Nano Dimension Mergers and Acquisitions Presentation Deck

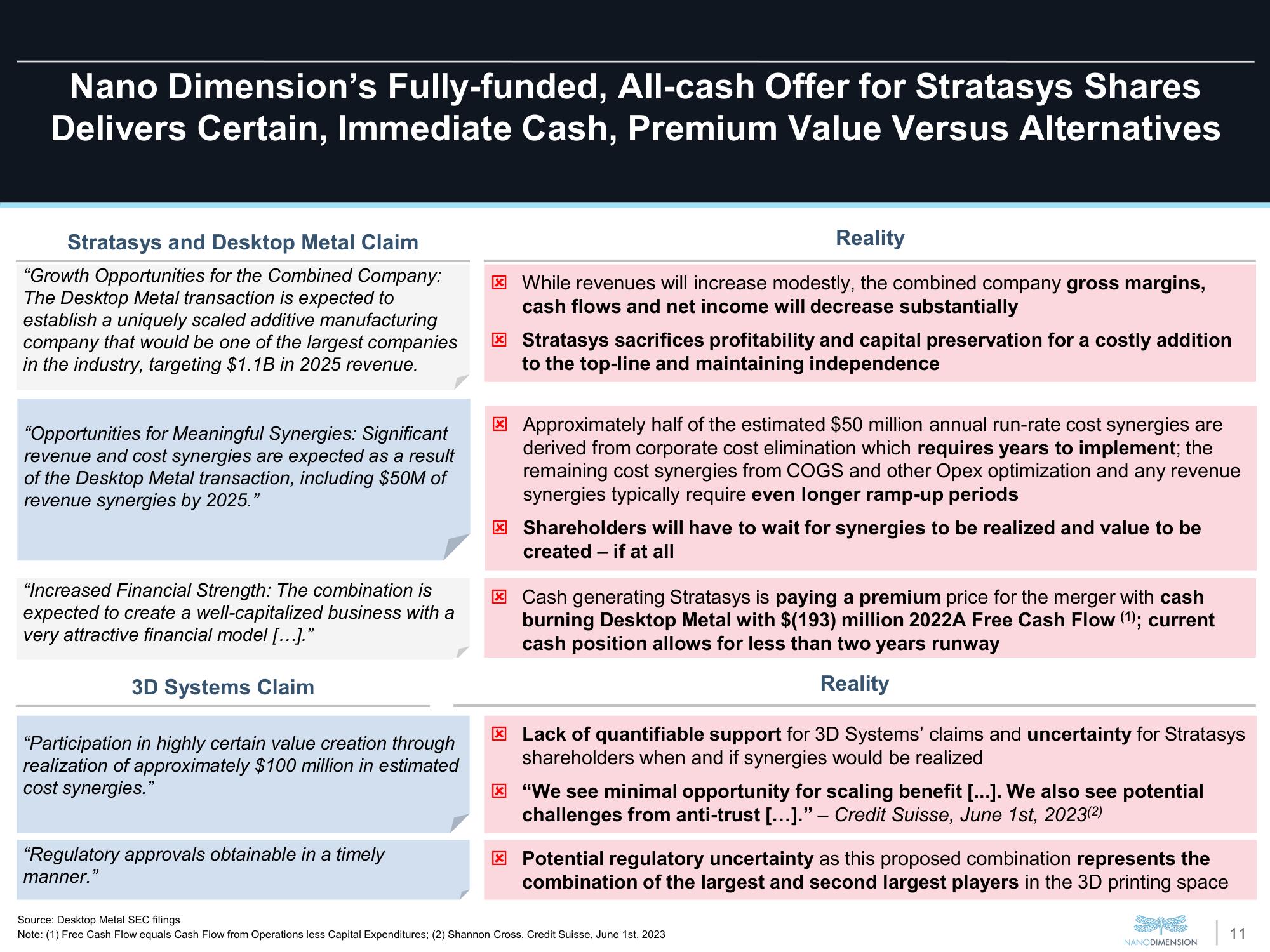

Nano Dimension's Fully-funded, All-cash Offer for Stratasys Shares

Delivers Certain, Immediate Cash, Premium Value Versus Alternatives

Stratasys and Desktop Metal Claim

"Growth Opportunities for the Combined Company:

The Desktop Metal transaction is expected to

establish a uniquely scaled additive manufacturing

company that would be one of the largest companies

in the industry, targeting $1.1B in 2025 revenue.

"Opportunities for Meaningful Synergies: Significant

revenue and cost synergies are expected as a result

of the Desktop Metal transaction, including $50M of

revenue synergies by 2025."

"Increased Financial Strength: The combination is

expected to create a well-capitalized business with a

very attractive financial model [...].”

3D Systems Claim

"Participation in highly certain value creation through

realization of approximately $100 million in estimated

cost synergies."

"Regulatory approvals obtainable in a timely

manner.

39

Reality

* While revenues will increase modestly, the combined company gross margins,

cash flows and net income will decrease substantially

Stratasys sacrifices profitability and capital preservation for a costly addition

to the top-line and maintaining independence

Approximately half of the estimated $50 million annual run-rate cost synergies are

derived from corporate cost elimination which requires years to implement; the

remaining cost synergies from COGS and other Opex optimization and any revenue

synergies typically require even longer ramp-up periods

Shareholders will have to wait for synergies to be realized and value to be

created - if at all

Cash generating Stratasys is paying a premium price for the merger with cash

burning Desktop Metal with $(193) million 2022A Free Cash Flow (1); current

cash position allows for less than two years runway

Reality

Lack of quantifiable support for 3D Systems' claims and uncertainty for Stratasys

shareholders when and if synergies would be realized

"We see minimal opportunity for scaling benefit [...]. We also see potential

challenges from anti-trust […..].” – Credit Suisse, June 1st, 2023(²)

-

Potential regulatory uncertainty as this proposed combination represents the

combination of the largest and second largest players in the 3D printing space

Source: Desktop Metal SEC filings

Note: (1) Free Cash Flow equals Cash Flow from Operations less Capital Expenditures; (2) Shannon Cross, Credit Suisse, June 1st, 2023

NANODIMENSION

11View entire presentation