Hilltop Holdings Results Presentation Deck

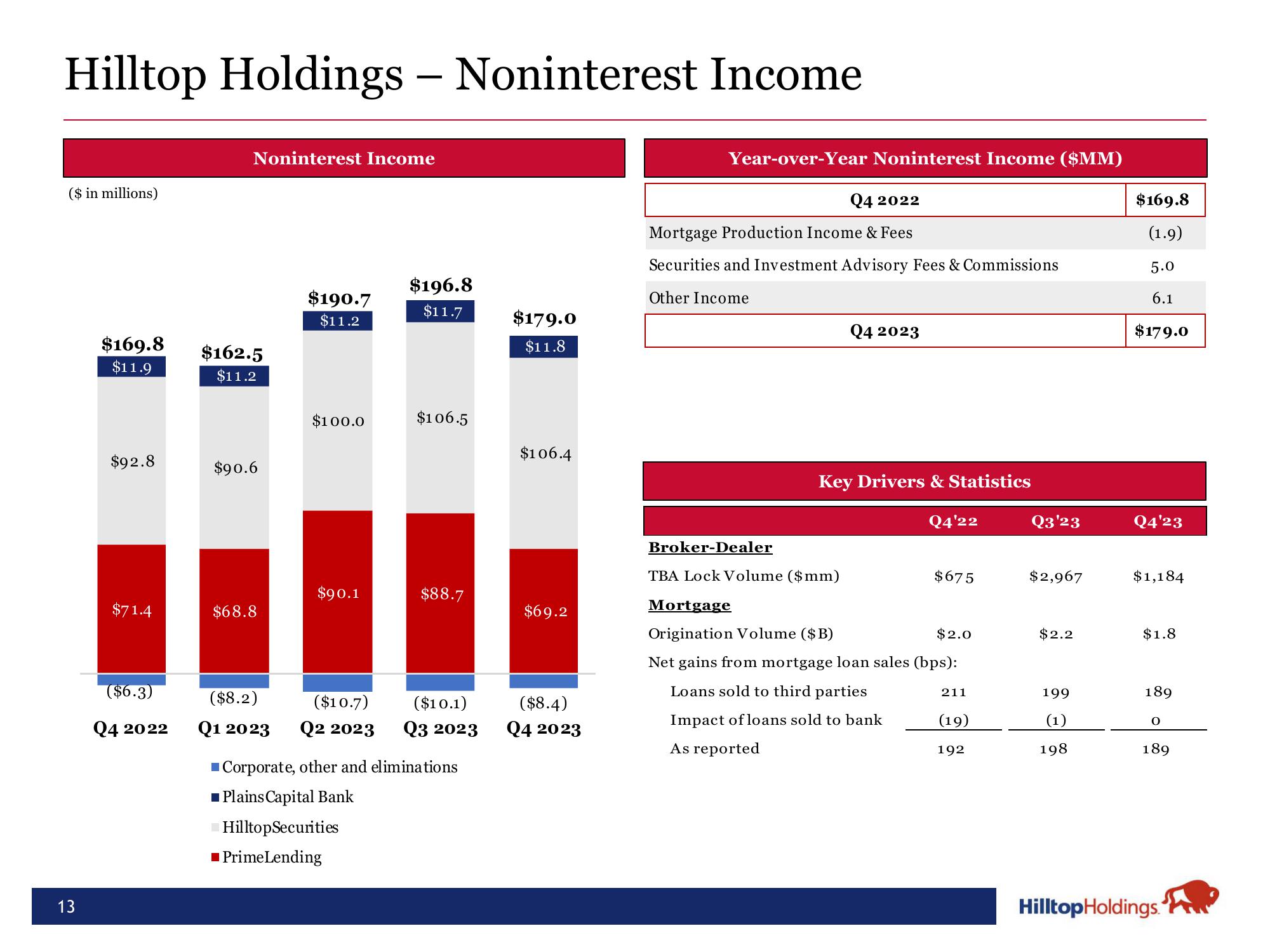

Hilltop Holdings - Noninterest Income

($ in millions)

13

$169.8

$11.9

$92.8

$71.4

($6.3)

Q4 2022

Noninterest Income

$162.5

$11.2

$90.6

$68.8

$190.7

$11.2

$100.0

$90.1

($8.2)

Q1 2023 Q2 2023

$196.8

$11.7

$106.5

■ Prime Lending

$88.7

($10.7) ($10.1)

Q3 2023

Corporate, other and eliminations

■Plains Capital Bank

Hilltop Securities

$179.0

$11.8

$106.4

$69.2

($8.4)

Q4 2023

Year-over-Year Noninterest Income ($MM)

Q4 2022

Mortgage Production Income & Fees

Securities and Investment Advisory Fees & Commissions

Other Income

Q4 2023

Key Drivers & Statistics

Broker-Dealer

TBA Lock Volume ($mm)

Q4'22

$675

Mortgage

Origination Volume ($B)

$2.0

Net gains from mortgage loan sales (bps):

Loans sold to third parties

Impact of loans sold to bank

As reported

211

(19)

192

Q3'23

$2,967

$2.2

199

(1)

198

$169.8

(1.9)

5.0

6.1

$179.0

Q4'23

$1,184

$1.8

189

O

189

Hilltop Holdings.View entire presentation