Oaktree Real Estate Opportunities Fund VII, L.P.

OAKTREE REAL ESTATE OPPORTUNITIES FUND VII, L.P.

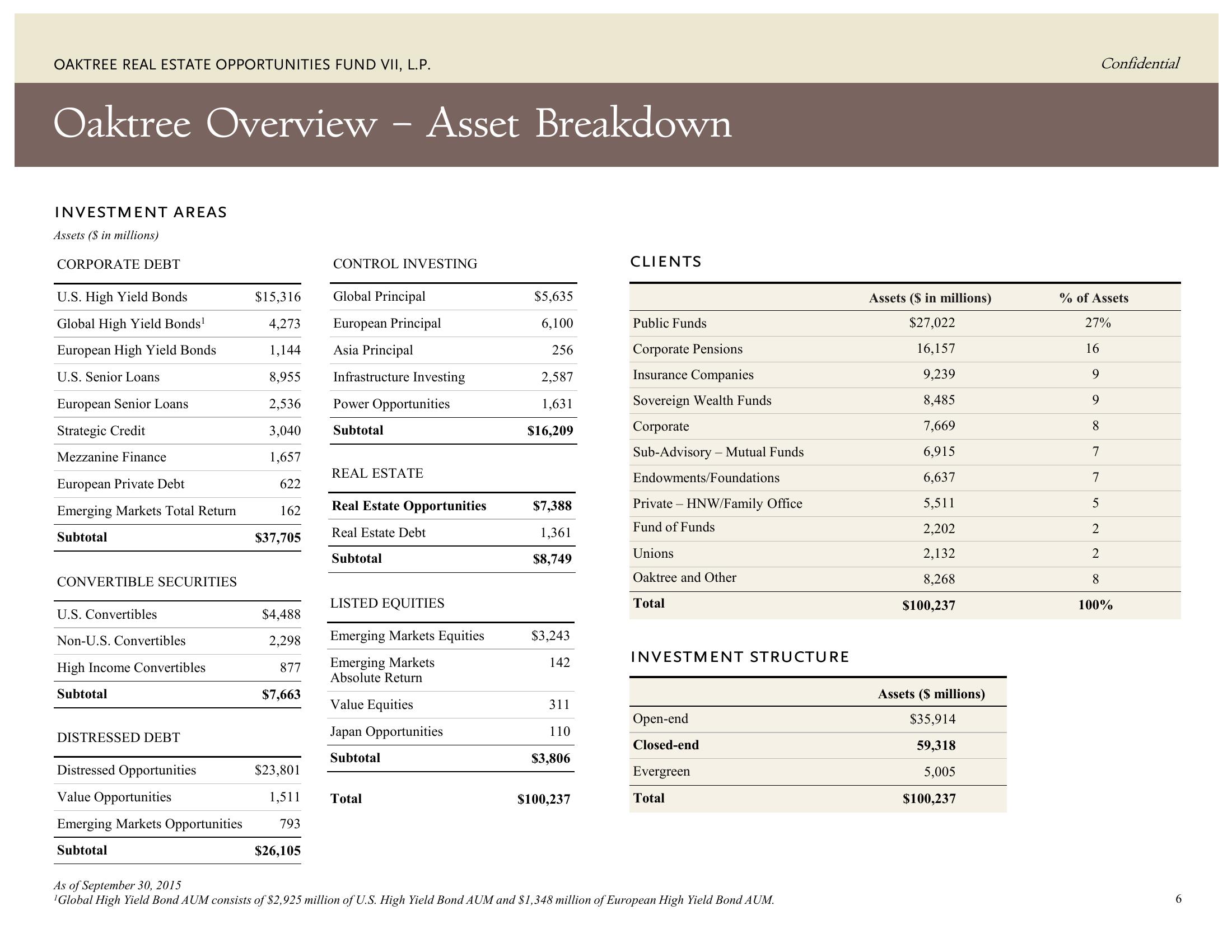

Oaktree Overview

INVESTMENT AREAS

Assets ($ in millions)

CORPORATE DEBT

U.S. High Yield Bonds

Global High Yield Bonds¹

European High Yield Bonds

U.S. Senior Loans

European Senior Loans

Strategic Credit

Mezzanine Finance

European Private Debt

Emerging Markets Total Return

Subtotal

CONVERTIBLE SECURITIES

U.S. Convertibles

Non-U.S. Convertibles

High Income Convertibles

Subtotal

DISTRESSED DEBT

Distressed Opportunities

Value Opportunities

Emerging Markets Opportunities

Subtotal

$15,316

4,273

1,144

8,955

2,536

3,040

1,657

622

162

$37,705

$4,488

2,298

877

$7,663

$23,801

1,511

793

$26,105

-

CONTROL INVESTING

Global Principal

European Principal

Asia Principal

Infrastructure Investing

Asset Breakdown

Power Opportunities

Subtotal

REAL ESTATE

Subtotal

Real Estate Opportunities

Real Estate Debt

LISTED EQUITIES

Emerging Markets Equities

Emerging Markets

Absolute Return

Total

Value Equities

Japan Opportunities

Subtotal

$5,635

6,100

256

2,587

1,631

$16,209

$7,388

1,361

$8,749

$3,243

142

311

110

$3,806

$100,237

CLIENTS

Public Funds

Corporate Pensions

Insurance Companies

Sovereign Wealth Funds

Corporate

Sub-Advisory - Mutual Funds

Endowments/Foundations

Private HNW/Family Office

Fund of Funds

Unions

Oaktree and Other

Total

INVESTMENT STRUCTURE

Open-end

Closed-end

Evergreen

Total

As of September 30, 2015

¹Global High Yield Bond AUM consists of $2,925 million of U.S. High Yield Bond AUM and $1,348 million of European High Yield Bond AUM.

Assets ($ in millions)

$27,022

16,157

9,239

8,485

7,669

6,915

6,637

5,511

2,202

2,132

8,268

$100,237

Assets ($ millions)

$35,914

59,318

5,005

$100,237

Confidential

% of Assets

27%

16

9

9

8

7

7

5

2

2

8

100%

6View entire presentation