Pathward Financial Results Presentation Deck

Cost of

Deposits

HIGHLIGHTS

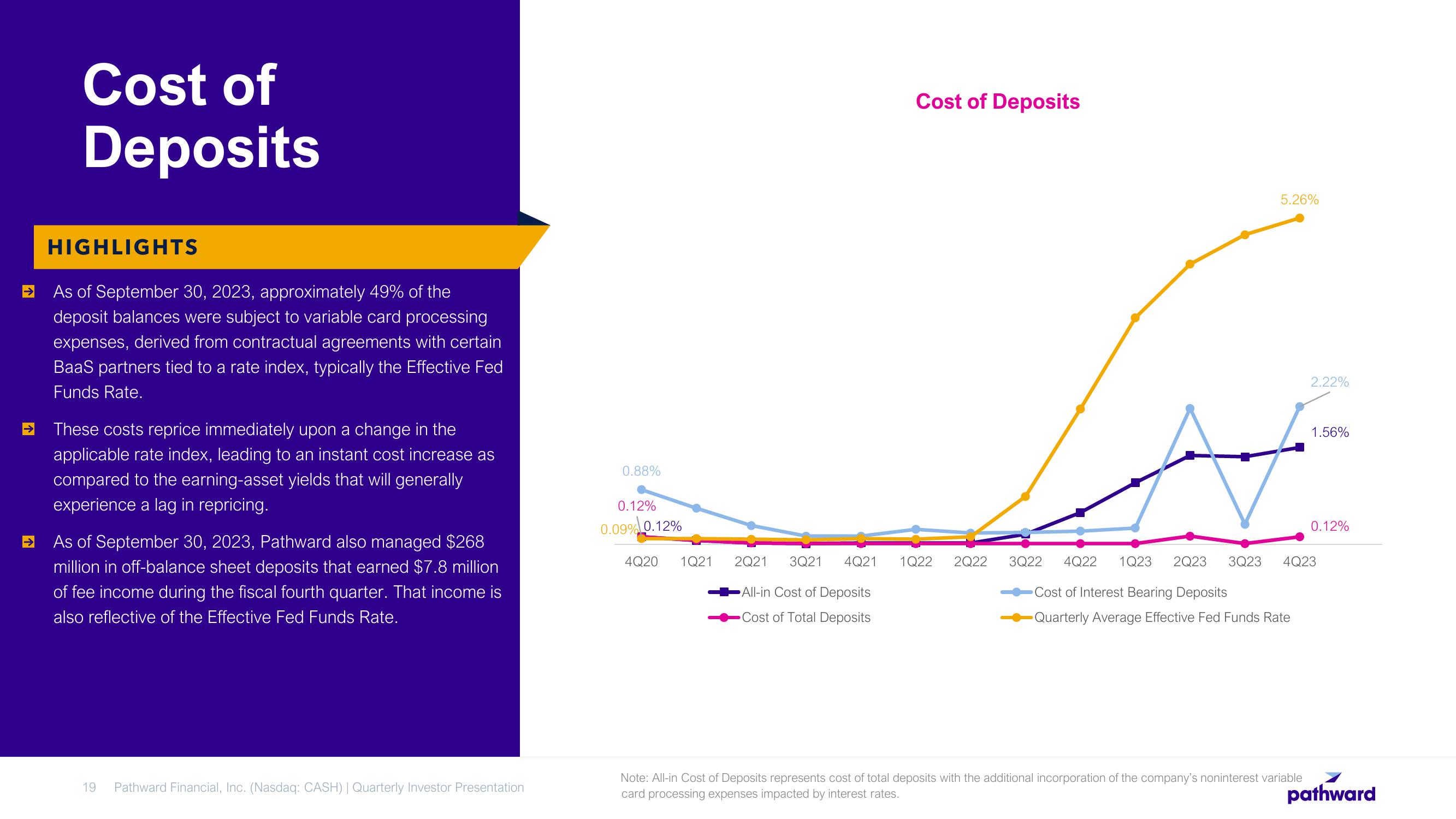

→ As of September 30, 2023, approximately 49% of the

deposit balances were subject to variable card processing

expenses, derived from contractual agreements with certain

BaaS partners tied to a rate index, typically the Effective Fed

Funds Rate.

These costs reprice immediately upon a change in the

applicable rate index, leading to an instant cost increase as

compared to the earning-asset yields that will generally

experience a lag in repricing.

As of September 30, 2023, Pathward also managed $268

million in off-balance sheet deposits that earned $7.8 million

of fee income during the fiscal fourth quarter. That income is

also reflective of the Effective Fed Funds Rate.

19 Pathward Financial, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation

0.88%

0.12%

0.09% 0.12%

4Q20 1Q21

2Q21 3Q21 4Q21

All-in Cost of Deposits

Cost of Total Deposits

Cost of Deposits

1Q22

5.26%

2.22%

Note: All-in Cost of Deposits represents cost of total deposits with the additional incorporation of the company's noninterest variable

card processing expenses impacted by interest rates.

1.56%

0.12%

2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23

Cost of Interest Bearing Deposits

-Quarterly Average Effective Fed Funds Rate

pathwardView entire presentation