Ashtead Group Results Presentation Deck

NET DEBT

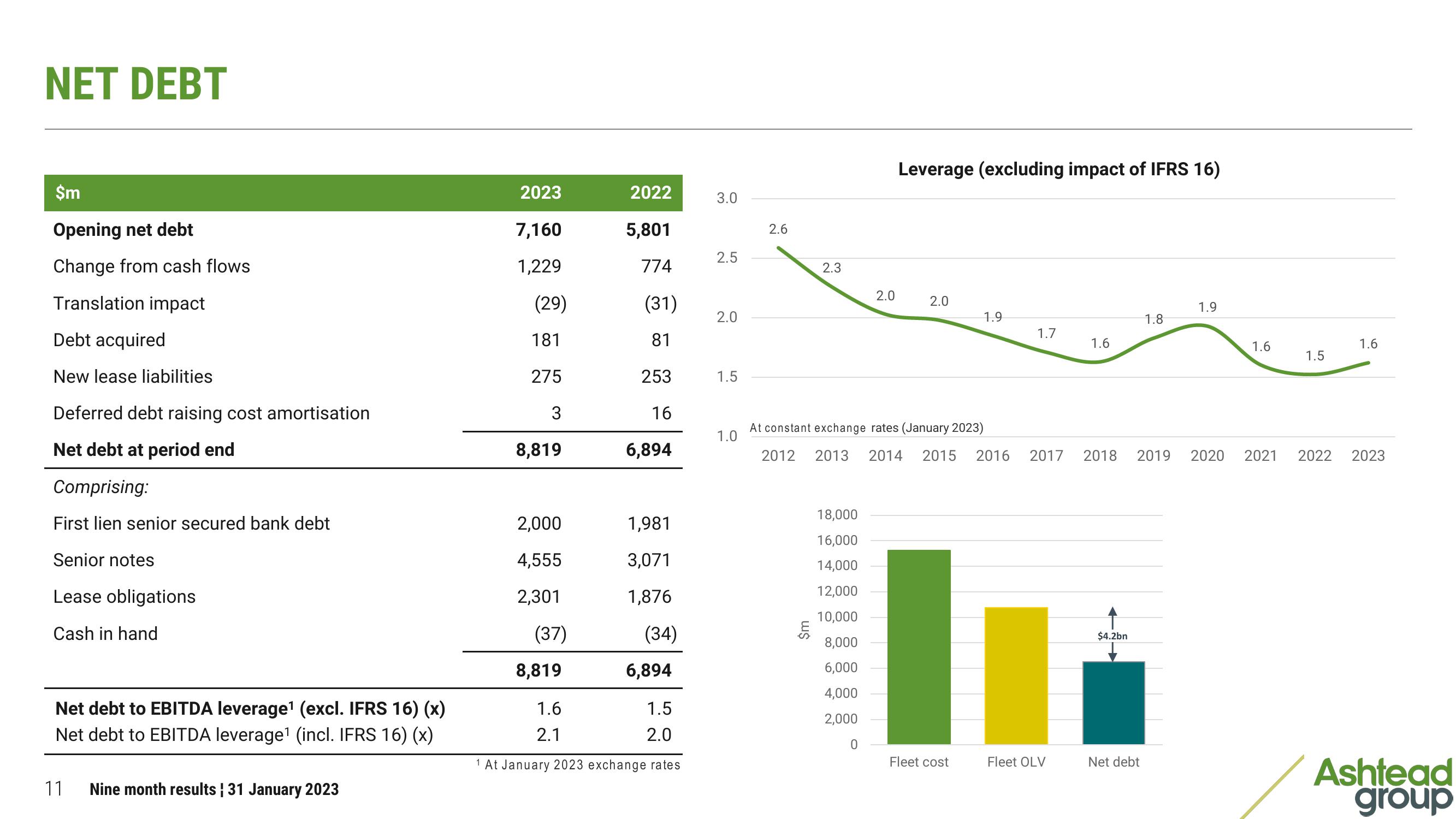

$m

Opening net debt

Change from cash flows

Translation impact

Debt acquired

New lease liabilities

Deferred debt raising cost amortisation

Net debt at period end

Comprising:

First lien senior secured bank debt

Senior notes

Lease obligations

Cash in hand

Net debt to EBITDA leverage¹ (excl. IFRS 16) (x)

Net debt to EBITDA leverage¹ (incl. IFRS 16) (x)

11

Nine month results | 31 January 2023

2023

7,160

1,229

(29)

181

275

3

8,819

2,000

4,555

2,301

(37)

8,819

1.6

2.1

2022

5,801

774

(31)

81

253

16

6,894

1,981

3,071

1,876

(34)

6,894

1.5

2.0

1 At January 2023 exchange rates

3.0

2.5

2.0

1.5

1.0

2.6

2.3

$m

2.0

18,000

16,000

14,000

12,000

10,000

8,000

6,000

4,000

2,000

0

Leverage (excluding impact of IFRS 16)

2.0

1.9

Fleet cost

1.7

At constant exchange rates (January 2023)

2012 2013 2014 2015 2016 2017 2018 2019 2020

1.6

Fleet OLV

$4.2bn

1.8

Net debt

1.9

1.6

1.5

2021 2022

1.6

2023

Ashtead

groupView entire presentation