Kinnevik Results Presentation Deck

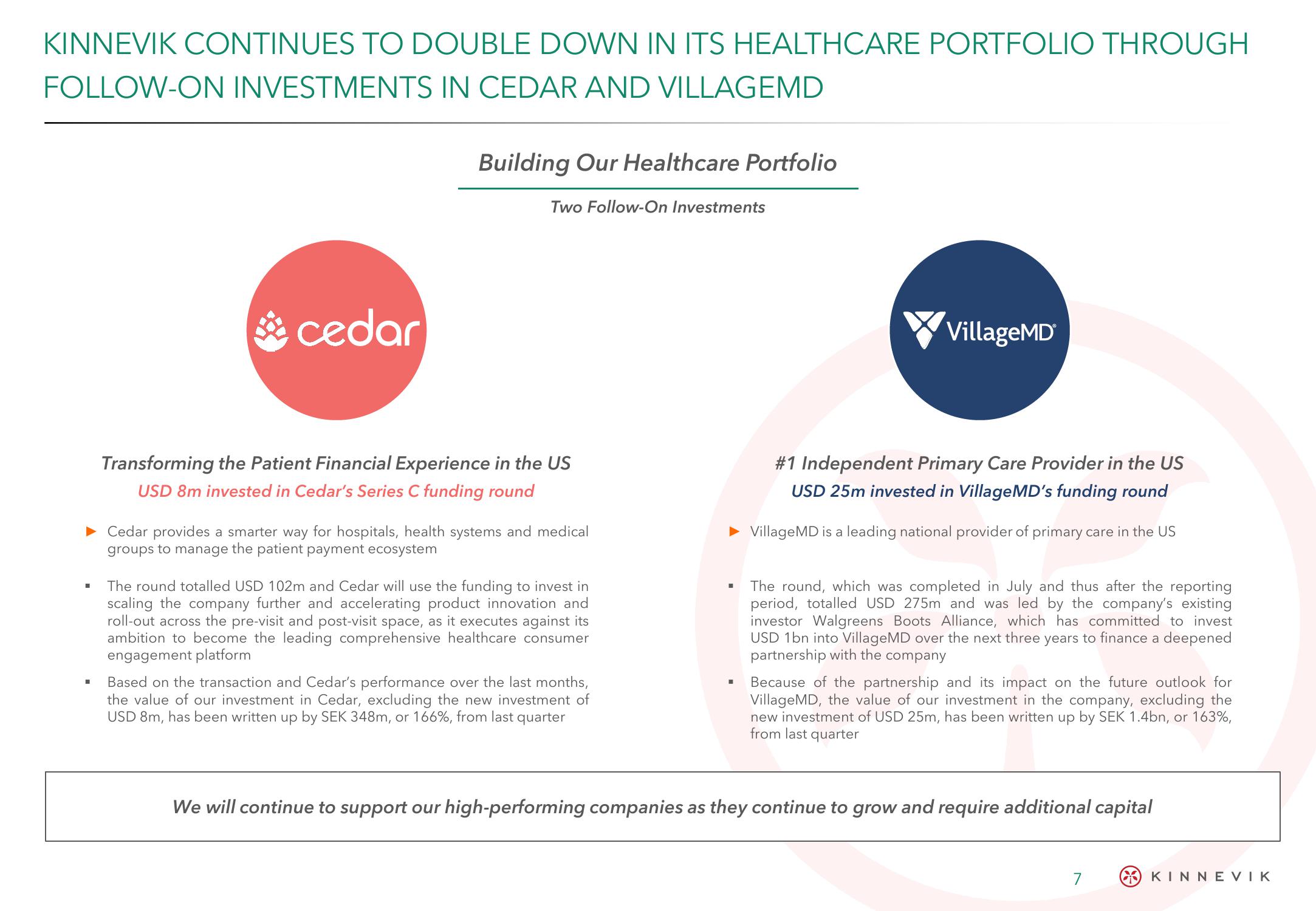

KINNEVIK CONTINUES TO DOUBLE DOWN IN ITS HEALTHCARE PORTFOLIO THROUGH

FOLLOW-ON INVESTMENTS IN CEDAR AND VILLAGEMD

■

cedar

Building Our Healthcare Portfolio

Two Follow-On Investments

Transforming the Patient Financial Experience in the US

USD 8m invested in Cedar's Series C funding round

dar provides a smarter way for hospitals, health systems and medical

groups to manage the patient payment ecosystem

The round totalled USD 102m and Cedar will use the funding to invest in

scaling the company further and accelerating product innovation and

roll-out across the pre-visit and post-visit space, as it executes against its

ambition to become the leading comprehensive healthcare consumer

engagement platform

Based on the transaction and Cedar's performance over the last months,

the value of our investment in Cedar, excluding the new investment of

USD 8m, has been written up by SEK 348m, or 166%, from last quarter

VillageMD

#1 Independent Primary Care Provider in the US

USD 25m invested in Village MD's funding round

► Village MD is a leading national provider of primary care in the US

■

The round, which was completed in July and thus after the reporting

period, totalled USD 275m and was led by the company's existing

investor Walgreens Boots Alliance, which has committed to invest

USD 1bn into VillageMD over the next three years to finance a deepened

partnership with the company

Because of the partnership and its impact on the future outlook for

VillageMD, the value of our investment in the company, excluding the

new investment of USD 25m, has been written up by SEK 1.4bn, or 163%,

from last quarter

We will continue to support our high-performing companies as they continue to grow and require additional capital

7

KINNEVIKView entire presentation