Bank of America Investment Banking Pitch Book

Go-Shop Considerations

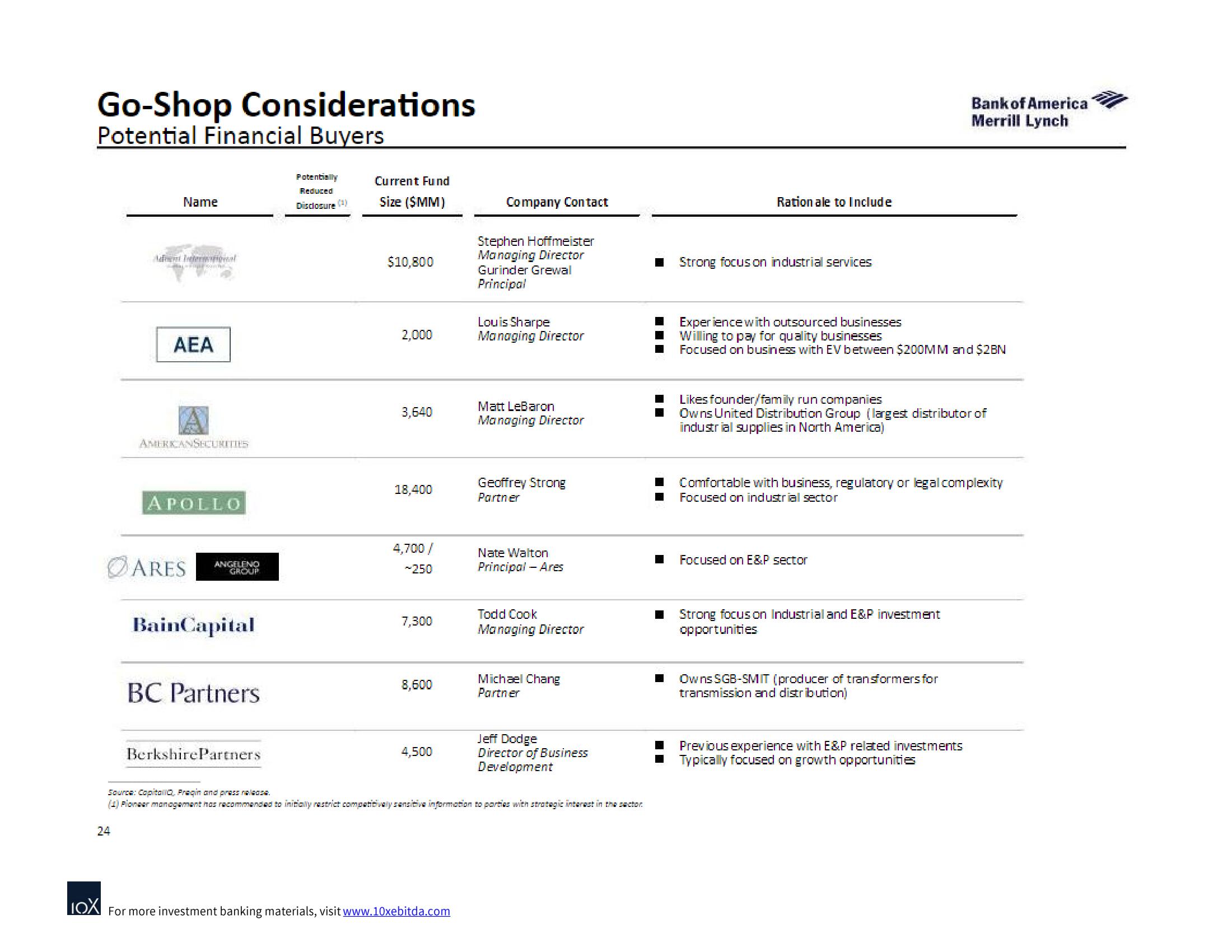

Potential Financial Buyers

Name

24

en International

may-Frigh Sonne

AEA

AMERICANSECURITIES

APOLLO

ARES

ANGELENO

GROUP

BainCapital

BC Partners

Berkshire Partners

Potentially

Reduced

Disclosure (¹)

Current Fund

Size ($MM)

$10,800

2,000

3,640

18,400

4,700/

~250

7,300

8,600

4,500

Company Contact

IOX For more investment banking materials, visit www.10xebitda.com

Stephen Hoffmeister

Managing Director

Gurinder Grewal

Principal

Louis Sharpe

Managing Director

Matt LeBaron

Managing Director

Geoffrey Strong

Partner

Nate Walton

Principal - Ares

Todd Cook

Managing Director

Michael Chang

Partner

Source: CapitaQ, Preqin and press release.

(1) Pioneer management has recommended to initially restrict competitivaly sensitive information to parties with strategic interest in the sector.

Jeff Dodge

Director of Business

Development

Rationale to Include

Strong focus on industrial services

Experience with outsourced businesses

Willing to pay for quality businesses

Focused on business with EV between $200MM and $2BN

Likes founder/family run companies

Owns United Distribution Group (largest distributor of

industrial supplies in North America)

Comfortable with business, regulatory or legal complexity

Focused on industrial sector

Focused on E&P sector

Bank of America

Merrill Lynch

Strong focus on Industrial and E&P investment

opportunities

Owns SGB-SMIT (producer of transformers for

transmission and distribution)

Previous experience with E&P related investments

Typically focused on growth opportunitiesView entire presentation