Cerberus Global NPL Fund, L.P.

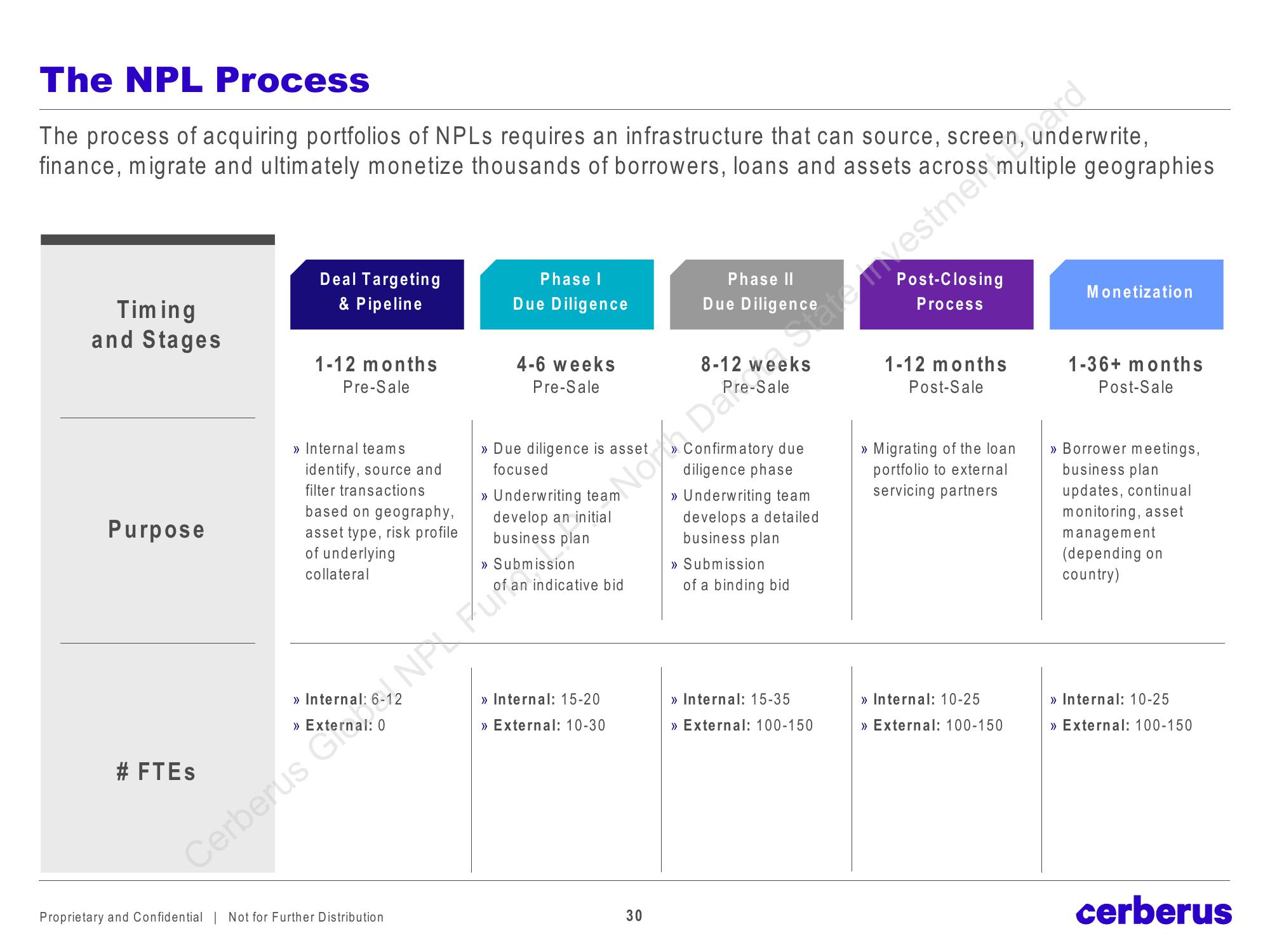

The NPL Process

The process of acquiring portfolios of NPLs requires an infrastructure that can source, screen,

finance, migrate and ultimately monetize thousands of borrowers, loans and assets across

Timing

and Stages

Purpose

# FTES

Deal Targeting

& Pipeline

1-12 months

Pre-Sale

» Internal teams

identify, source and

filter transactions

based on geography,

asset type, risk profile

of underlying

collateral

Phase I

Due Diligence

Proprietary and Confidential | Not for Further Distribution

4-6 weeks

Pre-Sale

>> Due diligence is asset

focused

>> Underwriting team

develop an initial

business plan

>> Submission

Non Date Statetiple geographies

af investmess und

indicative bid

>> Internal: 15-20

>> External: 10-30

Cerberus CNPX Fu

Phase II

Due Diligence

Team No Date

30

8-12

Confirmatory due

diligence phase

>> Underwriting team.

develops a detailed

business plan

>> Submission

of a binding bid

Post-Closing

>> Internal: 15-35

>> External: 100-150

Process

1-12 months

Post-Sale

>> Migrating of the loan

portfolio to external

servicing partners

, underwrite,

>> Internal: 10-25

>> External: 100-150

Monetization

1-36+ months

Post-Sale

>> Borrower meetings,

business plan

updates, continual

monitoring, asset

management

(depending on

country)

>> Internal: 10-25

>> External: 100-150

cerberusView entire presentation