AMC Mergers and Acquisitions Presentation Deck

Transaction Overview

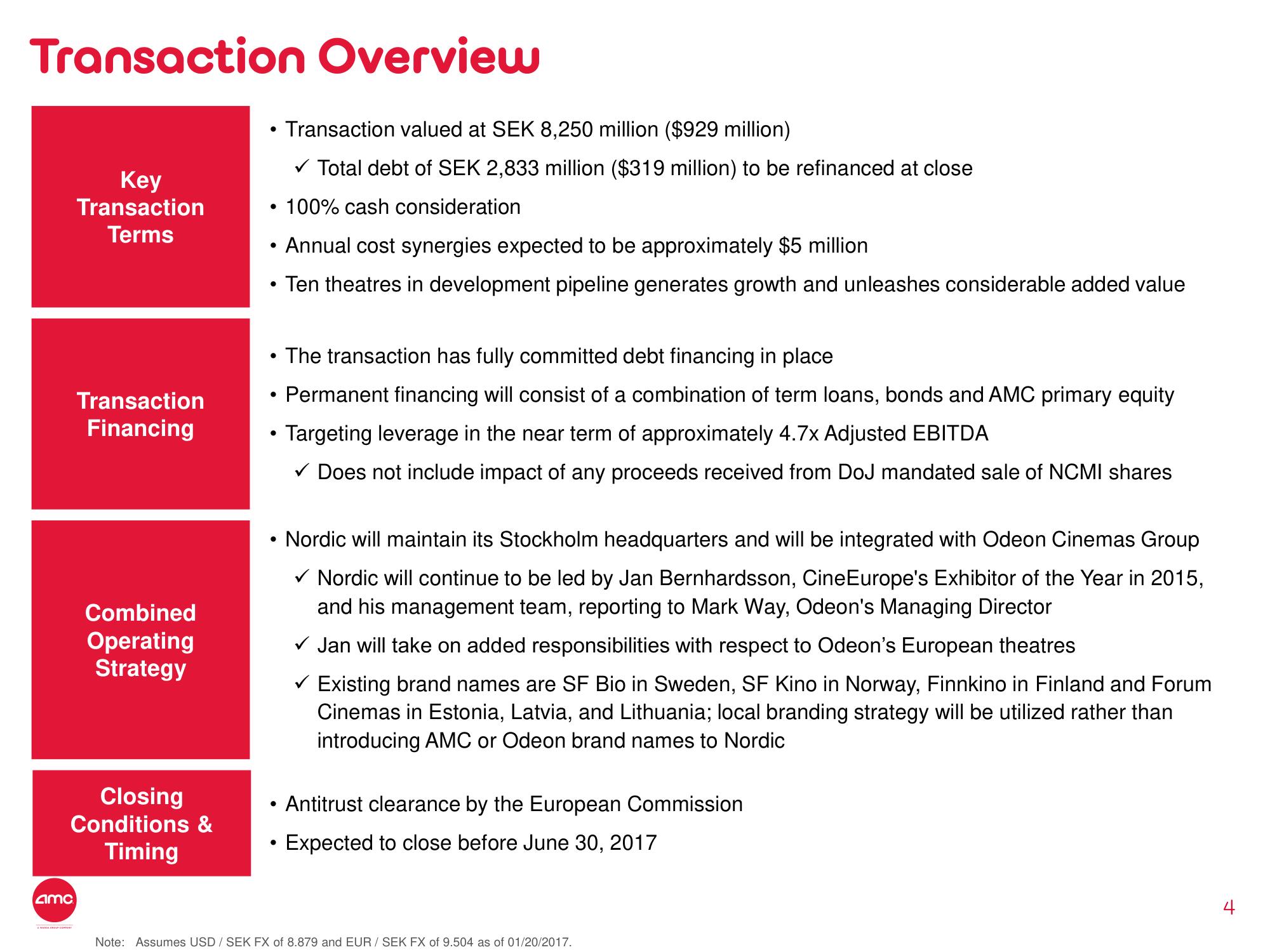

Key

Transaction

Terms

amc

Transaction

Financing

Combined

Operating

Strategy

Closing

Conditions &

Timing

Transaction valued at SEK 8,250 million ($929 million)

✓ Total debt of SEK 2,833 million ($319 million) to be refinanced at close

• 100% cash consideration

●

• Annual cost synergies expected to be approximately $5 million

Ten theatres in development pipeline generates growth and unleashes considerable added value

●

• The transaction has fully committed debt financing in place

Permanent financing will consist of a combination of term loans, bonds and AMC primary equity

Targeting leverage in the near term of approximately 4.7x Adjusted EBITDA

Does not include impact of any proceeds received from DoJ mandated sale of NCMI shares

●

●

• Nordic will maintain its Stockholm headquarters and will be integrated with Odeon Cinemas Group

✓ Nordic will continue to be led by Jan Bernhardsson, CineEurope's Exhibitor of the Year in 2015,

and his management team, reporting to Mark Way, Odeon's Managing Director

✓ Jan will take on added responsibilities with respect to Odeon's European theatres

Existing brand names are SF Bio in Sweden, SF Kino in Norway, Finnkino in Finland and Forum

Cinemas in Estonia, Latvia, and Lithuania; local branding strategy will be utilized rather than

introducing AMC or Odeon brand names to Nordic

• Antitrust clearance by the European Commission

Expected to close before June 30, 2017

●

Note: Assumes USD / SEK FX of 8.879 and EUR / SEK FX of 9.504 as of 01/20/2017.

+View entire presentation