Experienced Senior Team Overview

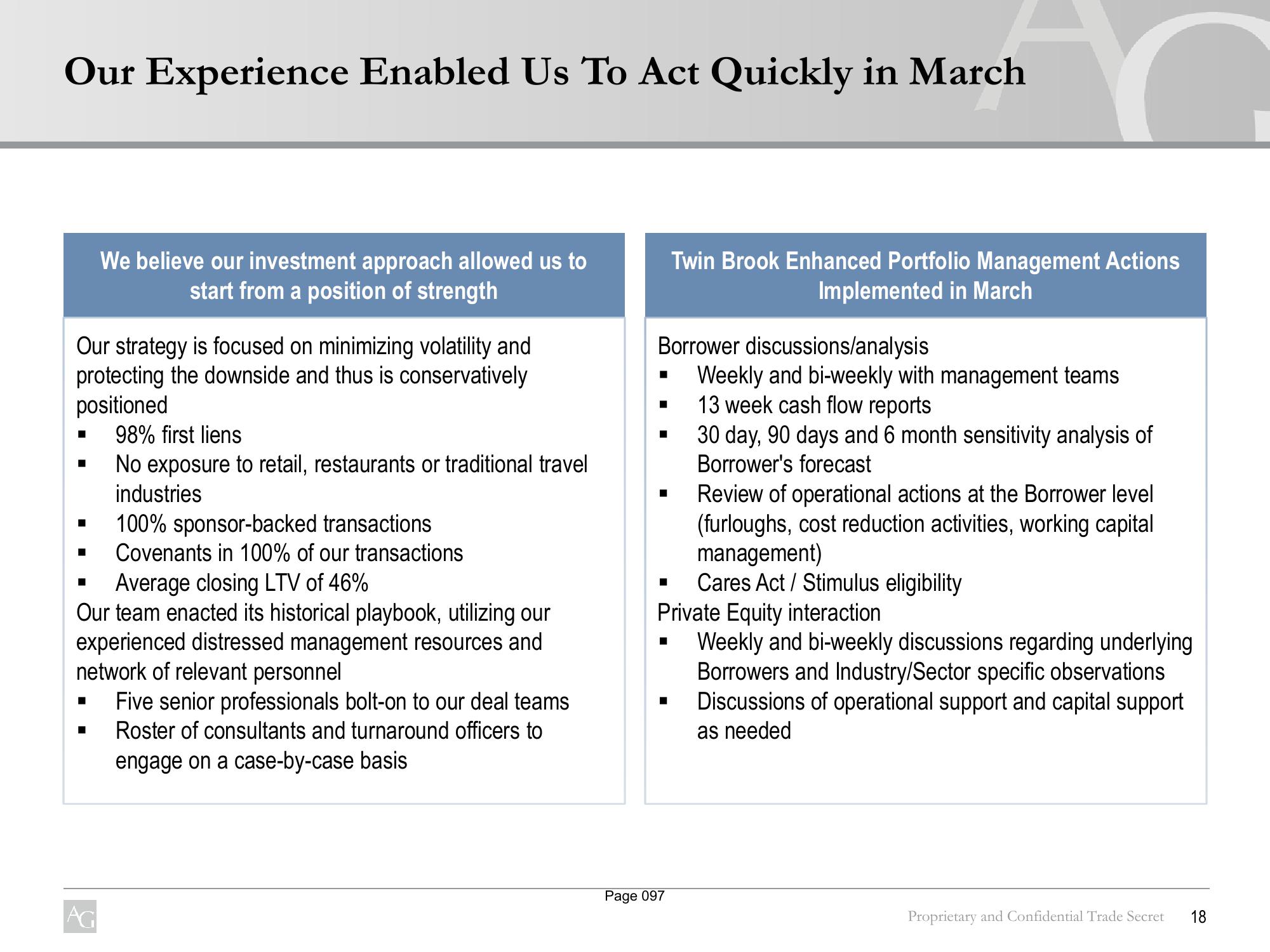

Our Experience Enabled Us To Act Quickly in March

Our strategy is focused on minimizing volatility and

protecting the downside and thus is conservatively

positioned

98% first liens

No exposure to retail, restaurants or traditional travel

industries

100% sponsor-backed transactions

■

We believe our investment approach allowed us to

start from a position of strength

■ Covenants in 100% of our transactions

Average closing LTV of 46%

Our team enacted its historical playbook, utilizing our

experienced distressed management resources and

network of relevant personnel

I

AG

Five senior professionals bolt-on to our deal teams

Roster of consultants and turnaround officers to

engage on a case-by-case basis

■

r

Borrower discussions/analysis

Weekly and bi-weekly with management teams

13 week cash flow reports

30 day, 90 days and 6 month sensitivity analysis of

Borrower's forecast

Review of operational actions at the Borrower level

(furloughs, cost reduction activities, working capital

management)

Cares Act / Stimulus eligibility

Twin Brook Enhanced Portfolio Management Actions

Implemented in March

Page 097

Private Equity interaction

Weekly and bi-weekly discussions regarding underlying

Borrowers and Industry/Sector specific observations

Discussions of operational support and capital support

as needed

Proprietary and Confidential Trade Secret

18View entire presentation