SmileDirectClub Investor Presentation Deck

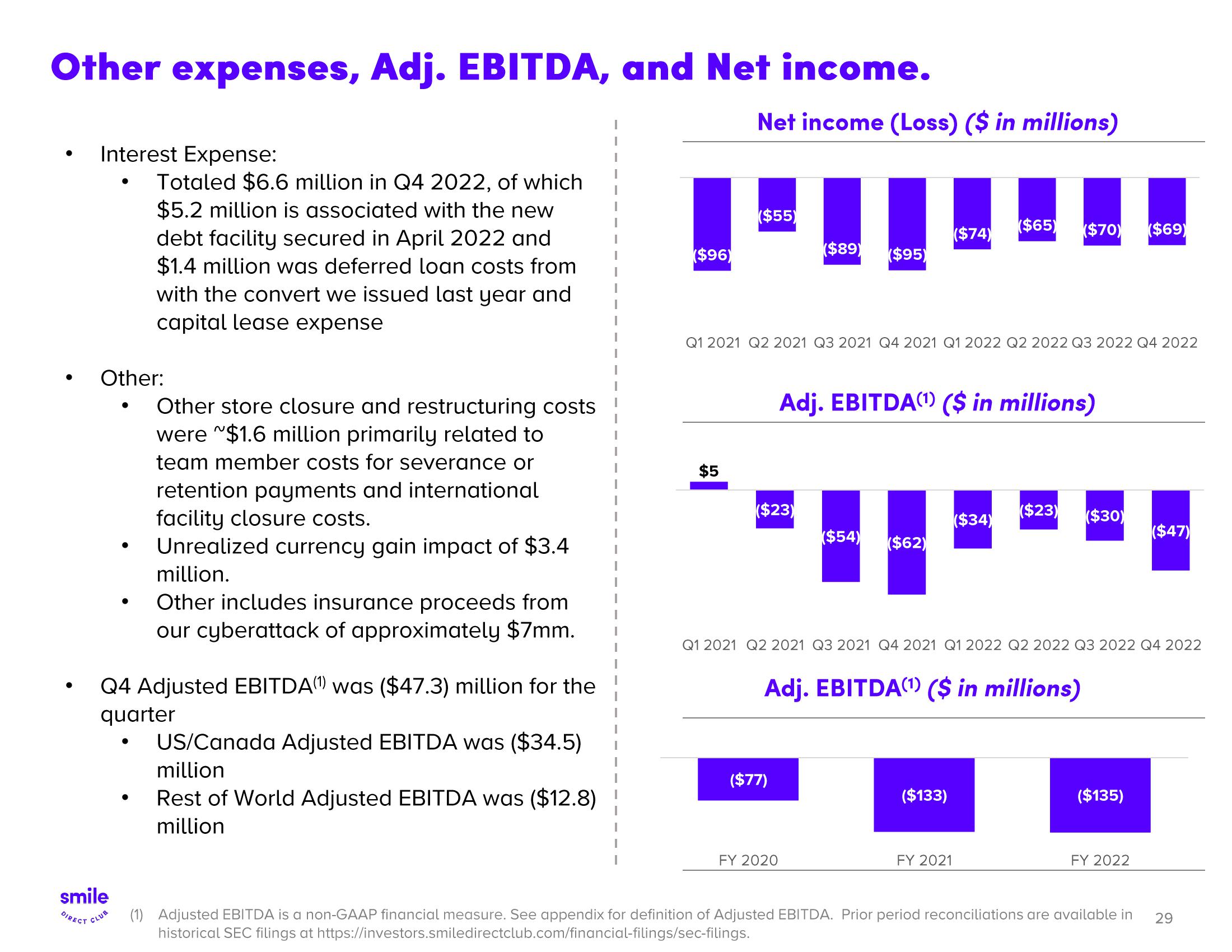

Other expenses, Adj. EBITDA, and Net income.

●

Interest Expense:

●

Other:

smile

DIRECT CLUB

●

●

●

Q4 Adjusted EBITDA(1) was ($47.3) million for the

quarter

●

Totaled $6.6 million in Q4 2022, of which

$5.2 million is associated with the new

debt facility secured in April 2022 and

$1.4 million was deferred loan costs from

with the convert we issued last year and

capital lease expense

●

(1)

Other store closure and restructuring costs

were ~$1.6 million primarily related to

team member costs for severance or

retention payments and international

facility closure costs.

Unrealized currency gain impact of $3.4

million.

Other includes insurance proceeds from

our cyberattack of approximately $7mm.

US/Canada Adjusted EBITDA was ($34.5)

million

Rest of World Adjusted EBITDA was ($12.8)

million

($96)

Net income (Loss) ($ in millions)

$5

($55)

($23)

($89) ($95)

Q1 2021 Q2 2021 Q3 2021 Q4 2021 Q1 2022 Q2 2022 Q3 2022 Q4 2022

($77)

FY 2020

($54)

Adj. EBITDA(¹) ($ in millions)

($62)

($74)

($65)

($133)

($34)

Adj. EBITDA(¹) ($ in millions)

FY 2021

($70) ($69)

($23)

Q1 2021 Q2 2021 Q3 2021 Q4 2021 Q1 2022 Q2 2022 Q3 2022 Q4 2022

($30)

($135)

FY 2022

($47)

Adjusted EBITDA is a non-GAAP financial measure. See appendix for definition of Adjusted EBITDA. Prior period reconciliations are available in

historical SEC filings at https://investors.smiledirectclub.com/financial-filings/sec-filings.

29View entire presentation