Lazard Investor Presentation Deck

Strong Balance Sheet and Liquidity

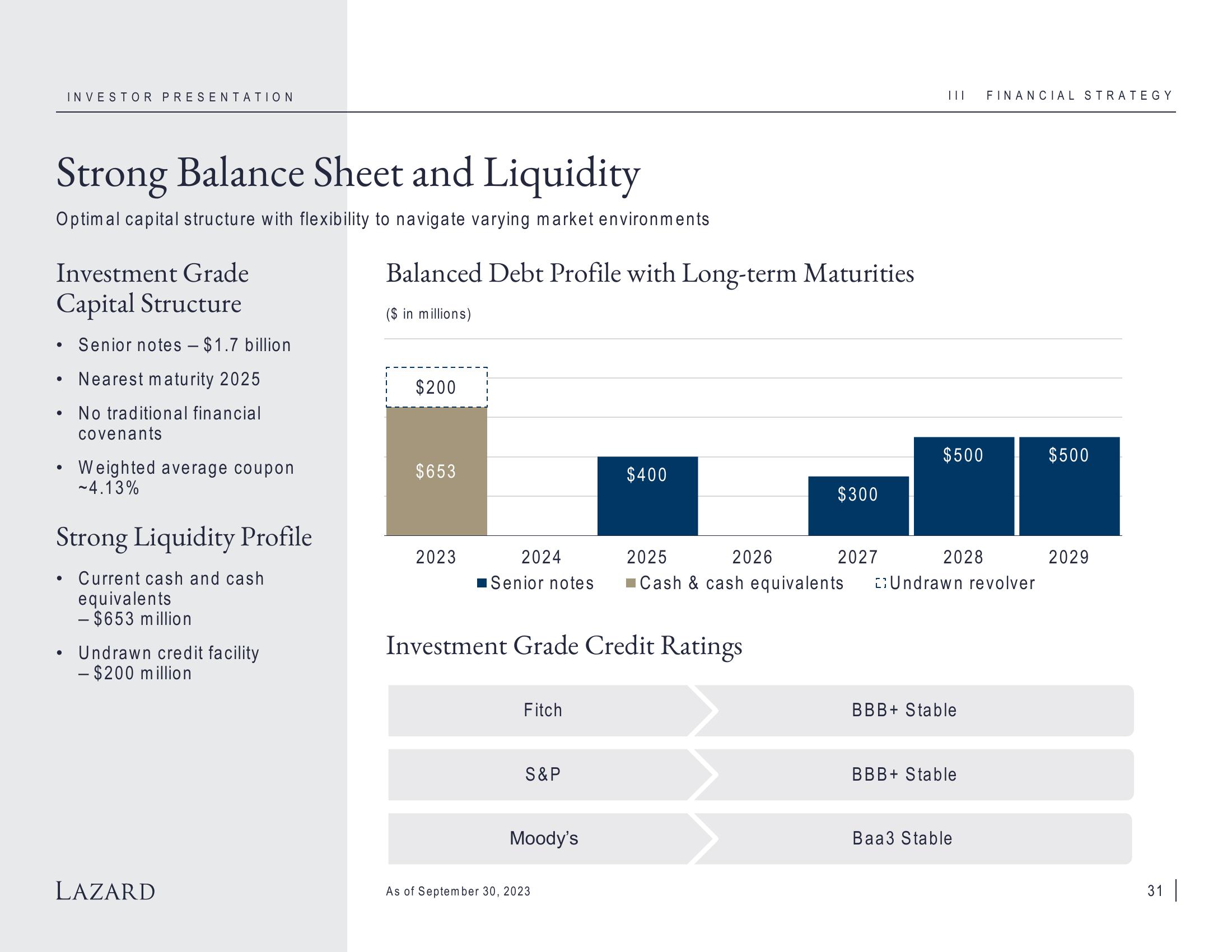

Optimal capital structure with flexibility to navigate varying market environments

Investment Grade

Capital Structure

●

●

●

INVESTOR PRESENTATION

●

●

Senior notes - $1.7 billion

Nearest maturity 2025

No traditional financial

covenants

Weighted average coupon

-4.13%

Strong Liquidity Profile

Current cash and cash

equivalents

- $653 million

Undrawn credit facility

- $200 million

LAZARD

Balanced Debt Profile with Long-term Maturities

($ in millions)

$200

$653

2023

2024

Senior notes

Fitch

Investment Grade Credit Ratings

S&P

Moody's

$400

As of September 30, 2023

$300

2026

2025

Cash & cash equivalents

2027

3

|||

$500

2028

Undrawn revolver

BBB+ Stable

BBB+ Stable

FINANCIAL STRATEGY

Baa3 Stable

$500

2029

31View entire presentation