Flutter Investor Day Presentation Deck

UK & Ireland

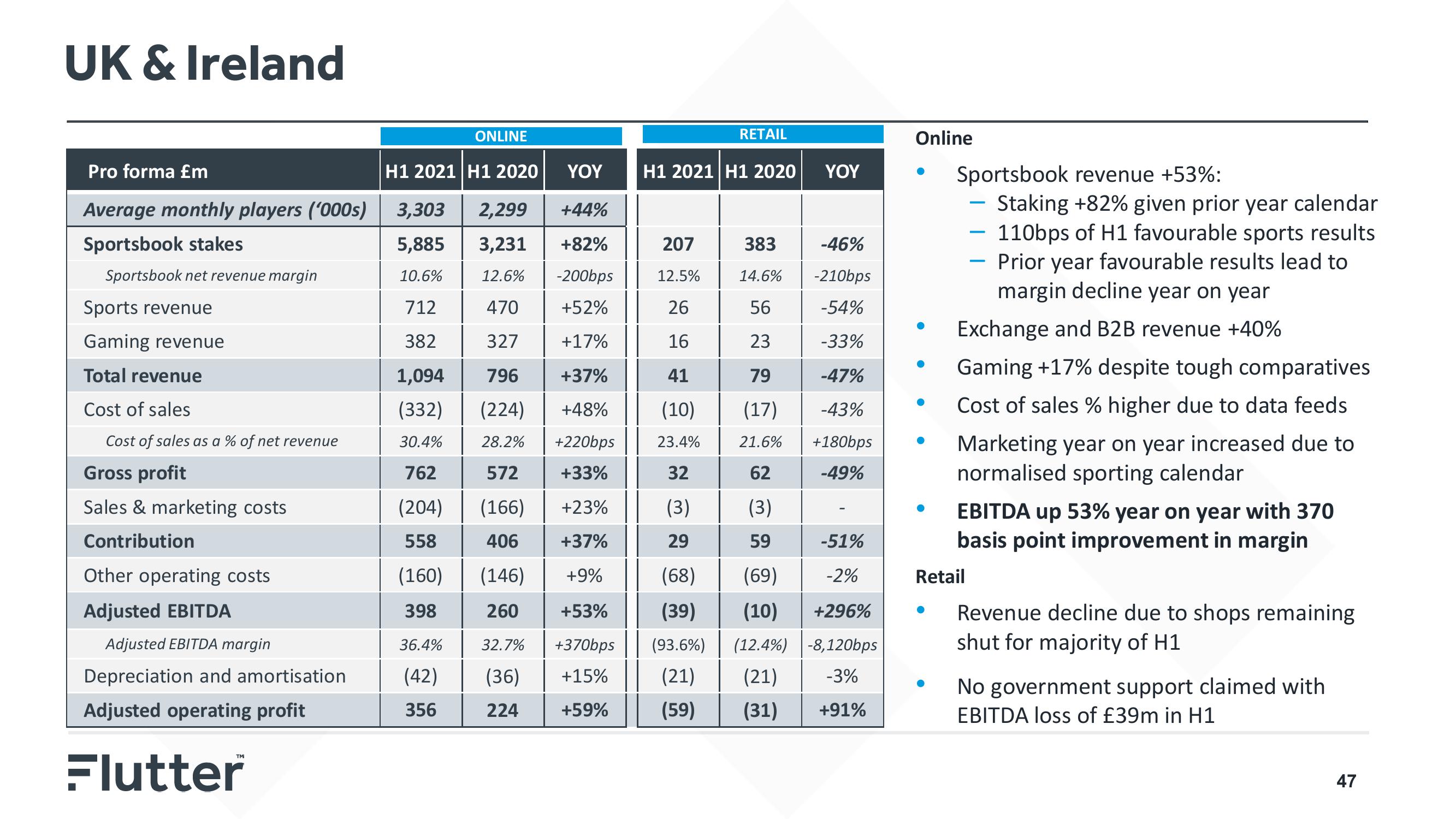

Pro forma £m

Average monthly players ('000s)

Sportsbook stakes

Sportsbook net revenue margin

Sports revenue

Gaming revenue

Total revenue

Cost of sales

Cost of sales as a % of net revenue

Gross profit

Sales & marketing costs

Contribution

Other operating costs

Adjusted EBITDA

Adjusted EBITDA margin

Depreciation and amortisation

Adjusted operating profit

Flutter

ONLINE

36.4%

(42)

356

RETAIL

H1 2021|H1 2020

YOY

3,303 2,299

+44%

5,885 3,231

10.6%

12.6%

+82%

-200bps

+52%

712

470

382

327

+17%

1,094

796

+37%

(332) (224) +48%

30.4%

28.2%

+220bps

762

572

+33%

(204)

(166)

+23%

558

406

+37%

(160)

(146)

+9% (68) (69)

398

260

+53%

+370bps

(39) (10)

(93.6%)

(21)

(12.4%)

+15%

(21)

+59%

(59) (31)

32.7%

(36)

224

H1 2021|H1 2020

383

207

12.5%

26

14.6%

56

16

23

79

41

(10) (17)

21.6%

23.4%

32

62

(3)

29

(3)

59

YOY

-46%

-210bps

-54%

-33%

-47%

-43%

+180bps

-49%

-51%

-2%

+296%

-8,120bps

-3%

+91%

Online

Sportsbook revenue +53%:

-

Staking +82% given prior year calendar

110bps of H1 favourable sports results

Prior year favourable results lead to

margin decline year on year

Exchange and B2B revenue +40%

Gaming +17% despite tough comparatives

Cost of sales % higher due to data feeds

Marketing year on year increased due to

normalised sporting calendar

Retail

EBITDA up 53% year on year with 370

basis point improvement in margin

Revenue decline due to shops remaining

shut for majority of H1

No government support claimed with

EBITDA loss of £39m in H1

47View entire presentation