ValueAct Capital Activist Presentation Deck

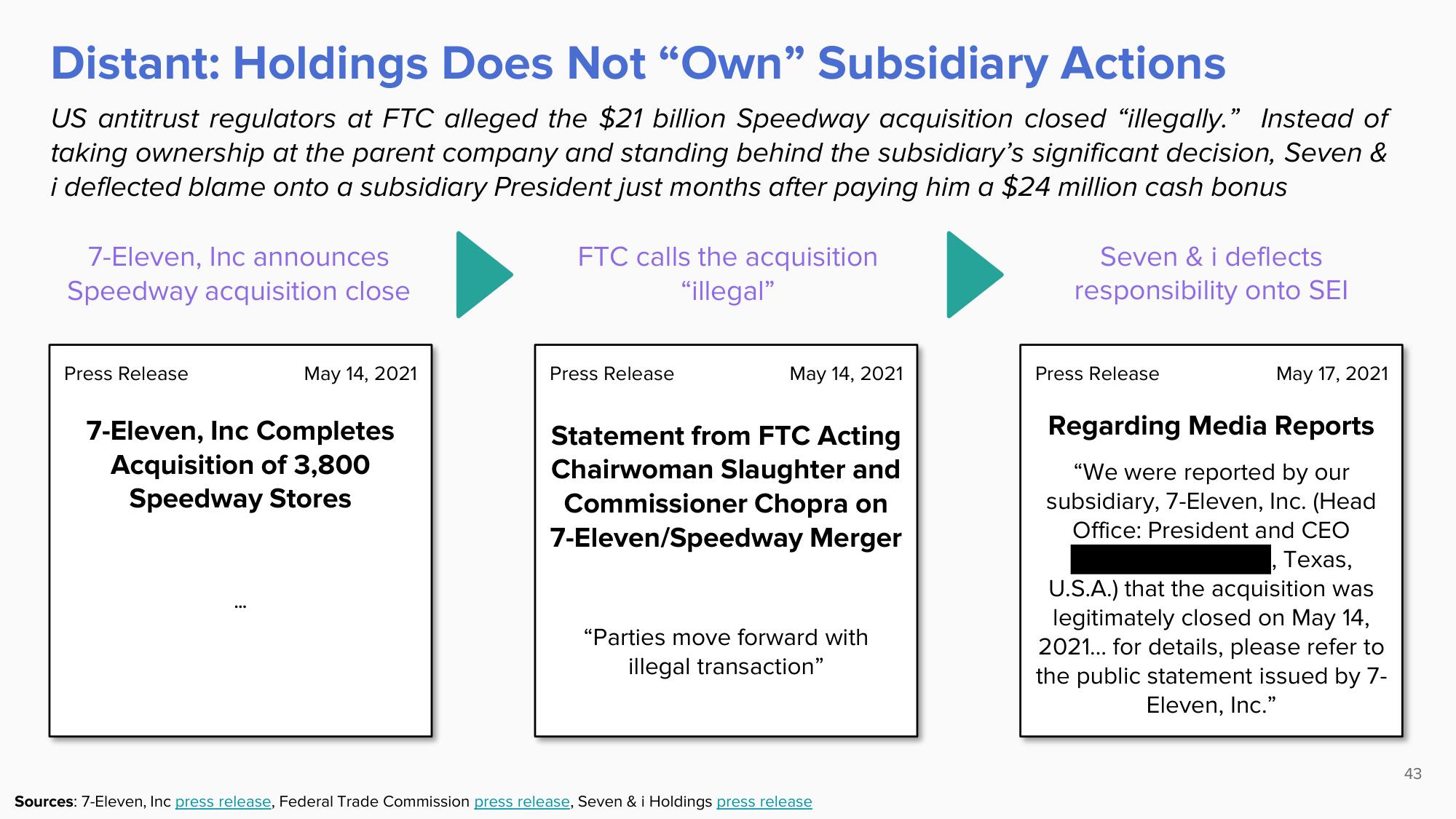

Distant: Holdings Does Not "Own" Subsidiary Actions

US antitrust regulators at FTC alleged the $21 billion Speedway acquisition closed "illegally." Instead of

taking ownership at the parent company and standing behind the subsidiary's significant decision, Seven &

i deflected blame onto a subsidiary President just months after paying him a $24 million cash bonus

7-Eleven, Inc announces

Speedway acquisition close

Press Release

May 14, 2021

7-Eleven, Inc Completes

Acquisition of 3,800

Speedway Stores

FTC calls the acquisition

"illegal"

Press Release

May 14, 2021

Statement from FTC Acting

Chairwoman Slaughter and

Commissioner Chopra on

7-Eleven/Speedway Merger

"Parties move forward with

illegal transaction"

Sources: 7-Eleven, Inc press release, Federal Trade Commission press release, Seven & i Holdings press release

Seven & i deflects

responsibility onto SEI

Press Release

May 17, 2021

Regarding Media Reports

"We were reported by our

subsidiary, 7-Eleven, Inc. (Head

Office: President and CEO

Texas,

U.S.A.) that the acquisition was

legitimately closed on May 14,

2021... for details, please refer to

the public statement issued by 7-

Eleven, Inc."

43View entire presentation