Credit Suisse Investment Banking Pitch Book

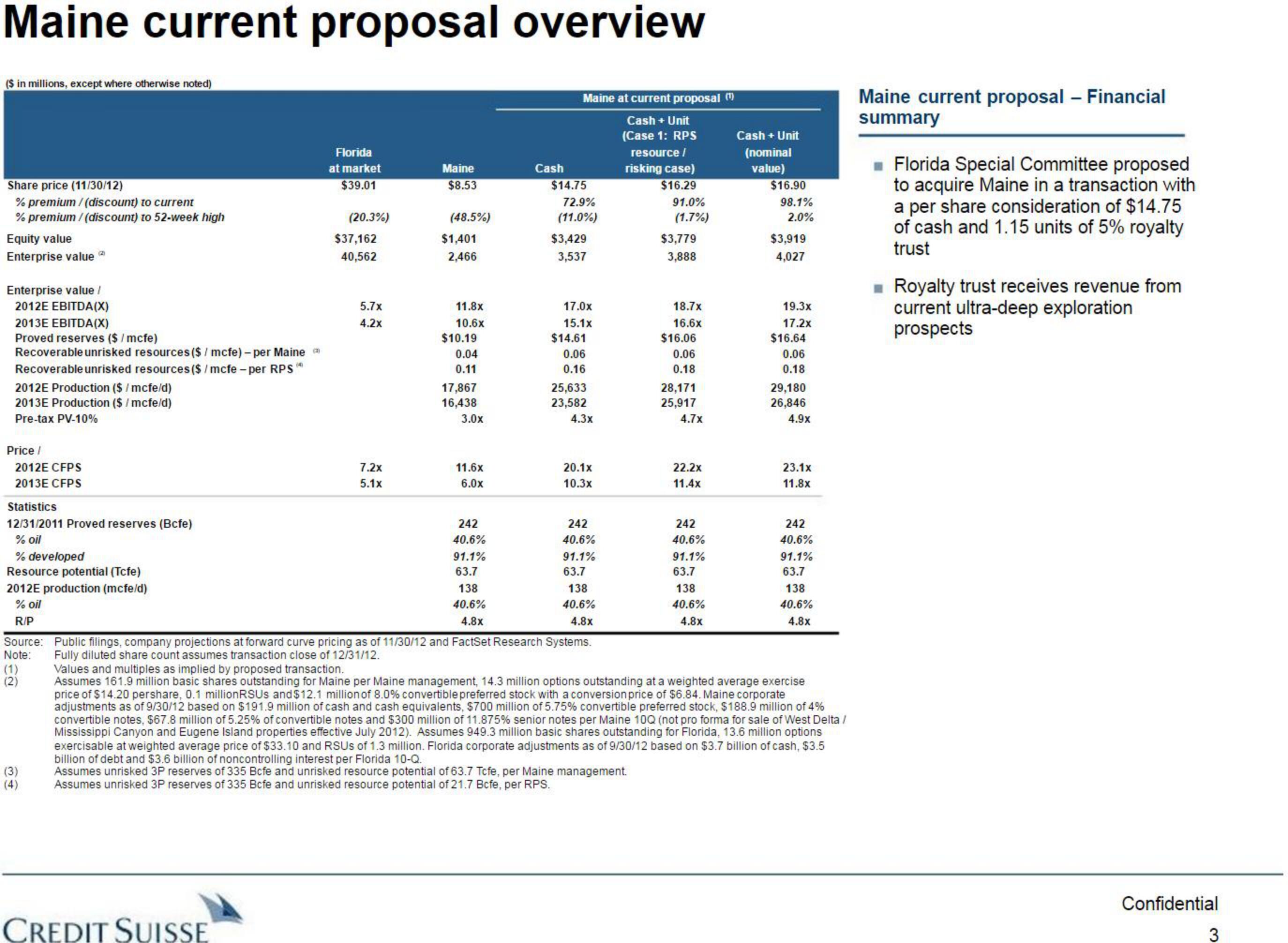

Maine current proposal overview

($ in millions, except where otherwise noted)

Share price (11/30/12)

% premium/(discount) to current

% premium/(discount) to 52-week high

Equity value

Enterprise value

Enterprise value /

2012E EBITDA(X)

2013E EBITDA(X)

Proved reserves ($/mcfe)

Recoverable unrisked resources ($/mcfe) -per Maine

Recoverable unrisked resources ($/mcfe - per RPS**

2012E Production ($/mcfe/d)

2013E Production ($/mcfe/d)

Pre-tax PV-10%

Price /

2012E CFPS

2013E CFPS

Statistics

12/31/2011 Proved reserves (Bcfe)

% oil

% developed

Resource potential (Tcfe)

2012E production (mcfe/d)

% oil

R/P

(1)

(2)

(3)

(4)

Florida

at market

$39.01

CREDIT SUISSE

(20.3%)

$37,162

40,562

5.7x

4.2x

7.2x

5.1x

Maine

$8.53

(48.5%)

$1,401

2,466

11.8x

10.6x

$10.19

0.04

0.11

17,867

16,438

3.0x

11.6x

6.0x

242

40.6%

91.1%

63.7

138

40.6%

4.8x

Cash

Maine at current proposal (

Cash + Unit

(Case 1: RPS

resource /

risking case)

$16.29

$14.75

72.9%

(11.0%)

$3,429

3,537

17.0x

15.1x

$14.61

0.06

0.16

25,633

23,582

4.3x

20.1x

10.3x

242

40.6%

91.1%

63.7

138

40.6%

4.8x

91.0%

(1.7%)

$3,779

3,888

18.7x

16.6x

$16.06

0.06

0.18

28,171

25,917

4.7x

22.2x

11.4x

242

40.6%

91.1%

63.7

138

40.6%

4.8x

Cash + Unit

(nominal

value)

$16.90

98.1%

2.0%

$3,919

4,027

19.3x

17.2x

$16.64

0.06

0.18

29,180

26,846

4.9x

23.1x

11.8x

242

40.6%

Source: Public filings, company projections at forward curve pricing as of 11/30/12 and FactSet Research Systems.

Note: Fully diluted share count assumes transaction close of 12/31/12.

Values and multiples as implied by proposed transaction.

Assumes 161.9 million basic shares outstanding for Maine per Maine management, 14.3 million options outstanding at a weighted average exercise

price of $14.20 pershare, 0.1 million RSUs and $12.1 million of 8.0% convertible preferred stock with a conversion price of $6.84. Maine corporate

adjustments as of 9/30/12 based on $191.9 million of cash and cash equivalents, $700 million of 5.75% convertible preferred stock, $188.9 million of 4%

convertible notes, $67.8 million of 5.25% of convertible notes and $300 million of 11.875% senior notes per Maine 10Q (not pro forma for sale of West Delta /

Mississippi Canyon and Eugene Island properties effective July 2012). Assumes 949.3 million basic shares outstanding for Florida, 13.6 million options

exercisable at weighted average price of $33.10 and RSUS of 1.3 million. Florida corporate adjustments as of 9/30/12 based on $3.7 billion of cash, $3.5

billion of debt and $3.6 billion of noncontrolling interest per Florida 10-Q.

Assumes unrisked 3P reserves of 335 Bcfe and unrisked resource potential of 63.7 Tcfe, per Maine management.

Assumes unrisked 3P reserves of 335 Bcfe and unrisked resource potential of 21.7 Bcfe, per RPS.

91.1%

63.7

138

40.6%

4.8x

Maine current proposal - Financial

summary

Florida Special Committee proposed

to acquire Maine in a transaction with

a per share consideration of $14.75

of cash and 1.15 units of 5% royalty

trust

Royalty trust receives revenue from

current ultra-deep exploration

prospects

Confidential

3View entire presentation