Bank of America Results Presentation Deck

Global Banking

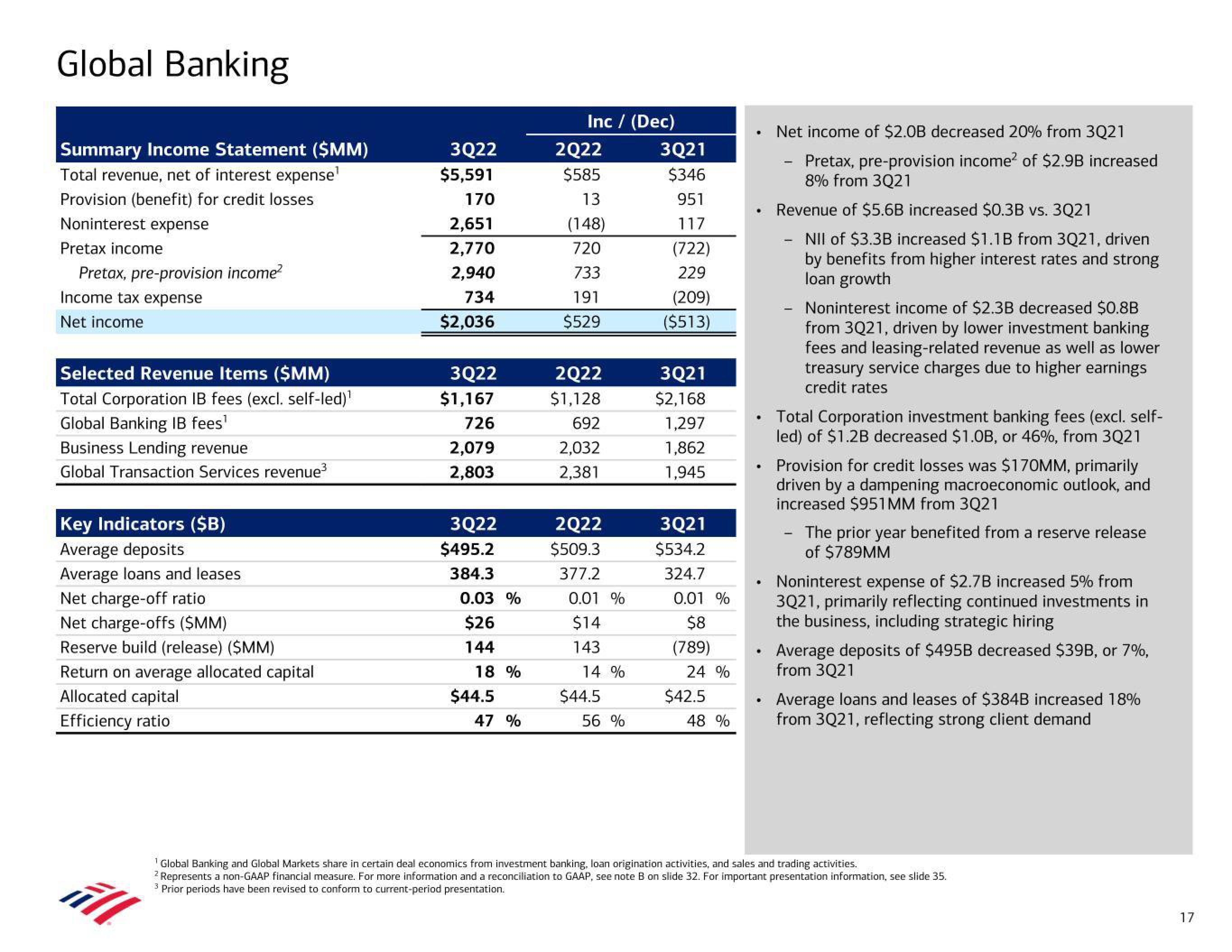

Summary Income Statement ($MM)

Total revenue, net of interest expense¹

Provision (benefit) for credit losses

Noninterest expense

Pretax income

Pretax, pre-provision income²

Income tax expense

Net income

Selected Revenue Items ($MM)

Total Corporation IB fees (excl. self-led)¹

Global Banking IB fees¹

Business Lending revenue

Global Transaction Services revenue³

Key Indicators ($B)

Average deposits

Average loans and leases

Net charge-off ratio

Net charge-offs ($MM)

Reserve build (release) ($MM)

Return on average allocated capital

Allocated capital

Efficiency ratio

3Q22

$5,591

170

2,651

2,770

2,940

734

$2,036

3Q22

$1,167

726

2,079

2,803

3Q22

$495.2

384.3

0.03 %

$26

144

18 %

$44.5

47 %

Inc / (Dec)

2Q22

$585

13

(148)

720

733

191

$529

2Q22

$1,128

692

2,032

2,381

2Q22

$509.3

377.2

0.01 %

$14

143

14 %

$44.5

56 %

3Q21

$346

951

117

(722)

229

(209)

($513)

3Q21

$2,168

1,297

1,862

1,945

3Q21

$534.2

324.7

0.01 %

$8

(789)

24 %

$42.5

48 %

.

.

.

.

Net income of $2.0B decreased 20% from 3Q21

Pretax, pre-provision income2 of $2.9B increased

8% from 3Q21

Revenue of $5.6B increased $0.3B vs. 3Q21

NII of $3.3B increased $1.1B from 3Q21, driven

by benefits from higher interest rates and strong

loan growth

Noninterest income of $2.3B decreased $0.8B

from 3Q21, driven by lower investment banking

fees and leasing-related revenue as well as lower

treasury service charges due to higher earnings

credit rates

Total Corporation investment banking fees (excl. self-

led) of $1.2B decreased $1.0B, or 46%, from 3Q21

Provision for credit losses was $170MM, primarily

driven by a dampening macroeconomic outlook, and

increased $951MM from 3Q21

The prior year benefited from a reserve release

of $789MM

Noninterest expense of $2.7B increased 5% from

3Q21, primarily reflecting continued investments in

the business, including strategic hiring

Average deposits of $495B decreased $39B, or 7%,

from 3Q21

Average loans and leases of $384B increased 18%

from 3Q21, reflecting strong client demand

Global Banking and Global Markets share in certain deal economics from investment banking, loan origination activities, and sales and trading activities.

² Represents a non-GAAP financial measure. For more information and a reconciliation to GAAP, see note B on slide 32. For important presentation information, see slide 35.

3 Prior periods have been revised to conform to current-period presentation.

All

17View entire presentation