J.P.Morgan Results Presentation Deck

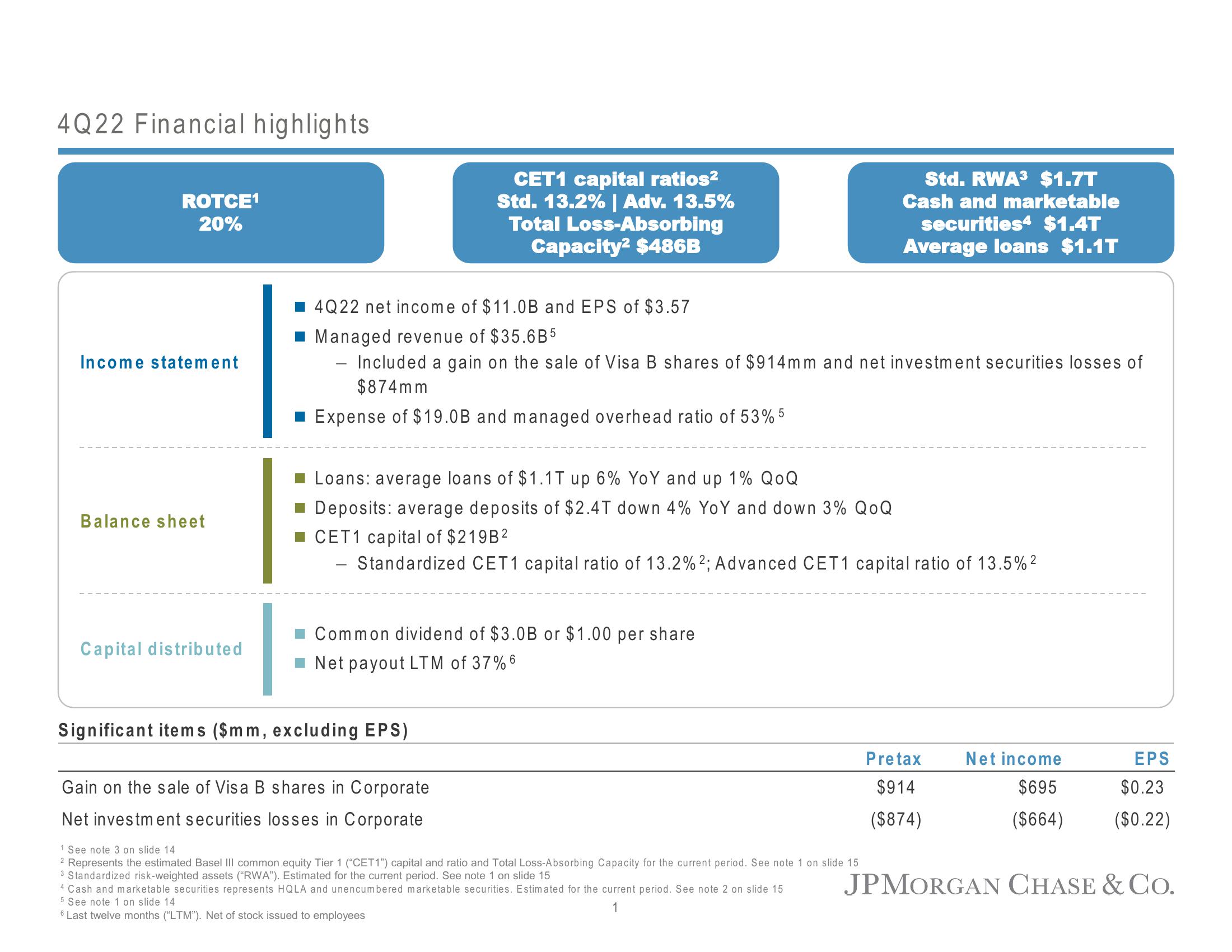

4Q22 Financial highlights

ROTCE¹

20%

Income statement

Balance sheet

Capital distributed

CET1 capital ratios²

Std. 13.2% | Adv. 13.5%

Total Loss-Absorbing

Capacity² $486B

4Q22 net income of $11.0B and EPS of $3.57

Managed revenue of $35.6B5

- Included a gain on the sale of Visa B shares of $914mm and net investment securities losses of

$874mm

■ Expense of $19.0B and managed overhead ratio of 53% 5

Loans: average loans of $1.1T up 6% YoY and up 1% QOQ

■ Deposits: average deposits of $2.4T down 4% YoY and down 3% QOQ

■ CET1 capital of $219B²

2

Standardized CET1 capital ratio of 13.2% 2; Advanced CET1 capital ratio of 13.5% ²

■ Common dividend of $3.0B or $1.00 per share

Net payout LTM of 37% 6

Significant items ($mm, excluding EPS)

Gain on the sale of Visa B shares in Corporate

Net investment securities losses in Corporate

Std. RWA³ $1.7T

Cash and marketable

securities4 $1.4T

Average loans $1.1T

1 See note 3 on slide 14

2 Represents the estimated Basel III common equity Tier 1 ("CET1") capital and ratio and Total Loss-Absorbing Capacity for the current period. See note 1 on slide 15

3 Standardized risk-weighted assets ("RWA"). Estimated for the current period. See note 1 on slide 15

4 Cash and marketable securities represents HQLA and unencumbered marketable securities. Estimated for the current period. See note 2 on slide 15

5 See note 1 on slide 14

1

6 Last twelve months ("LTM"). Net of stock issued to employees

Pretax

$914

($874)

Net income

$695

($664)

EPS

$0.23

($0.22)

JPMORGAN CHASE & Co.View entire presentation