Crocs Results Presentation Deck

Q1 Financial Highlights

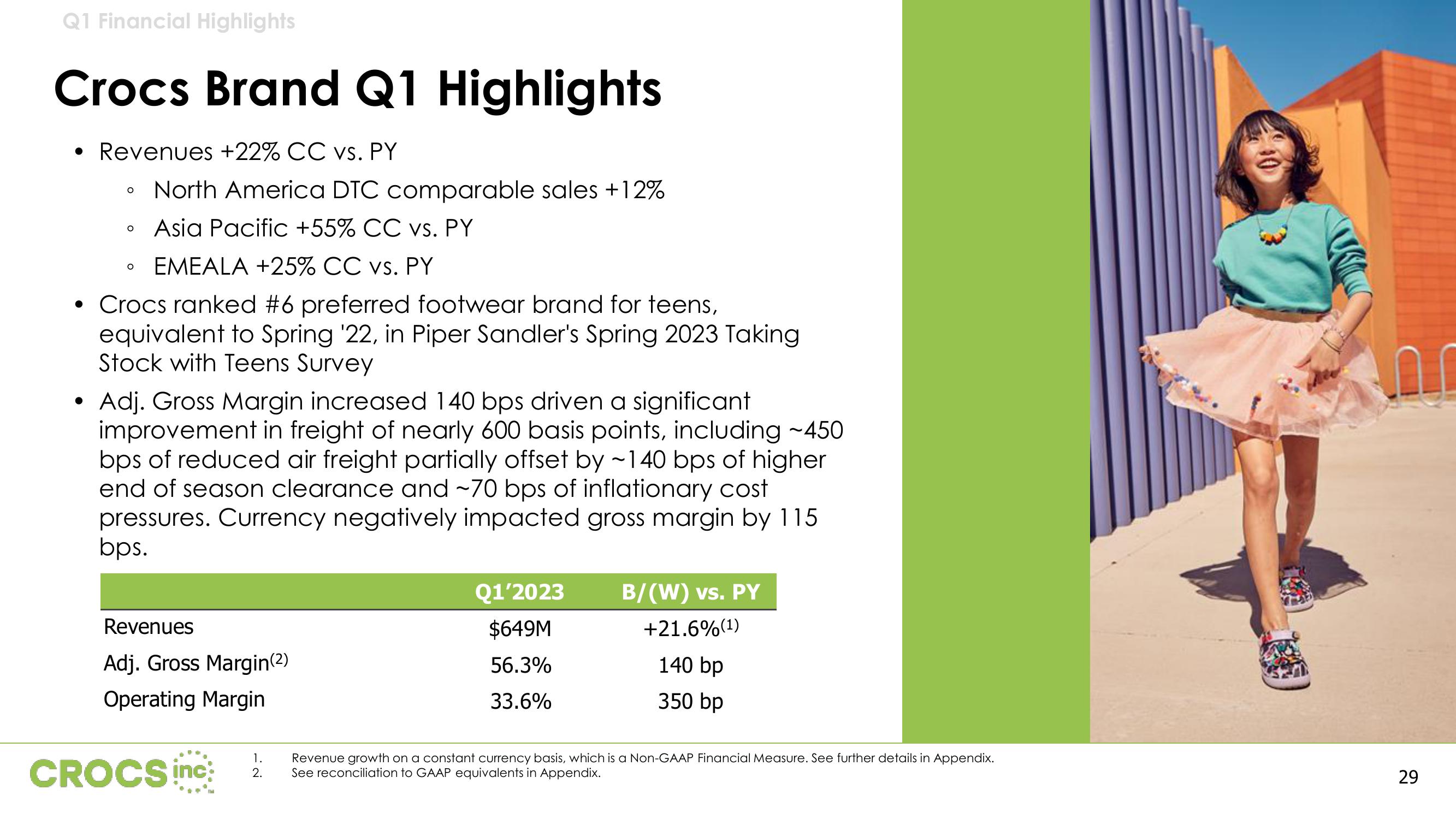

Crocs Brand Q1 Highlights

• Revenues +22% CC vs. PY

O

●

O

North America DTC comparable sales +12%

Asia Pacific +55% CC vs. PY

• EMEALA +25% CC vs. PY

O

• Crocs ranked #6 preferred footwear brand for teens,

equivalent to Spring '22, in Piper Sandler's Spring 2023 Taking

Stock with Teens Survey

Adj. Gross Margin increased 140 bps driven a significant

improvement in freight of nearly 600 basis points, including ~450

bps of reduced air freight partially offset by ~140 bps of higher

end of season clearance and ~70 bps of inflationary cost

pressures. Currency negatively impacted gross margin by 115

bps.

Revenues

Adj. Gross Margin(2)

Operating Margin

CROCS inc

1.

2.

Q1'2023

$649M

56.3%

33.6%

B/(W) vs. PY

+21.6%(1)

140 bp

350 bp

Revenue growth on a constant currency basis, which is a Non-GAAP Financial Measure. See further details in Appendix.

See reconciliation to GAAP equivalents in Appendix.

29View entire presentation