33

$3,188

4,558

219.5

211.9

2Q23

FR impact

$303

303

146

$119

2Q23

FR impact

$0.7

2%

1

9.7

ex. FR

$4,640

2,128

2,512

3,163

(1)

$1,107

ex. FR

$16.0

27%

32

$3,188

4,558

209.8

211.9

ex. FR $ 0/(U)

1Q23

($144)

(306)

162

72

(29)

($260)

ex. FR

1Q23

$16.0

34%

35

4,347

211.5

2Q22

224.4

$334

(9)

343

244

(45)

$103

2Q22

$17.0

$3,006 $2,743

3,798

23%

31

216.8

268.9

CCB

CIB

AWM Corp.

FINANCIAL PERFORMANCE (ex. FR)

Net income of $1.1B, up 10% YoY

Revenue of $4.6B, up 8% YoY, driven by higher deposit

margins on lower balances and higher management fees on

strong net inflows

Expense of $3.2B, up 8% YoY, driven by higher

compensation, including growth in private banking advisor

teams, higher revenue-related compensation and the impact

of Global Shares and JPMAM China

AUM of $3.2T was up 16% YoY and client assets of $4.6T

were up 20% YoY, driven by continued net inflows, higher

market levels and the impact of the acquisition of Global

Shares

For the quarter, AUM had long-term net inflows of $61B

and liquidity net inflows of $60B

Average loans of $210B, down 3% YoY and down 1% QOQ

Average deposits of $212B, down 21% YoY and down 6%

QoQ

1 See note 1 on slide 11

2 Actual numbers for all periods, not over/(under); FR numbers represent applicable balance only for the period of the quarter from the date of the transaction, May 1, 2023 through June 30, 2023; FR contribution to 3 month average

balances represents only 2 months from May 1, 2023 through June 30, 2023

JPMORGAN CHASE & CO.

8View entire presentation