Pershing Square Activist Presentation Deck

II. Pershing's View of McDonald's

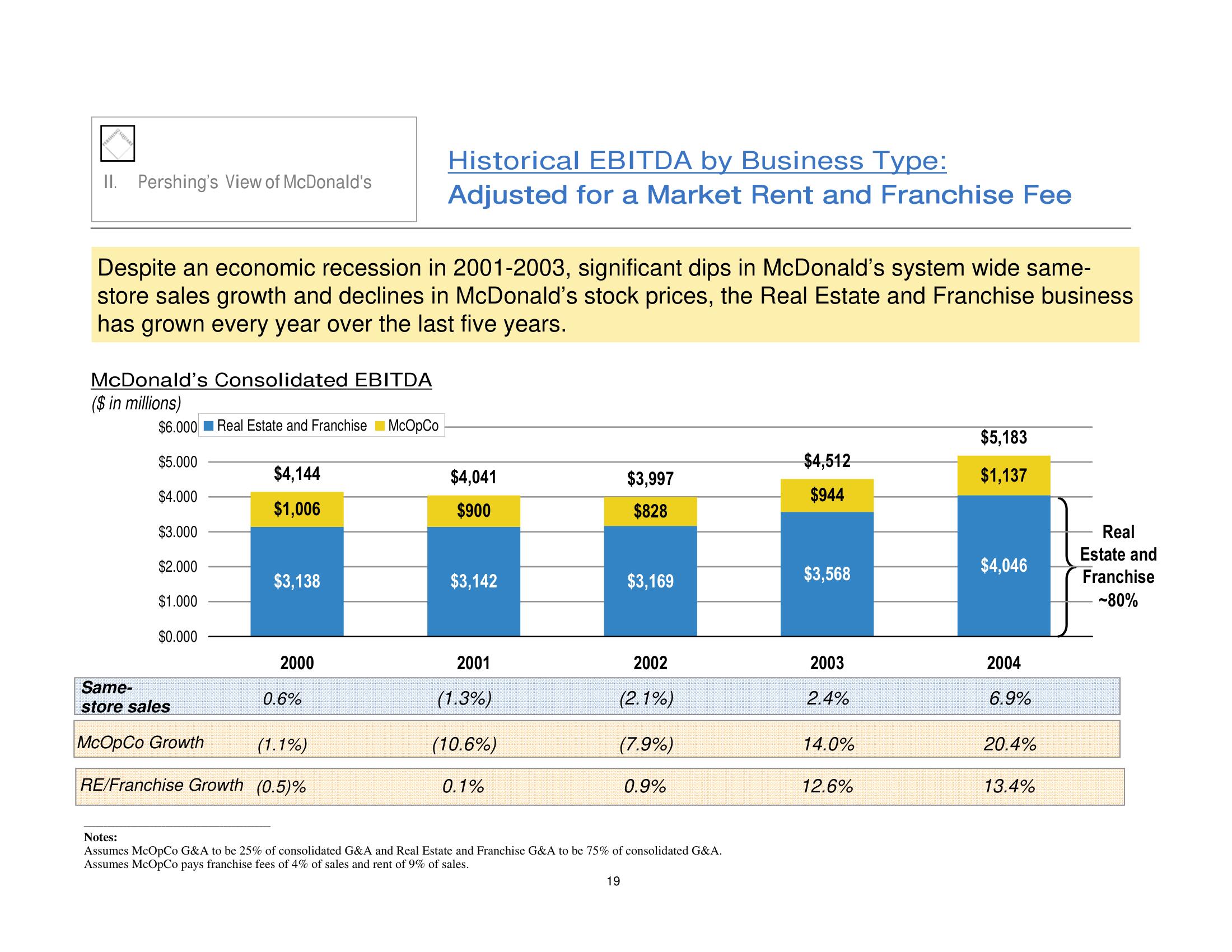

Despite an economic recession in 2001-2003, significant dips in McDonald's system wide same-

store sales growth and declines in McDonald's stock prices, the Real Estate and Franchise business

has grown every year over the last five years.

McDonald's Consolidated EBITDA

($ in millions)

$6.000

$5.000

$4.000

$3.000

$2.000

$1.000

$0.000

Same-

store sales

McOpCo Growth

Real Estate and Franchise McOpCo

$4,144

$1,006

$3,138

2000

0.6%

Historical EBITDA by Business Type:

Adjusted for a Market Rent and Franchise Fee

(1.1%)

RE/Franchise Growth (0.5)%

$4,041

$900

$3,142

2001

(1.3%)

(10.6%)

0.1%

$3,997

$828

$3,169

2002

(2.1%)

(7.9%)

0.9%

19

Notes:

Assumes McOpCo G&A to be 25% of consolidated G&A and Real Estate and Franchise G&A to be 75% of consolidated G&A.

Assumes McOpCo pays franchise fees of 4% of sales and rent of 9% of sales.

$4,512

$944

$3,568

2003

2.4%

14.0%

12.6%

$5,183

$1,137

$4,046

2004

6.9%

20.4%

13.4%

Real

Estate and

Franchise

~80%View entire presentation