Tempo SPAC Presentation Deck

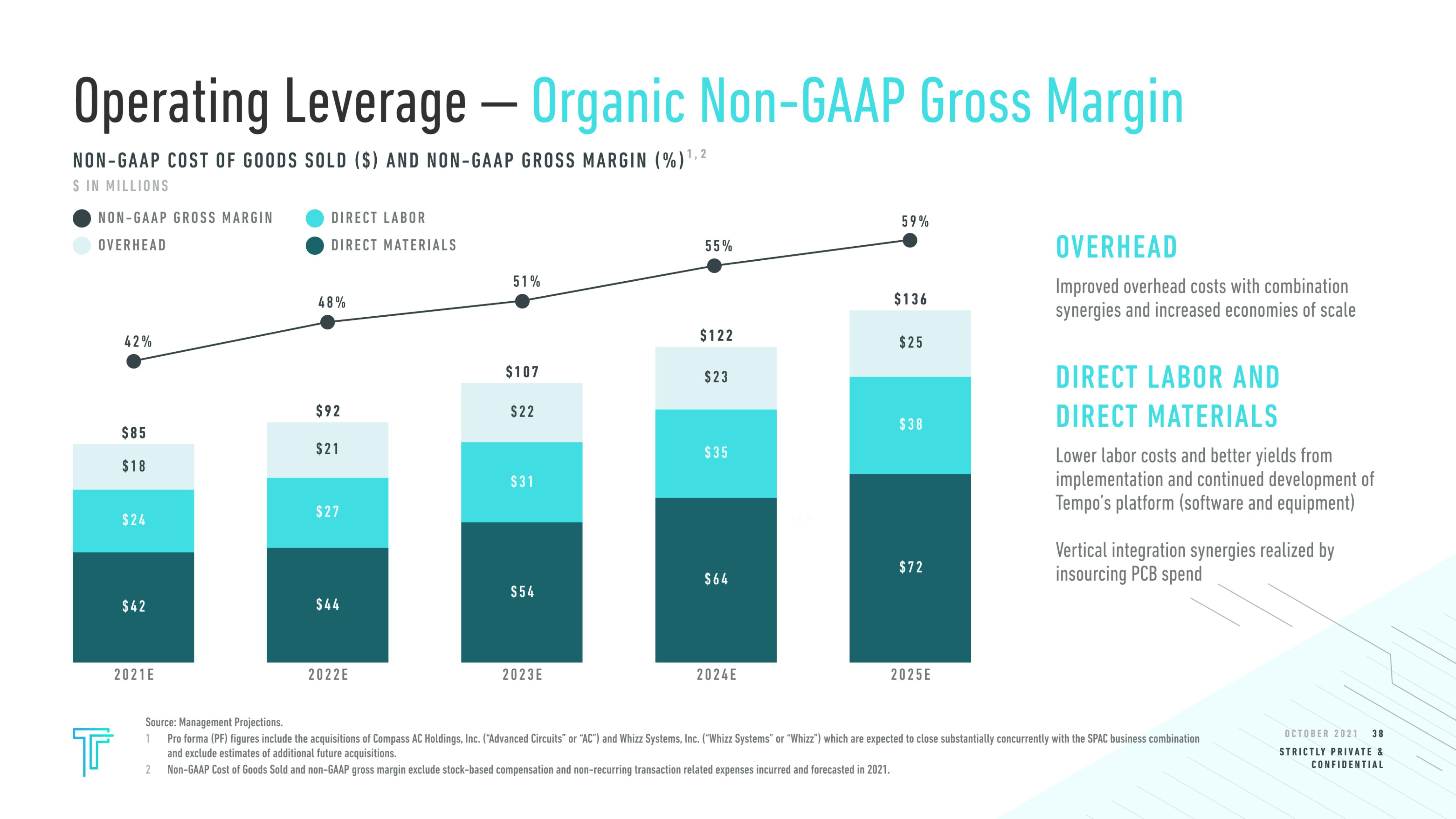

Operating Leverage - Organic Non-GAAP Gross Margin

1,2

NON-GAAP COST OF GOODS SOLD ($) AND NON-GAAP GROSS MARGIN (%) ¹,²

$ IN MILLIONS

NON-GAAP GROSS MARGIN

OVERHEAD

42%

$85

$18

$24

$42

2021E

DIRECT LABOR

DIRECT MATERIALS

48%

$92

$21

$27

$44

2022E

51%

$107

$22

$31

$54

2023E

55%

$122

$23

$35

$64

2024E

59%

$136

$25

$38

$72

2025E

OVERHEAD

Improved overhead costs with combination

synergies and increased economies of scale

DIRECT LABOR AND

DIRECT MATERIALS

Lower labor costs and better yields from

implementation and continued development of

Tempo's platform (software and equipment)

Vertical integration synergies realized by

insourcing PCB spend

Source: Management Projections.

Tr

1 Pro forma (PF) figures include the acquisitions of Compass AC Holdings, Inc. ("Advanced Circuits" or "AC") and Whizz Systems, Inc. ("Whizz Systems" or "Whizz") which are expected to close substantially concurrently with the SPAC business combination

and exclude estimates of additional future acquisitions.

2 Non-GAAP Cost of Goods Sold and non-GAAP gross margin exclude stock-based compensation and non-recurring transaction related expenses incurred and forecasted in 2021.

OCTOBER 2021 38

STRICTLY PRIVATE &

CONFIDENTIALView entire presentation