Evercore Investment Banking Pitch Book

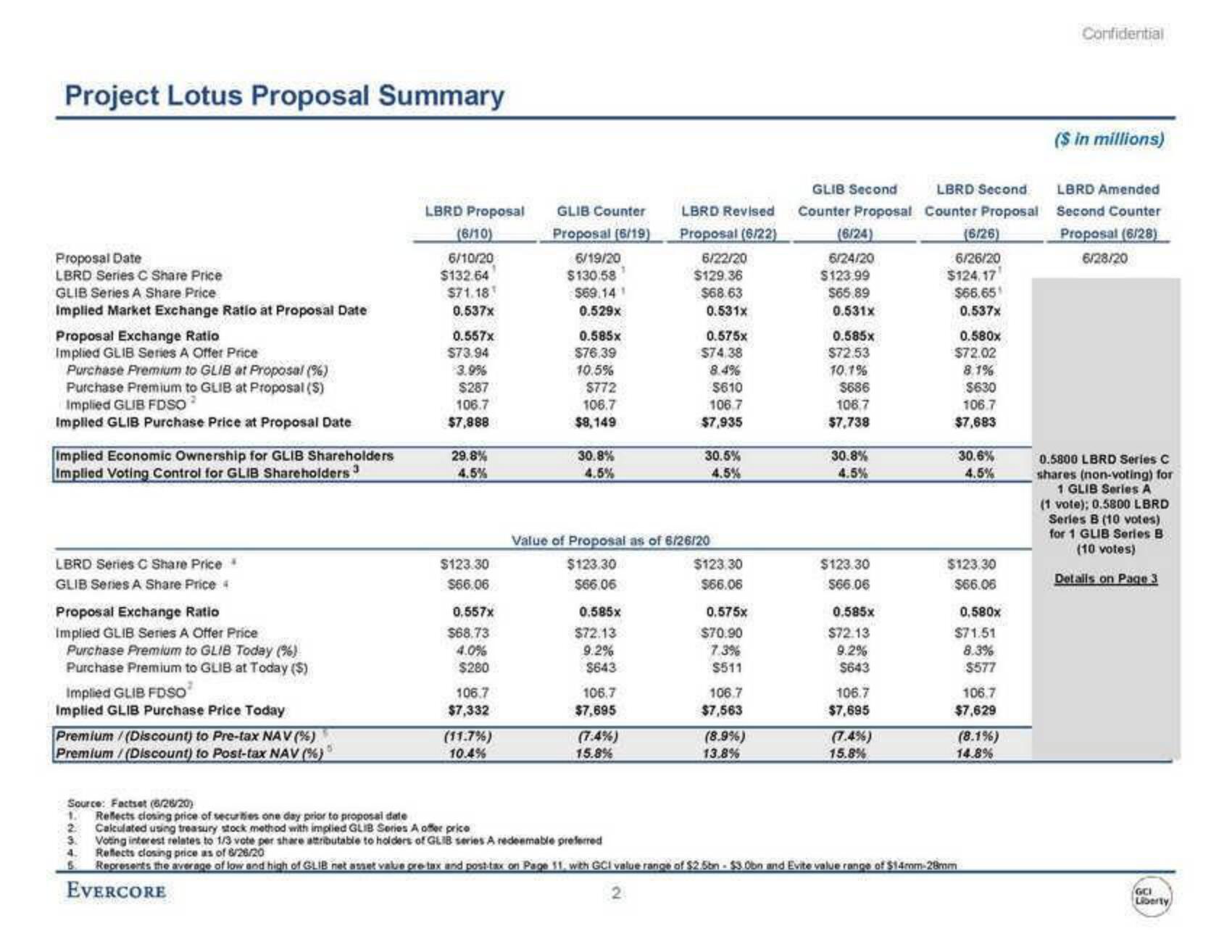

Project Lotus Proposal Summary

Proposal Date

LBRD Series C Share Price

GLIB Series A Share Price

Implied Market Exchange Ratio at Proposal Date

Proposal Exchange Ratio

Implied GLIB Series A Offer Price

Purchase Premium to GLIB at Proposal (%)

Purchase Premium to GLIB at Proposal (S)

Implied GLIB FDSO

Implied GLIB Purchase Price at Proposal Date

Implied Economic Ownership for GLIB Shareholders

Implied Voting Control for GLIB Shareholders 3

LBRD Series C Share Price

GLIB Series A Share Price 4

Proposal Exchange Ratio

Implied GLIB Series A Offer Price

Purchase Premium to GLIB Today (%)

Purchase Premium to GLIB at Today ($)

Implied GLIB FDSO

Implied GLIB Purchase Price Today

Premium / (Discount) to Pre-tax NAV (%)

Premium /(Discount) to Post-tax NAV (%)

LBRD Proposal

(6/10)

6/10/20

$132.64

$71.18

0.537x

0.557x

$73.94

-3.9%

$287

106.7

$7,888

29.8%

4.5%

$123.30

$66.06

0,557x

$68.73

4.0%

$280

106.7

$7,332

(11.7%)

10.4%

Source: Factset (6/26/20)

1.

Reffects closing price of securities one day prior to proposal date

2 Calculated using treasury stock method with implied GLIB Series A offer price

GLIB Counter

Proposal (6/19)

6/19/20

$130.58

$69.14 1

0.529x

0.585x

$76.39

10.5%

$772

106.7

$8,149

30.8%

4.5%

0.585x

$72.13

9.2%

$643

106.7

$7,695

LBRD Revised

Proposal (6/22)

6/22/20

$129.36

$68.63

(7.4%)

15.8%

0.531x

Value of Proposal as of 6/26/20

$123.30

$66.06

0.575x

$74.38

8.4%

$610

106.7

$7,935

30.5%

4.5%

$123.30

$66.06

0.575x

$70.90

7.3%

$511

106.7

$7,563

(8.9%)

13.8%

GLIB Second

Counter Proposal

(6/24)

6/24/20

$123.99

$65.89

0.531x

0.585x

$72.53

10.1%

$686

106,7

$7,738

30.8%

4.5%

$123.30

$66.06

0.585x

$72.13

9.2%

$643

106.7

$7,695

(7.4%)

15.8%

LBRD Second

Counter Proposal

(6/26)

6/26/20

$124,17

$66.65¹

0.537x

0.580x

$72.02

8.1%

$630

106.7

$7,683

30.6%

4.5%

$123.30

$66.06

0,580x

$71.51

8.3%

$577

3. Voting interest relates to 1/3 vote per share attributable to holders of GLIB series A redeemable preferred

4.

Reffects closing price as of 6/26/20

Represents the average of low and high of GLIB net asset value pre-tax and post-tax on Page 11, with GCI value range of $2.5bn-$3.0bn and Evite value range of $14mm-28mm

EVERCORE

2

106.7

$7,629

(8.1%)

14.8%

Confidential

($ in millions)

LBRD Amended

Second Counter

Proposal (6/28)

6/28/20

0.5800 LBRD Series C

shares (non-voting) for

1 GLIB Series A

(1 vote); 0.5800 LBRD

Series B (10 votes)

for 1 GLIB Series B

(10 votes)

Details on Page 3

GCI

LibertyView entire presentation