Avantor Results Presentation Deck

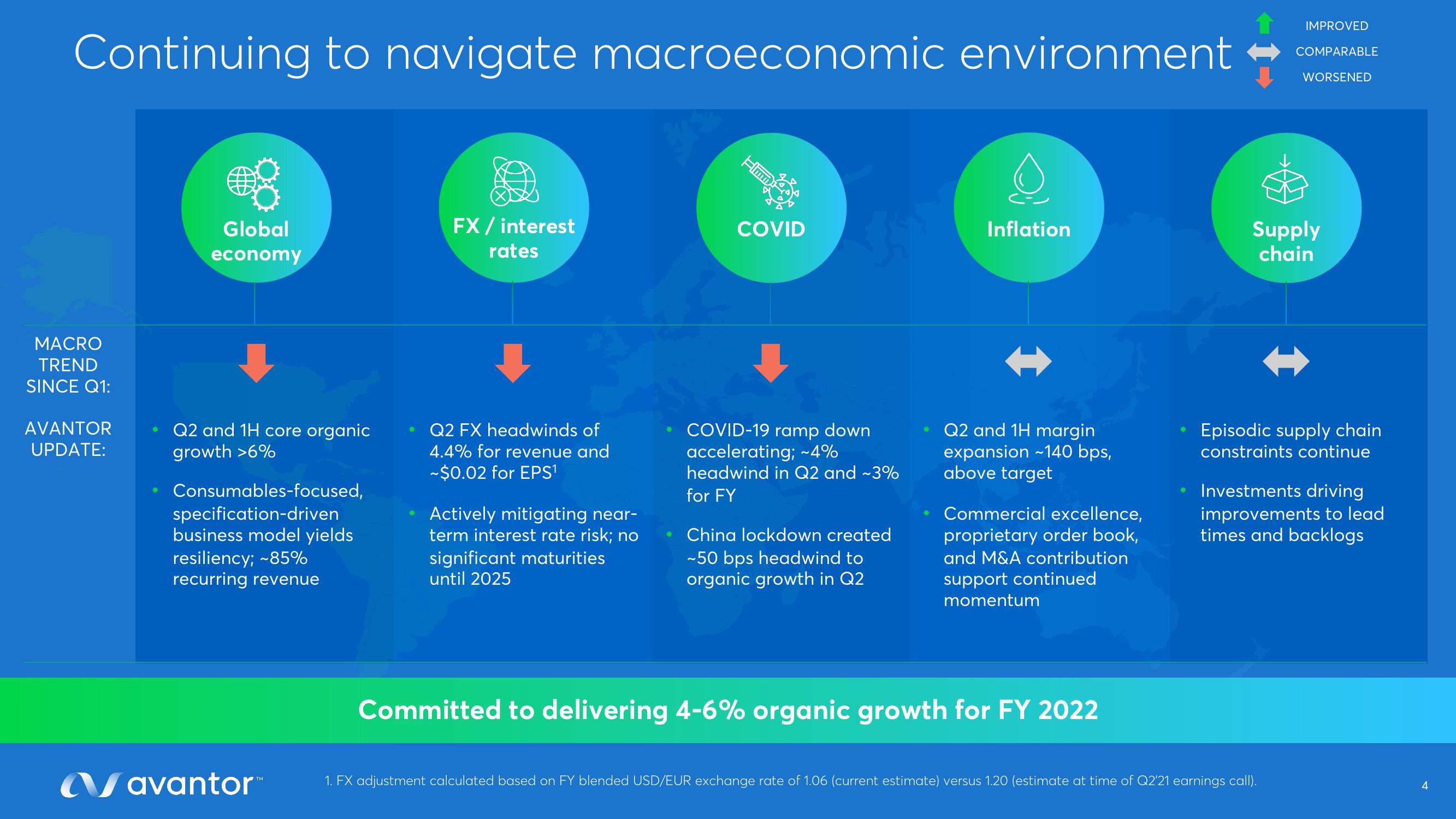

Continuing to navigate macroeconomic environment

MACRO

TREND

SINCE Q1:

AVANTOR

UPDATE:

og

Global

economy

Q2 and 1H core organic

growth >6%

Consumables-focused,

specification-driven

business model yields

resiliency; -85%

recurring revenue

avantor™

O

FX / interest

rates

Q2 FX headwinds of

4.4% for revenue and

~$0.02 for EPS¹

Actively mitigating near-

term interest rate risk; no

significant maturities

until 2025

Flam

COVID

31

COVID-19 ramp down

accelerating; ~4%

headwind in Q2 and ~3%

for FY

China lockdown created

~50 bps headwind to

organic growth in Q2

Inflation

Q2 and 1H margin

expansion ~140 bps,

above target

Commercial excellence,

proprietary order book,

and M&A contribution

support continued

momentum

Committed to delivering 4-6% organic growth for FY 2022

IMPROVED

COMPARABLE

WORSENED

Supply

chain

Episodic supply chain

constraints continue

Investments driving

improvements to lead

times and backlogs

1. FX adjustment calculated based on FY blended USD/EUR exchange rate of 1.06 (current estimate) versus 1.20 (estimate at time of Q2'21 earnings call).

4View entire presentation