Sportradar IPO Presentation Deck

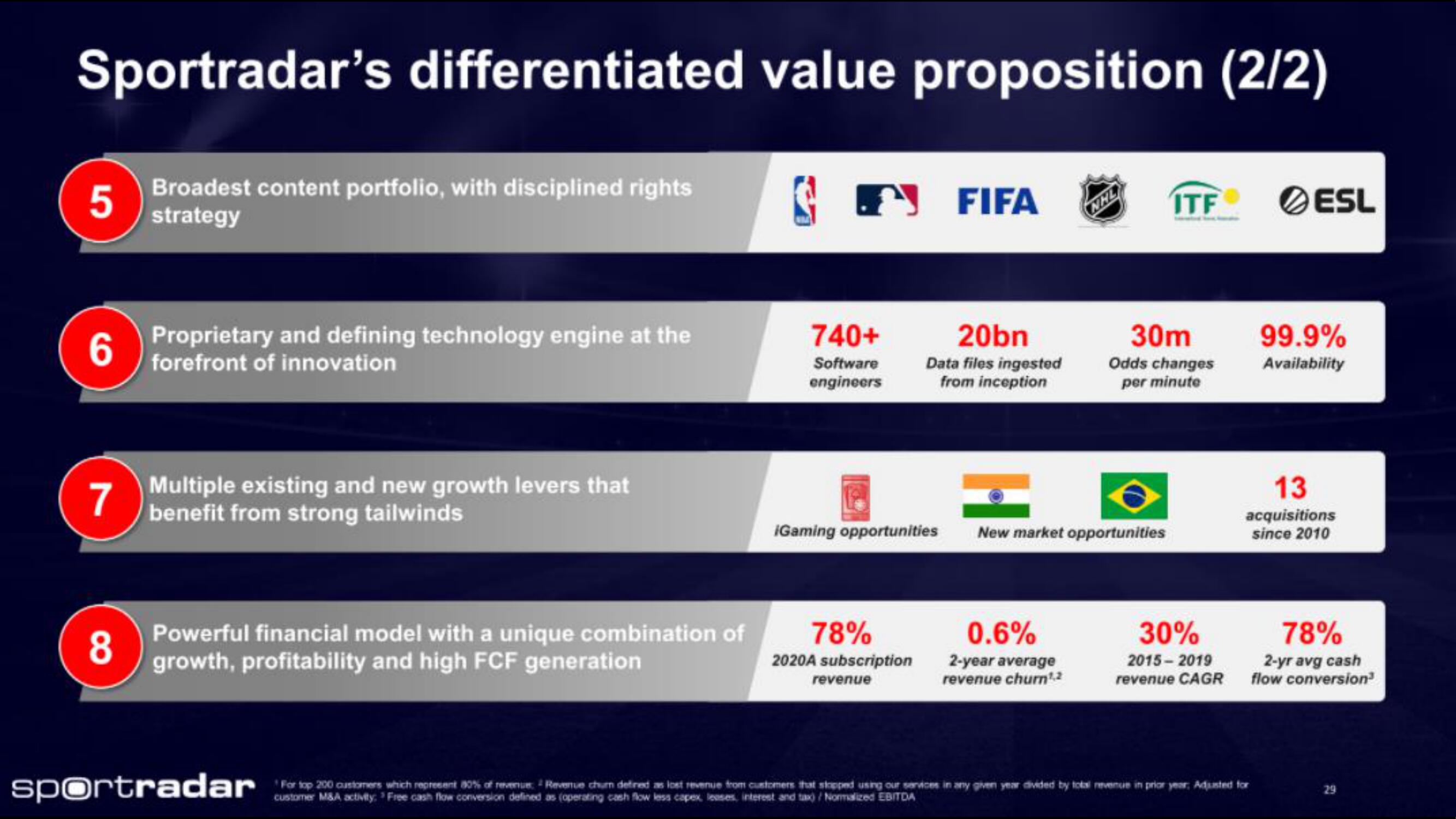

Sportradar's differentiated value proposition (2/2)

Broadest content portfolio, with disciplined rights

strategy

5

6

7

8

Proprietary and defining technology engine at the

forefront of innovation

Multiple existing and new growth levers that

benefit from strong tailwinds

Powerful financial model with a unique combination of

growth, profitability and high FCF generation

740+

Software

engineers

iGaming opportunities

78%

2020A subscription

revenue

FIFA

20bn

Data files ingested

from inception

NHL

0.6%

2-year average

revenue churn¹.2

New market opportunities

ITF

30m

Odds changes

per minute

30%

2015-2019

revenue CAGR

ESL

99.9%

Availability

13

acquisitions

since 2010

sportradarbo 200 cartonges which meinent 80% of moenice i Remus chin defned as last manus from customers the firsted using person in any open your sided by their mense in prospero Adjusted for

customer M&A activity: Free cash flow conversion defined as (operating cash flow less capex, leases, interest and tax)/Normalized EBITDA

78%

2-yr avg cash

flow conversion³

29View entire presentation