Allwyn Results Presentation Deck

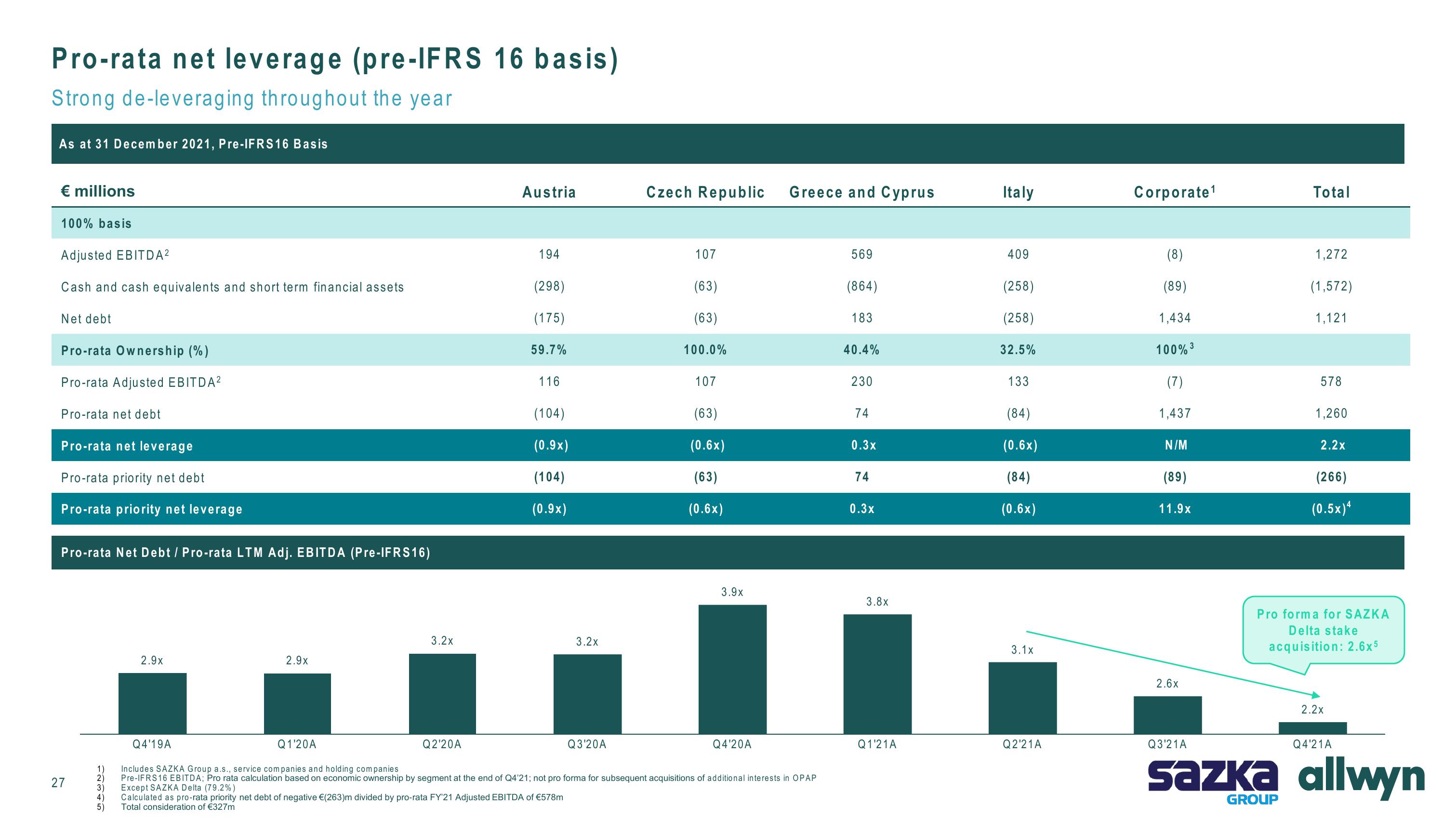

Pro-rata net leverage (pre-IFRS 16 basis)

Strong de-leveraging throughout the year

As at 31 December 2021, Pre-IFRS16 Basis

€ millions

100% basis

Adjusted EBITDA²

Cash and cash equivalents and short term financial assets

Net debt

Pro-rata Ownership (%)

Pro-rata Adjusted EBITDA²

Pro-rata net debt

Pro-rata net leverage

Pro-rata priority net debt

Pro-rata priority net leverage

Pro-rata Net Debt / Pro-rata LTM Adj. EBITDA (Pre-IFRS16)

27

1)

2)

3)

4)

5)

2.9x

Q4'19A

2.9x

Austria

Q1'20A

194

(298)

(175)

59.7%

116

(104)

(0.9x)

(104)

(0.9x)

3.2x

Czech Republic

3.2x

…….

Q2'20A

Q3'20A

107

(63)

(63)

100.0%

107

(63)

(0.6x)

(63)

(0.6x)

3.9x

Greece and Cyprus

Q4'20A

Includes SAZKA Group a.s., service companies and holding companies

Pre-IFRS16 EBITDA; Pro rata calculation based on economic ownership by segment at the end of Q4'21; not pro forma for subsequent acquisitions of additional interests in OPAP

Except SAZKA Delta (79.2%)

Calculated as pro-rata priority net debt of negative €(263)m divided by pro-rata FY'21 Adjusted EBITDA of €578m

Total consideration of €327m

569

(864)

183

40.4%

230

74

0.3x

74

0.3x

3.8x

Q1'21A

Italy

409

(258)

(258)

32.5%

133

(84)

(0.6x)

(84)

(0.6x)

3.1x

Q2'21A

Corporate¹

(8)

(89)

1,434

100% ³

(7)

1,437

N/M

(89)

11.9x

2.6x

Q3'21A

Total

1,272

GROUP

(1,572)

1,121

578

1,260

2.2x

(266)

(0.5x)4

Pro forma for SAZKA

Delta stake

acquisition: 2.6x5

2.2x

Q4'21A

sazka allwynView entire presentation