BlackRock Investor Conference Presentation Deck

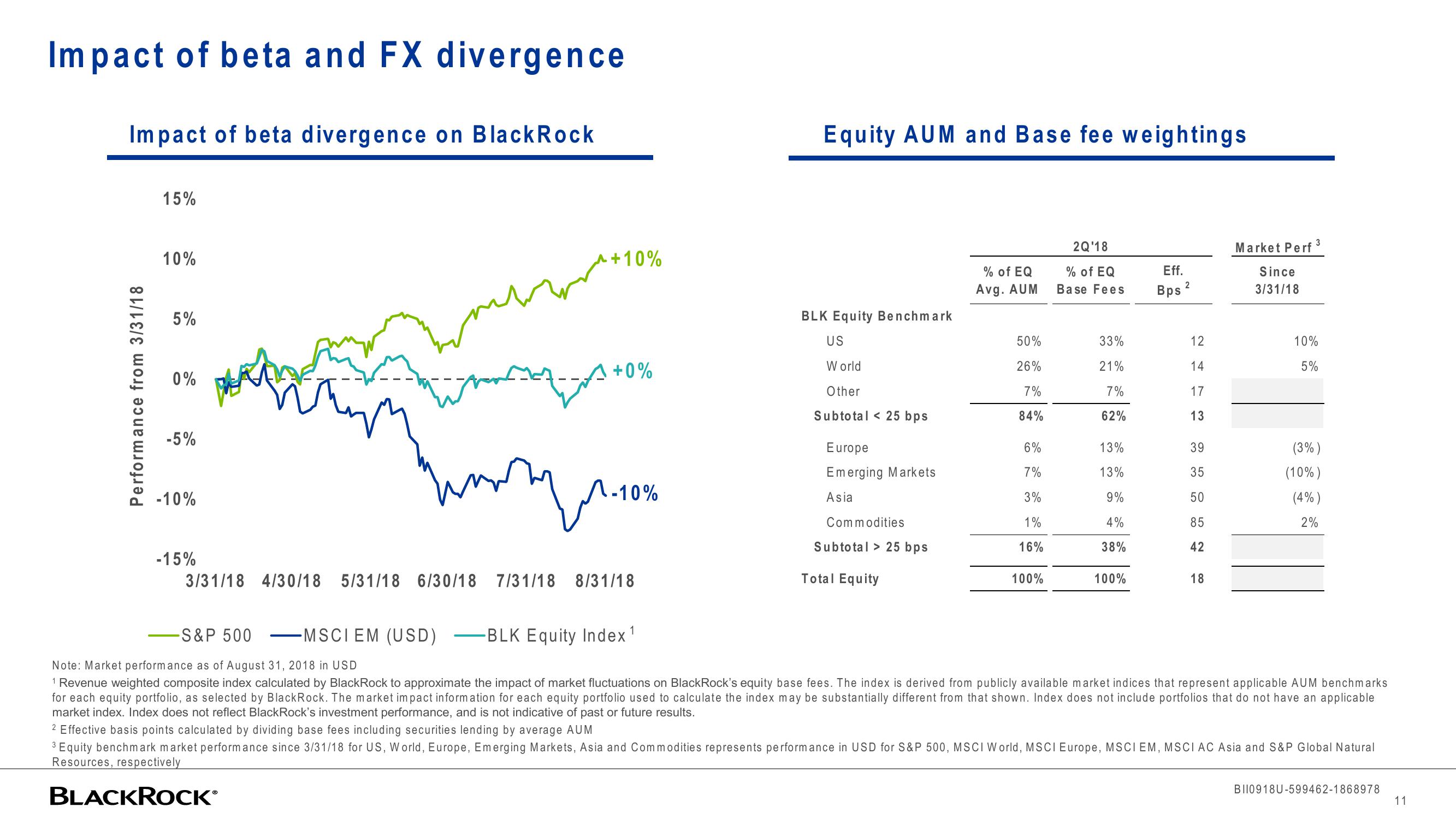

Impact of beta and FX divergence

Impact of beta divergence on BlackRock

Performance from 3/31/18

15%

10%

5%

0%

-5%

-10%

-15%

- +10%

+0%

mm.10%

-10%

3/31/18 4/30/18 5/31/18 6/30/18 7/31/18 8/31/18

- S&P 500 -MSCI EM (USD) -BLK Equity Index ¹

Equity AUM and Base fee weightings

BLK Equity Benchmark

US

World

Other

Subtotal 25 bps

Europe

Emerging Markets

Asia

Commodities

Subtotal > 25 bps

Total Equity

% of EQ

Avg. AUM

50%

26%

7%

84%

6%

7%

3%

1%

16%

100%

2Q'18

% of EQ

Base Fees

33%

21%

7%

62%

13%

13%

9%

4%

38%

100%

Eff.

2

Bps ²

12

14

17

13

39

35

50

85

42

18

Market Perf ³

3

Since

3/31/18

10%

5%

(3%)

(10%)

(4%)

2%

Note: Market performance as of August 31, 2018 in USD

¹ Revenue weighted composite index calculated by BlackRock to approximate the impact of market fluctuations on BlackRock's equity base fees. The index is derived from publicly available market indices that represent applicable AUM benchmarks

for each equity portfolio, as selected by BlackRock. The market impact information for each equity portfolio used to calculate the index may be substantially different from that shown. Index does not include portfolios that do not have an applicable

market index. Index does not reflect BlackRock's investment performance, and is not indicative of past or future results.

2 Effective basis points calculated by dividing base fees including securities lending by average AUM

3 Equity benchmark market performance since 3/31/18 for US, World, Europe, Emerging Markets, Asia and Commodities represents performance in USD for S&P 500, MSCI World, MSCI Europe, MSCI EM, MSCI AC Asia and S&P Global Natural

Resources, respectively

BLACKROCK®

BI10918U-599462-1868978

11View entire presentation