Nexters Results Presentation Deck

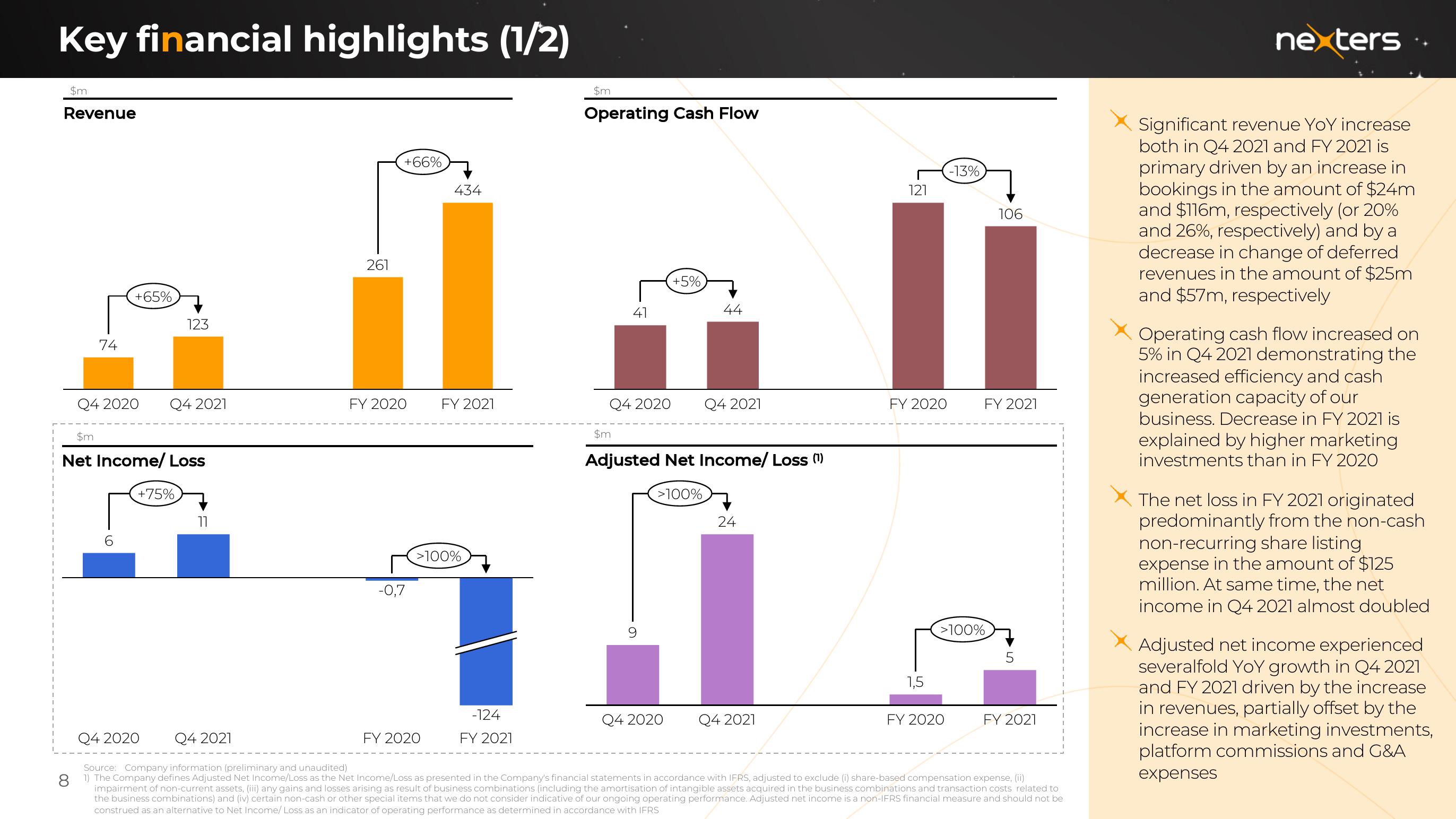

Key financial highlights (1/2)

$m

Revenue

74

+65%

Q4 2020 Q4 2021

6

123

$m

Net Income/ Loss

+75%

11

261

+66%

FY 2020

-0,7

434

FY 2021

>100%

FY 2020

-124

FY 2021

$m

Operating Cash Flow

41

$m

+5%

Q4 2020 Q4 2021

44

Adjusted Net Income/ Loss (1)

>100%

24

Q4 2020 Q4 2021

121

FY 2020

1,5

-13%

>100%

FY 2020

106

FY 2021

5

FY 2021

Q4 2020 Q4 2021

Source: Company information (preliminary and unaudited)

8 1) The Company defines Adjusted Net Income/Loss as the Net Income/Loss as presented in the Company's financial statements in accordance with IFRS, adjusted to exclude (i) share-based compensation expense, (ii)

impairment of non-current assets, (iii) any gains and losses arising as result of business combinations (including the amortisation of intangible assets acquired in the business combinations and transaction costs related to

the business combinations) and (iv) certain non-cash or other special items that we do not consider indicative of our ongoing operating performance. Adjusted net income is a non-IFRS financial measure and should not be

construed as an alternative to Net Income/ Loss as an indicator of operating performance as determined in accordance with IFRS

nexters

Significant revenue YoY increase

both in Q4 2021 and FY 2021 is

primary driven by an increase in

bookings in the amount of $24m

and $116m, respectively (or 20%

and 26%, respectively) and by a

decrease in change of deferred

revenues in the amount of $25m

and $57m, respectively

Operating cash flow increased on

5% in Q4 2021 demonstrating the

increased efficiency and cash

generation capacity of our

business. Decrease in FY 2021 is

explained by higher marketing

investments than in FY 2020

The net loss in FY 2021 originated

predominantly from the non-cash

non-recurring share listing

expense in the amount of $125

million. At same time, the net

income in Q4 2021 almost doubled

Adjusted net income experienced

severalfold YoY growth in Q4 2021

and FY 2021 driven by the increase

in revenues, partially offset by the

increase in marketing investments,

platform commissions and G&A

expensesView entire presentation