Yelp Investor Presentation Deck

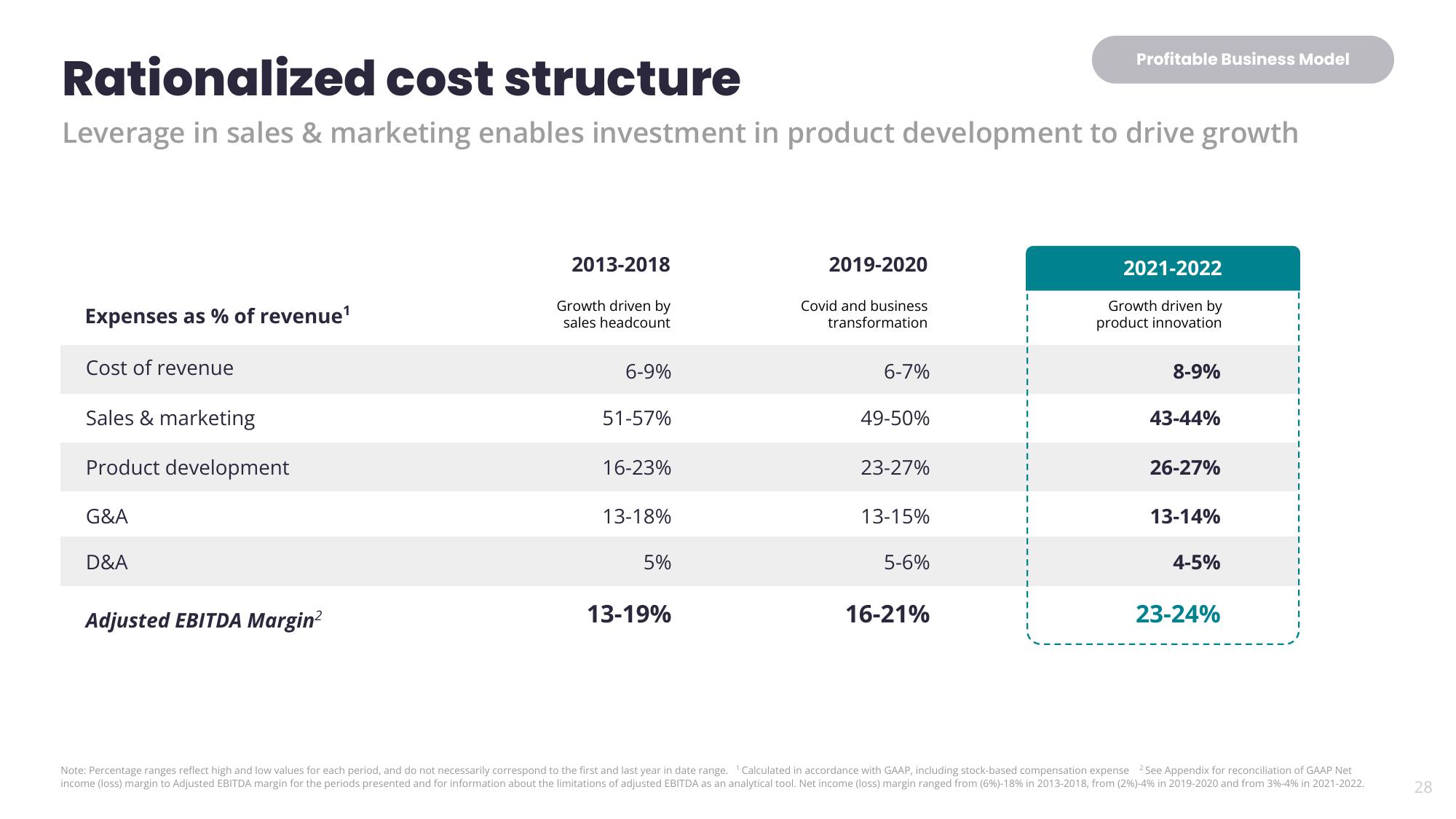

Rationalized cost structure

Leverage in sales & marketing enables investment in product development to drive growth

Expenses as % of revenue¹

Cost of revenue

Sales & marketing

Product development

G&A

D&A

Adjusted EBITDA Margin²

2013-2018

Growth driven by

sales headcount

6-9%

51-57%

16-23%

13-18%

5%

13-19%

2019-2020

Covid and business

transformation

6-7%

49-50%

23-27%

13-15%

5-6%

Profitable Business Model

16-21%

2021-2022

Growth driven by

product innovation

8-9%

43-44%

26-27%

13-14%

4-5%

23-24%

Note: Percentage ranges reflect high and low values for each period, and do not necessarily correspond to the first and last year in date range. Calculated in accordance with GAAP, including stock-based compensation expense 2See Appendix for reconciliation of GAAP Net

income (loss) margin to Adjusted EBITDA margin for the periods presented and for information about the limitations of adjusted EBITDA as an analytical tool. Net income (loss) margin ranged from (6%) -18% in 2013-2018, from (2%) -4% in 2019-2020 and from 3% -4% in 2021-2022.

28View entire presentation