Enact IPO Presentation Deck

Enact | Investor Presentation

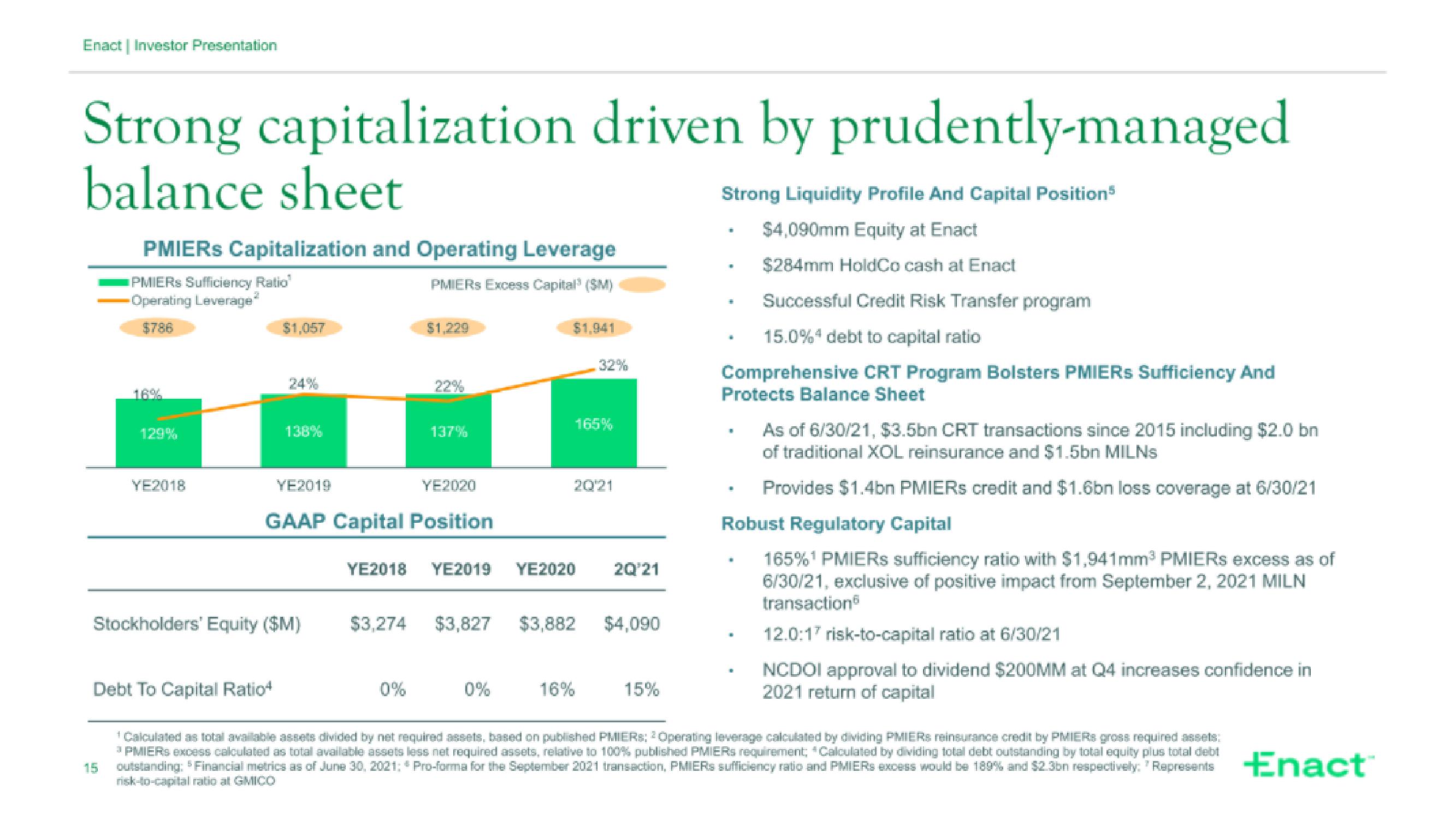

Strong capitalization driven by prudently-managed

balance sheet

PMIERS Capitalization and Operating Leverage

PMIERS Excess Capital³ (SM)

PMIERS Sufficiency Ratio

2

Operating Leverage

$786

15

16%

129%

YE2018

Debt To Capital Ratio

$1,057

24%

138%

YE2019

Stockholders' Equity ($M)

$1,229

137%

GAAP Capital Position

YE2020

0%

$1,941

YE2018 YE2019 YE2020

0%

$3,274 $3,827 $3,882

165%

20′21

32%

16%

2Q'21

$4,090

15%

Strong Liquidity Profile And Capital Position³

$4,090mm Equity at Enact

$284mm HoldCo cash at Enact

Successful Credit Risk Transfer program

15.0% 4 debt to capital ratio

Comprehensive CRT Program Bolsters PMIERS Sufficiency And

Protects Balance Sheet

#

■

As of 6/30/21, $3.5bn CRT transactions since 2015 including $2.0 bn

of traditional XOL reinsurance and $1.5bn MILNs

Provides $1.4bn PMIERS credit and $1.6bn loss coverage at 6/30/21

Robust Regulatory Capital

165%¹ PMIERS sufficiency ratio with $1,941mm³ PMIERS excess as of

6/30/21, exclusive of positive impact from September 2, 2021 MILN

transaction

.

.

#

12.0:17 risk-to-capital ratio at 6/30/21

NCDOI approval to dividend $200MM at Q4 increases confidence in

2021 return of capital

¹ Calculated as total available assets divided by net required assets, based on published PMIERS: 2 Operating leverage calculated by dividing PMIERS reinsurance credit by PMIERS gross required assets;

³PMIERS excess calculated as total available assets less net required assets, relative to 100% published PMIERS requirement, *Calculated by dividing total debt outstanding by total equity plus total debi

outstanding: Financial metrics as of June 30, 2021; Pro-forma for the September 2021 transaction, PMIERS sufficiency ratio and PMIERS excess would be 189% and $2.3bn Represents Enact™

risk-to-capital ratio at GMICOView entire presentation