Waldencast 2Q22 Investor Results

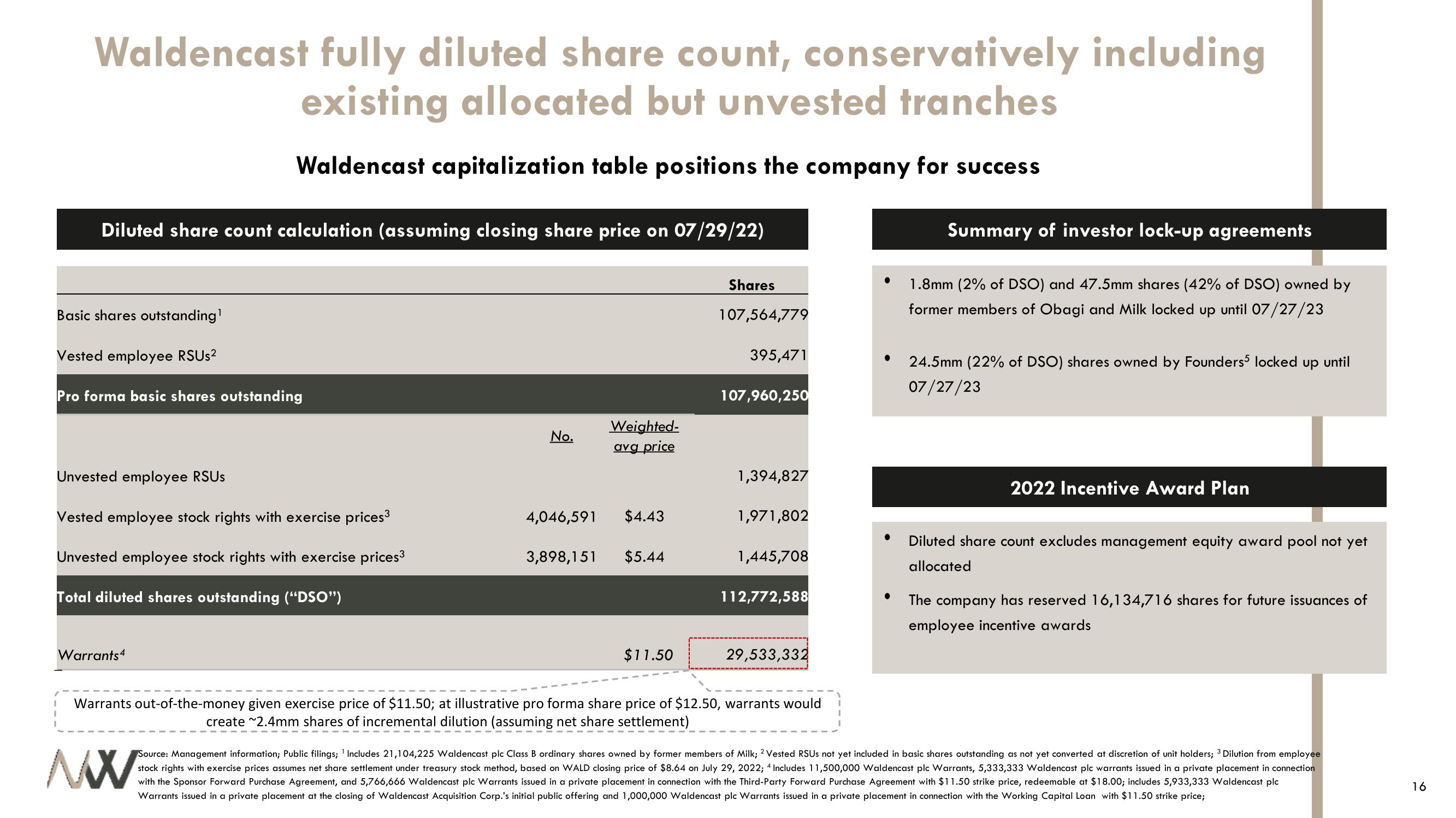

Waldencast fully diluted share count, conservatively including

existing allocated but unvested tranches

Waldencast capitalization table positions the company for success

Diluted share count calculation (assuming closing share price on 07/29/22)

Basic shares outstanding¹

Vested employee RSUs²

Pro forma basic shares outstanding

Unvested employee RSUs

Vested employee stock rights with exercise prices³

Unvested employee stock rights with exercise prices³

Total diluted shares outstanding ("DSO")

Warrants4

No.

Weighted-

avg_price

4,046,591 $4.43

3,898,151 $5.44

$11.50

Shares

107,564,779

395,471

107,960,250

1,394,827

1,971,802

1,445,708

112,772,588

29,533,332

Warrants out-of-the-money given exercise price of $11.50; at illustrative pro forma share price of $12.50, warrants would

create ~2.4mm shares of incremental dilution (assuming net share settlement)

●

Summary of investor lock-up agreements

1.8mm (2% of DSO) and 47.5mm shares (42% of DSO) owned by

former members of Obagi and Milk locked up until 07/27/23

24.5mm (22% of DSO) shares owned by Founders5 locked

07/27/23

2022 Incentive Award Plan

up

until

Diluted share count excludes management equity award pool not yet

allocated

The company has reserved 16,134,716 shares for future issuances of

employee incentive awards

MX

Source: Management information; Public filings; Includes 21,104,225 Waldencast plc Class B ordinary shares owned by former members of Milk; 2 Vested RSUs not yet included in basic shares outstanding as not yet converted at discretion of unit holders; 3 Dilution from employee

stock rights with exercise prices assumes net share settlement under treasury stock method, based on WALD closing price of $8.64 on July 29, 2022; 4 Includes 11,500,000 Waldencast plc Warrants, 5,333,333 Waldencast plc warrants issued in a private placement in connection

with the Sponsor Forward Purchase Agreement, and 5,766,666 Waldencast plc Warrants issued in a private placement in connection with the Third-Party Forward Purchase Agreement with $11.50 strike price, redeemable at $18.00; includes 5,933,333 Waldencast plc

Warrants issued in a private placement at the closing of Waldencast Acquisition Corp.'s initial public offering and 1,000,000 Waldencast plc Warrants issued in a private placement in connection with the Working Capital Loan with $11.50 strike price;

16View entire presentation