Main Street Capital Fixed Income Presentation Deck

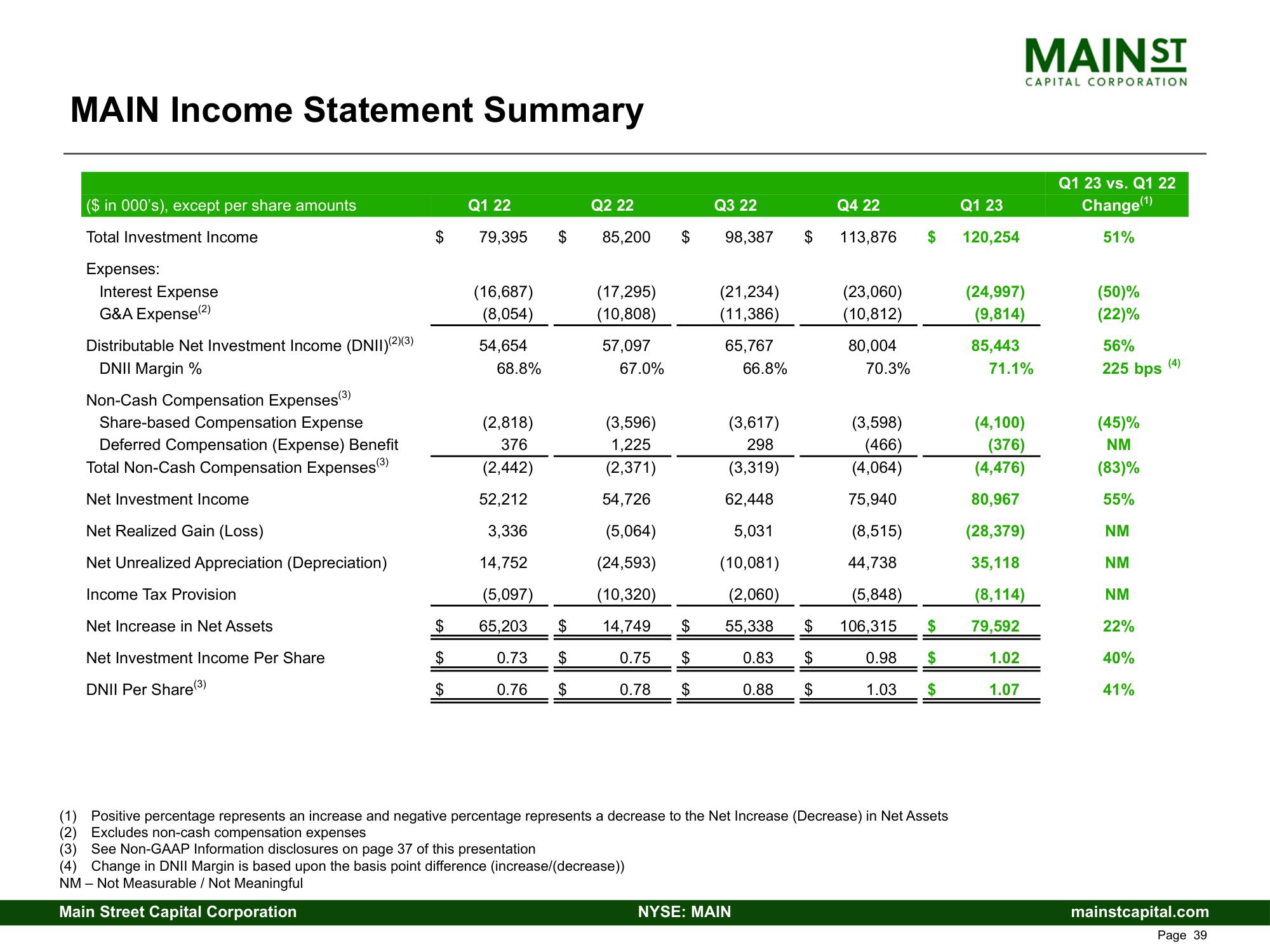

MAIN Income Statement Summary

($ in 000's), except per share amounts

Total Investment Income

Expenses:

Interest Expense

G&A Expense (2)

Distributable Net Investment Income (DNII)(2)(3)

DNII Margin %

Non-Cash Compensation Expenses (³)

Share-based Compensation Expense

Deferred Compensation (Expense) Benefit

Total Non-Cash Compensation Expenses(³)

Net Investment Income

Net Realized Gain (Loss)

Net Unrealized Appreciation (Depreciation)

Income Tax Provision

Net Increase in Net Assets

Net Investment Income Per Share

DNII Per Share (³)

Q1 22

79,395

(16,687)

(8,054)

54,654

68.8%

(2,818)

376

(2,442)

52,212

3,336

14,752

(5,097)

$ 65,203

$

$

$

$

0.73 $

0.76 $

Q2 22

85,200

(17,295)

(10,808)

57,097

67.0%

(3,596)

1,225

(2,371)

54,726

$

(5,064)

(24,593)

(10,320)

14,749

0.75

0.78 $

$

Q3 22

98,387

(21,234)

(11,386)

65,767

66.8%

$

NYSE: MAIN

Q4 22

113,876

(23,060)

(10,812)

80,004

70.3%

(3,598)

(466)

(4,064)

75,940

(3,617)

298

(3,319)

62,448

5,031

(5,848)

(10,081)

(2,060)

55,338 $ 106,315

0.83 $

0.98 $

0.88 $

1.03

$

$

(8,515)

44,738

Positive percentage represents an increase and negative percentage represents a decrease to the Net Increase (Decrease) in Net Assets

(2) Excludes non-cash compensation expenses

(3) See Non-GAAP Information disclosures on page 37 of this presentation

(4) Change in DNII Margin is based upon the basis point difference (increase/(decrease))

NM - Not Measurable / Not Meaningful

Main Street Capital Corporation

Q1 23

120,254

MAIN ST

85,443

CAPITAL CORPORATION

(24,997)

(9,814)

(4,100)

(376)

(4,476)

80,967

(28,379)

35,118

(8,114)

$ 79,592

1.02

1.07

71.1%

Q1 23 vs. Q1 22

Change (¹)

51%

(50)%

(22)%

56%

225 bps

(45)%

NM

(83)%

55%

NM

NM

NM

22%

40%

41%

(4)

mainstcapital.com

Page 39View entire presentation