Apollo Global Management Investor Day Presentation Deck

CLO Anatomy Illustrates Structural Benefits

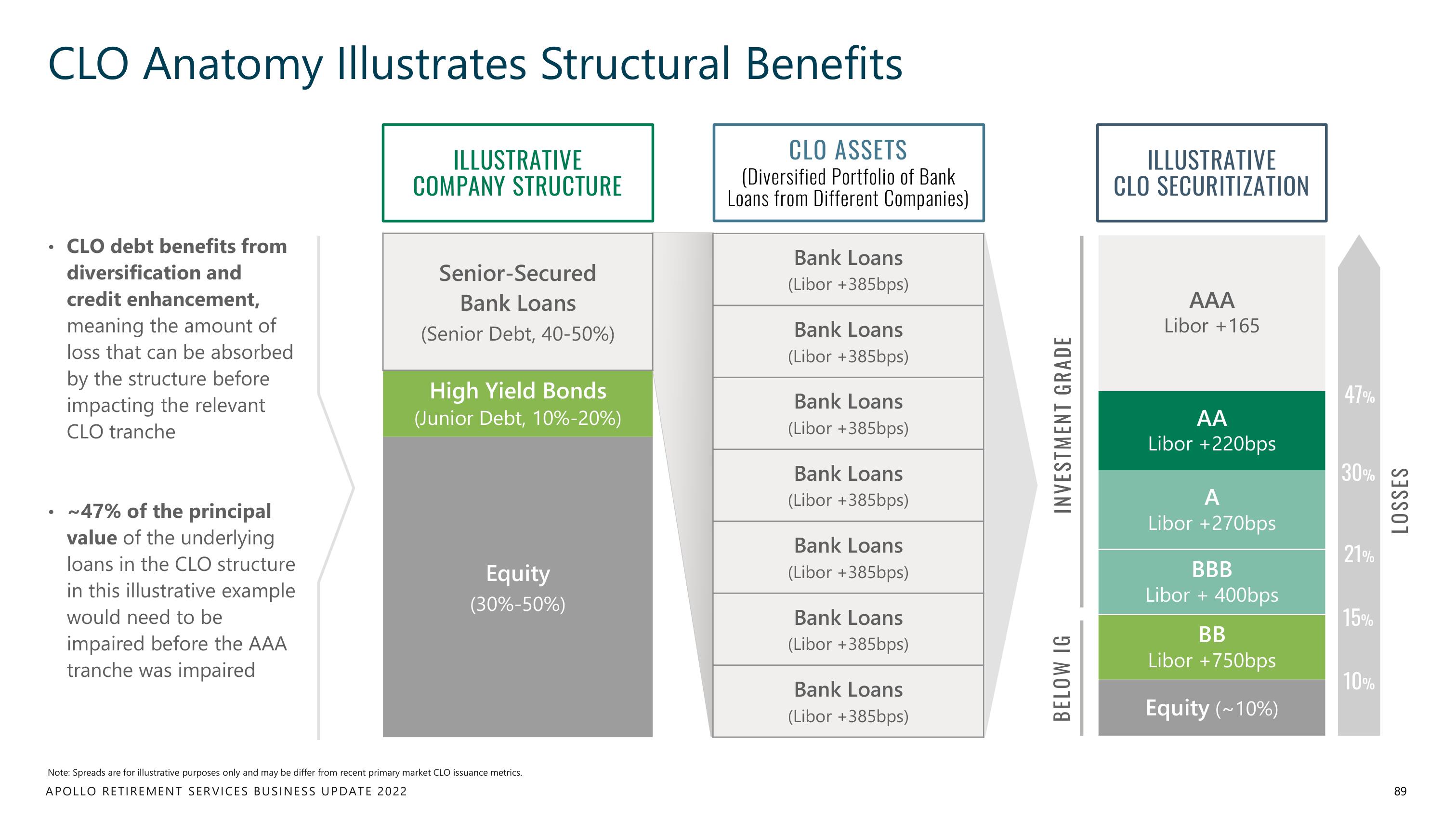

CLO ASSETS

(Diversified Portfolio of Bank

Loans from Different Companies)

●

●

CLO debt benefits from

diversification and

credit enhancement,

meaning the amount of

loss that can be absorbed

by the structure before

impacting the relevant

CLO tranche

~47% of the principal

value of the underlying

loans in the CLO structure

in this illustrative example

would need to be

impaired before the AAA

tranche was impaired

ILLUSTRATIVE

COMPANY STRUCTURE

Senior-Secured

Bank Loans

(Senior Debt, 40-50%)

High Yield Bonds

(Junior Debt, 10%-20%)

Equity

(30%-50%)

Note: Spreads are for illustrative purposes only and may be differ from recent primary market CLO issuance metrics.

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022

Bank Loans

(Libor +385bps)

Bank Loans

(Libor +385bps)

Bank Loans

(Libor +385bps)

Bank Loans

(Libor +385bps)

Bank Loans

(Libor +385bps)

Bank Loans

(Libor +385bps)

Bank Loans

(Libor +385bps)

INVESTMENT GRADE

BELOW IG

ILLUSTRATIVE

CLO SECURITIZATION

AAA

Libor +165

AA

Libor +220bps

A

Libor + 270bps

BBB

Libor + 400bps

BB

Libor +750bps

Equity (~10%)

47%

30%

21%

15%

10%

LOSSES

89View entire presentation