Intertek Results Presentation Deck

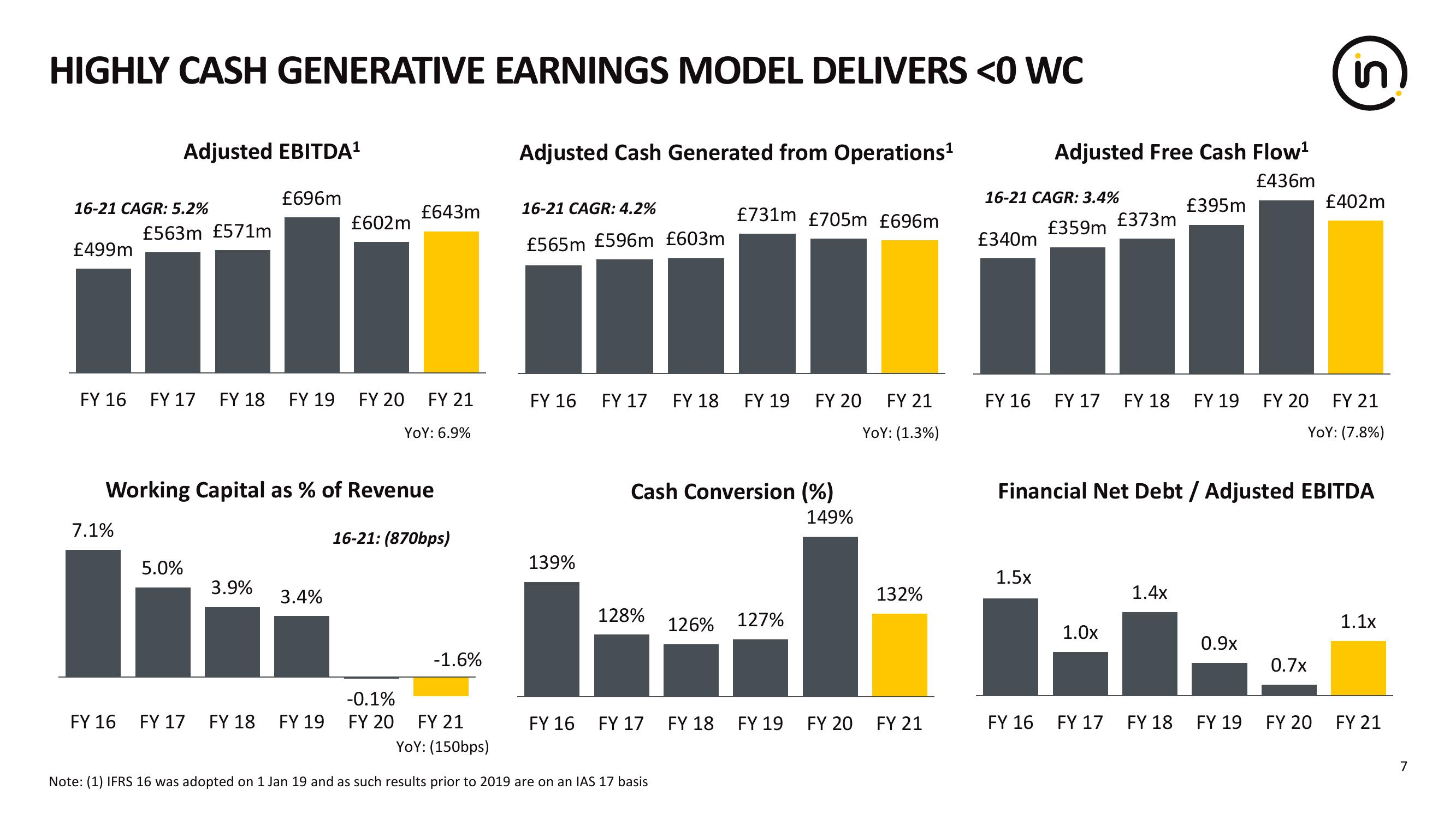

HIGHLY CASH GENERATIVE EARNINGS MODEL DELIVERS <0 WC

16-21 CAGR: 5.2%

£499m

Adjusted EBITDA¹

£563m £571m

7.1%

£696m

FY 16 FY 17 FY 18 FY 19 FY 20 FY 21

YOY: 6.9%

5.0%

Working Capital as % of Revenue

3.9%

£602m

3.4%

£643m

FY 16 FY 17 FY 18 FY 19

16-21: (870bps)

-0.1%

FY 20

-1.6%

Adjusted Cash Generated from Operations¹

16-21 CAGR: 4.2%

£565m £596m £603m

FY 16

139%

FY 17

128%

FY 21

YOY: (150bps)

Note: (1) IFRS 16 was adopted on 1 Jan 19 and as such results prior to 2019 are on an IAS 17 basis

Cash Conversion (%)

149%

£731m £705m £696m

FY 16 FY 17

FY 18 FY 19 FY 20 FY 21

YOY: (1.3%)

126% 127%

132%

FY 18 FY 19 FY 20 FY 21

16-21 CAGR: 3.4%

£359m

£340m

Adjusted Free Cash Flow¹

£436m

1.5x

FY 16

£373m

1.0x

FY 16 FY 17 FY 18 FY 19 FY 20 FY 21

YOY: (7.8%)

FY 17

Financial Net Debt / Adjusted EBITDA

£395m

1.4x

FY 18

0.9x

FY 19

in

0.7x

S

FY 20

£402m

1.1x

FY 21

7View entire presentation