Telia Company Results Presentation Deck

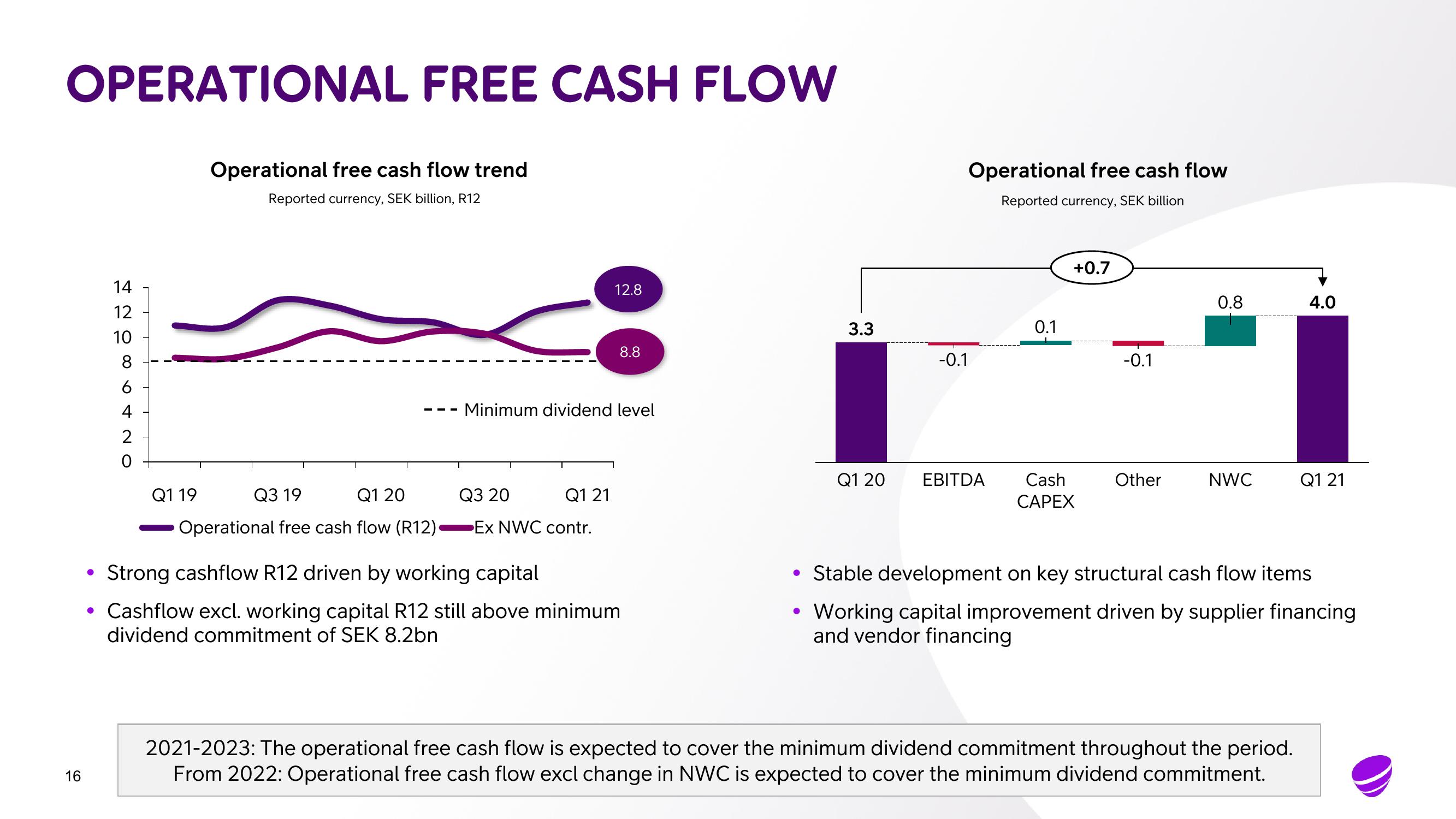

OPERATIONAL FREE CASH FLOW

16

14 12 10

●

8

6

4

2

Q1 19

Operational free cash flow trend

Reported currency, SEK billion, R12

Q3 19

Q1 20

Operational free cash flow (R12)

12.8

Q3 20

Q1 21

Ex NWC contr.

8.8

- Minimum dividend level

Strong cashflow R12 driven by working capital

• Cashflow excl. working capital R12 still above minimum

dividend commitment of SEK 8.2bn

3.3

●

-0.1

Operational free cash flow

Reported currency, SEK billion

Q1 20 EBITDA

0.1

Cash

CAPEX

+0.7

-0.1

Other

0.8

NWC

4.0

• Stable development on key structural cash flow items

Working capital improvement driven by supplier financing

and vendor financing

2021-2023: The operational free cash flow is expected to cover the minimum dividend commitment throughout the period.

From 2022: Operational free cash flow excl change in NWC is expected to cover the minimum dividend commitment.

Q1 21View entire presentation