Barclays Credit Presentation Deck

STRATEGY, TARGETS

& GUIDANCE

Income

£3.5bn

Q420: £3.5bn

Cost: income

ratio

66%

Q420: 68%

Loan loss rate

7bps

Q420: 90bps

ROTE

10.4%

Q420: 5.8%

PERFORMANCE

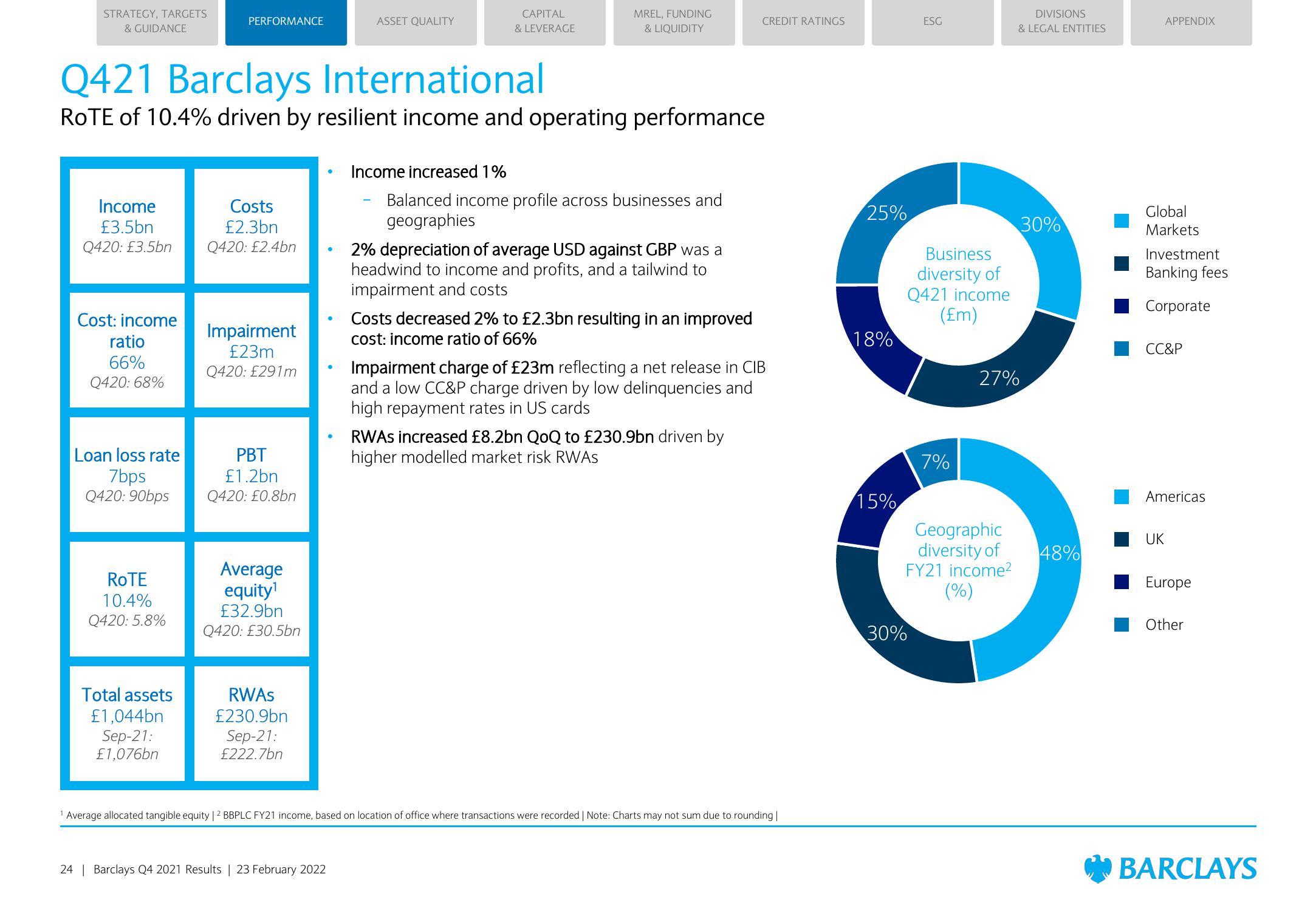

Q421 Barclays International

ROTE of 10.4% driven by resilient income and operating performance

Total assets

£1,044bn

Sep-21:

£1,076bn

Costs

£2.3bn

Q420: £2.4bn

Impairment

£23m

Q420: £291m

PBT

£1.2bn

Q420: £0.8bn

Average

equity¹

£32.9bn

Q420: £30.5bn

RWAS

£230.9bn

Sep-21:

£222.7bn

●

24 | Barclays Q4 2021 Results | 23 February 2022

ASSET QUALITY

●

CAPITAL

& LEVERAGE

Income increased 1%

MREL, FUNDING

& LIQUIDITY

Balanced income profile across businesses and

geographies

2% depreciation of average USD against GBP was a

headwind to income and profits, and a tailwind to

impairment and costs

Costs decreased 2% to £2.3bn resulting in an improved

cost: income ratio of 66%

CREDIT RATINGS

Impairment charge of £23m reflecting a net release in CIB

and a low CC&P charge driven by low delinquencies and

high repayment rates in US cards

RWAS increased £8.2bn QoQ to £230.9bn driven by

higher modelled market risk RWAS

Average allocated tangible equity | ² BBPLC FY21 income, based on location of office where transactions were recorded | Note: Charts may not sum due to rounding |

25%

18%

15%

30%

ESG

Business

diversity of

Q421 income

(£m)

7%

DIVISIONS

& LEGAL ENTITIES

27%

Geographic

diversity of

FY21 income²

(%)

30%

48%

APPENDIX

Global

Markets

Investment

Banking fees

Corporate

CC&P

Americas

UK

Europe

Other

BARCLAYSView entire presentation