Evercore Investment Banking Pitch Book

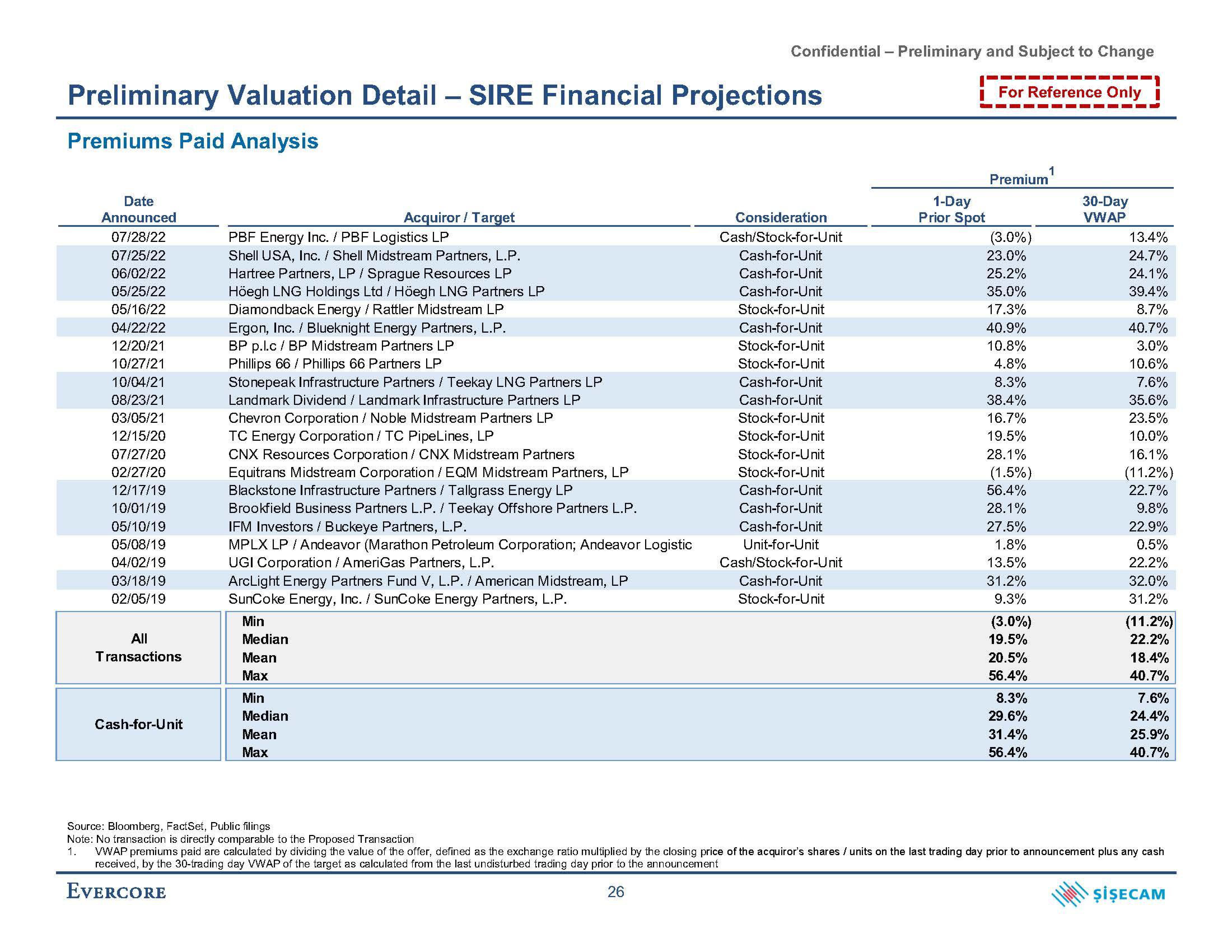

Preliminary Valuation Detail - SIRE Financial Projections

Premiums Paid Analysis

Date

Announced

07/28/22

07/25/22

06/02/22

05/25/22

05/16/22

04/22/22

12/20/21

10/27/21

10/04/21

08/23/21

03/05/21

12/15/20

07/27/20

02/27/20

12/17/19

10/01/19

05/10/19

05/08/19

04/02/19

03/18/19

02/05/19

All

Transactions

Cash-for-Unit

PBF Energy Inc. / PBF Logistics LP

Shell USA, Inc. / Shell Midstream Partners, L.P.

Hartree Partners, LP / Sprague Resources LP

Höegh LNG Holdings Ltd / Höegh LNG Partners LP

Diamondback Energy / Rattler Midstream LP

Acquiror / Target

Ergon, Inc. / Blueknight Energy Partners, L.P.

BP p.l.c / BP Midstream Partners LP

Phillips 66 Phillips 66 Partners LP

Stonepeak Infrastructure Partners / Teekay LNG Partners LP

Landmark Dividend / Landmark Infrastructure Partners LP

Chevron Corporation / Noble Midstream Partners LP

TC Energy Corporation / TC PipeLines, LP

CNX Resources Corporation / CNX Midstream Partners

Equitrans Midstream Corporation / EQM Midstream Partners, LP

Blackstone Infrastructure Partners / Tallgrass Energy LP

Brookfield Business Partners L.P./ Teekay Offshore Partners L.P.

IFM Investors / Buckeye Partners, L.P.

MPLX LP / Andeavor (Marathon Petroleum Corporation; Andeavor Logistic

UGI Corporation / AmeriGas Partners, L.P.

ArcLight Energy Partners Fund V, L.P. / American Midstream, LP

SunCoke Energy, Inc. / SunCoke Energy Partners, L.P.

Min

Median

Mean

Max

Min

Median

Mean

Max

Confidential - Preliminary and Subject to Change

For Reference Only

Source: Bloomberg, FactSet, Public filings

Note: No transaction is directly comparable to the Proposed Transaction

Consideration

Cash/Stock-for-Unit

Cash-for-Unit

Cash-for-Unit

Cash-for-Unit

Stock-for-Unit

Cash-for-Unit

Stock-for-Unit

Stock-for-Unit

Cash-for-Unit

Cash-for-Unit

Stock-for-Unit

Stock-for-Unit

Stock-for-Unit

Stock-for-Unit

Cash-for-Unit

Cash-for-Unit

Cash-for-Unit

Unit-for-Unit

Cash/Stock-for-Unit

Cash-for-Unit

Stock-for-Unit

1-Day

Prior Spot

Premium

(3.0%)

23.0%

25.2%

35.0%

17.3%

40.9%

10.8%

4.8%

8.3%

38.4%

16.7%

19.5%

28.1%

(1.5%)

56.4%

28.1%

27.5%

1.8%

13.5%

31.2%

9.3%

(3.0%)

19.5%

20.5%

56.4%

8.3%

29.6%

31.4%

56.4%

1

30-Day

VWAP

13.4%

24.7%

24.1%

39.4%

8.7%

40.7%

3.0%

10.6%

7.6%

35.6%

23.5%

10.0%

16.1%

(11.2%)

22.7%

9.8%

22.9%

0.5%

22.2%

32.0%

31.2%

(11.2%)

22.2%

18.4%

40.7%

7.6%

24.4%

25.9%

40.7%

1. VWAP premiums paid are calculated by dividing the value of the offer, defined as the exchange ratio multiplied by the closing price of the acquiror's shares / units on the last trading day prior to announcement plus any cash

received, by the 30-trading day VWAP of the target as calculated from the last undisturbed trading day prior to the announcement

EVERCORE

26

ŞİŞECAMView entire presentation