Silicon Valley Bank Results Presentation Deck

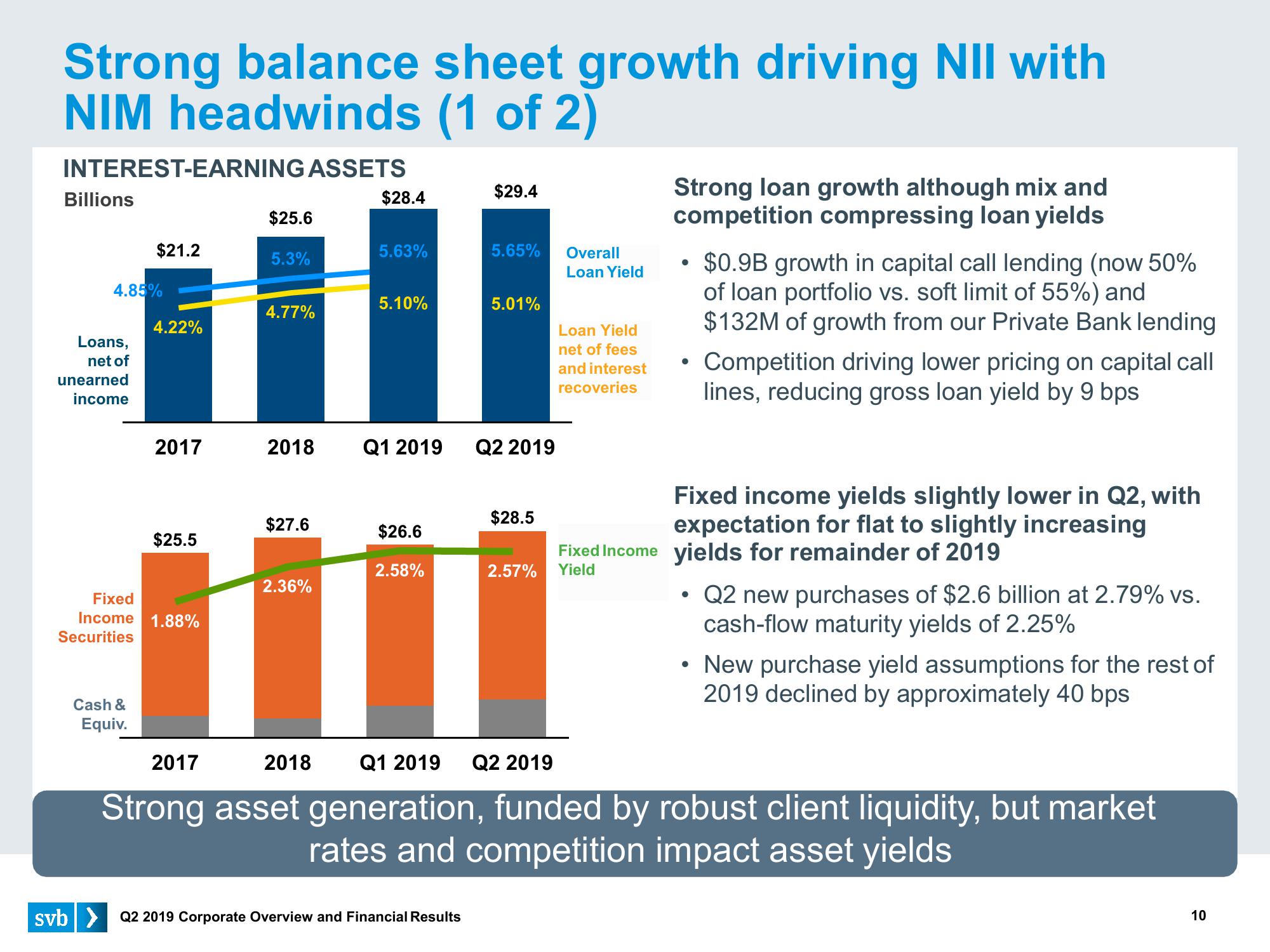

Strong balance sheet growth driving NII with

NIM headwinds (1 of 2)

INTEREST-EARNING ASSETS

Billions

Loans,

net of

unearned

income

4.85%

$21.2

Cash &

Equiv.

svb>

4.22%

2017

Fixed

Income 1.88%

Securities

$25.5

$25.6

5.3%

4.77%

2018

$27.6

2.36%

$28.4

2018

5.63%

5.10%

$26.6

2.58%

$29.4

5.65% Overall

Q1 2019 Q2 2019

Q2 2019 Corporate Overview and Financial Results

5.01%

$28.5

2.57%

Loan Yield

Loan Yield

net of fees

and interest

recoveries

Strong loan growth although mix and

competition compressing loan yields

●

$0.9B growth in capital call lending (now 50%

of loan portfolio vs. soft limit of 55%) and

$132M of growth from our Private Bank lending

• Competition driving lower pricing on capital call

lines, reducing gross loan yield by 9 bps

Fixed income yields slightly lower in Q2, with

expectation for flat to slightly increasing

Fixed Income yields for remainder of 2019

Yield

●

Q2 new purchases of $2.6 billion at 2.79% vs.

cash-flow maturity yields of 2.25%

2017

Q1 2019 Q2 2019

Strong asset generation, funded by robust client liquidity, but market

rates and competition impact asset yields

• New purchase yield assumptions for the rest of

2019 declined by approximately 40 bps

10View entire presentation