Comcast Results Presentation Deck

Cable Communications 2nd Quarter 2022 Overview

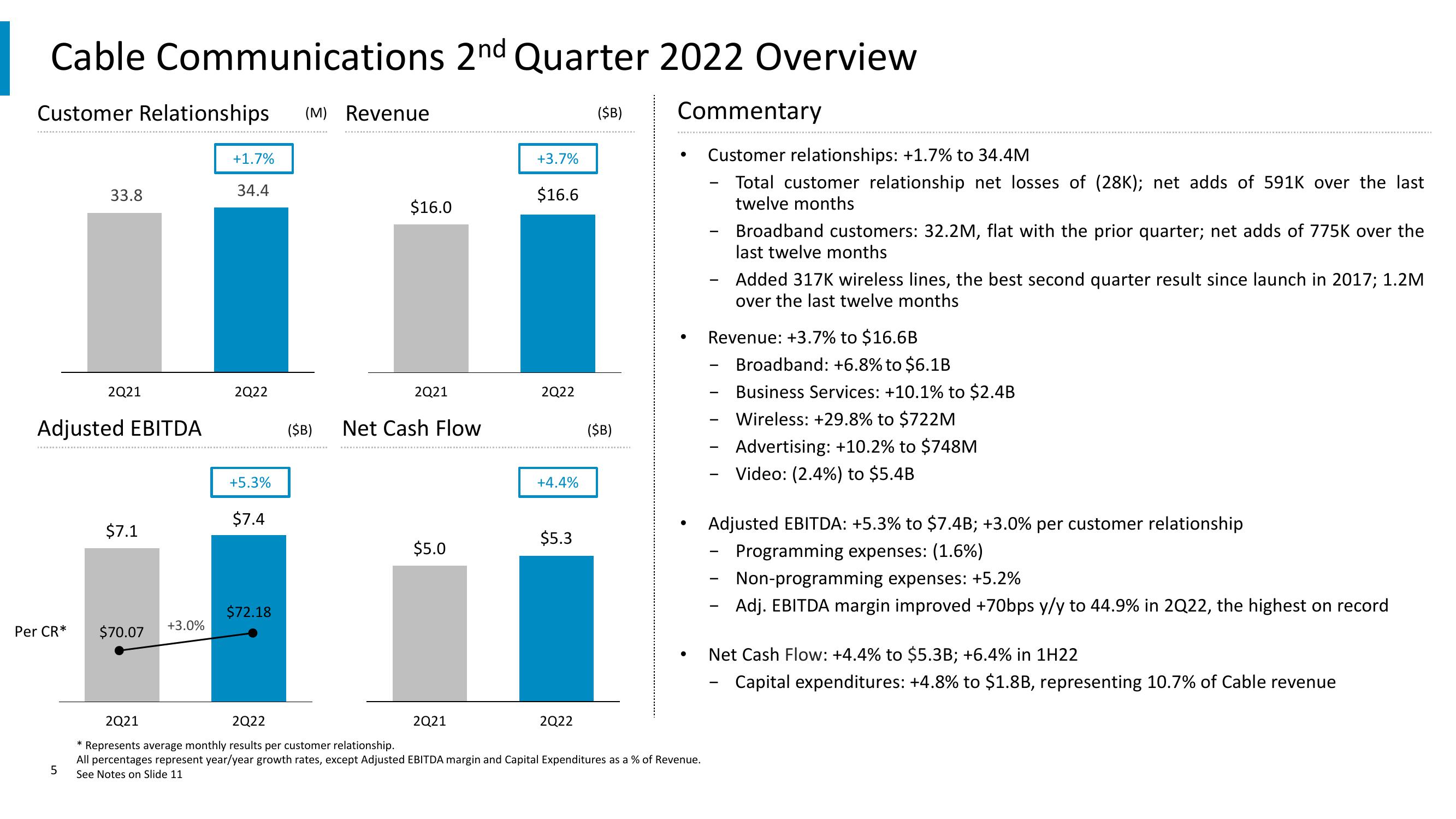

Customer Relationships (M) Revenue

Per CR*

Adjusted EBITDA

5

33.8

2Q21

*

$7.1

$70.07

+3.0%

+1.7%

34.4

2Q22

+5.3%

$7.4

$72.18

$16.0

2Q21

($B) Net Cash Flow

$5.0

+3.7%

2Q21

$16.6

2Q22

+4.4%

$5.3

($B)

2Q21

2Q22

Represents average monthly results per customer relationship.

All percentages represent year/year growth rates, except Adjusted EBITDA margin and Capital Expenditures as a % of Revenue.

See Notes on Slide 11

2Q22

($B)

Commentary

Customer relationships: +1.7% to 34.4M

Total customer relationship net losses of (28K); net adds of 591K over the last

twelve months

-

Broadband customers: 32.2M, flat with the prior quarter; net adds of 775K over the

last twelve months

Added 317K wireless lines, the best second quarter result since launch in 2017; 1.2M

over the last twelve months

Revenue: +3.7% to $16.6B

-

Broadband: +6.8% to $6.1B

Business Services: +10.1% to $2.4B

Wireless: +29.8% to $722M

Advertising: +10.2% to $748M

Video: (2.4%) to $5.4B

Adjusted EBITDA: +5.3% to $7.4B; +3.0% per customer relationship

Programming expenses: (1.6%)

Non-programming expenses: +5.2%

Adj. EBITDA margin improved +70bps y/y to 44.9% in 2Q22, the highest on record

Net Cash Flow: +4.4% to $5.3B; +6.4% in 1H22

Capital expenditures: +4.8% to $1.8B, representing 10.7% of Cable revenueView entire presentation