Goldman Sachs Results Presentation Deck

Asset & Wealth Management - Alternative Investments

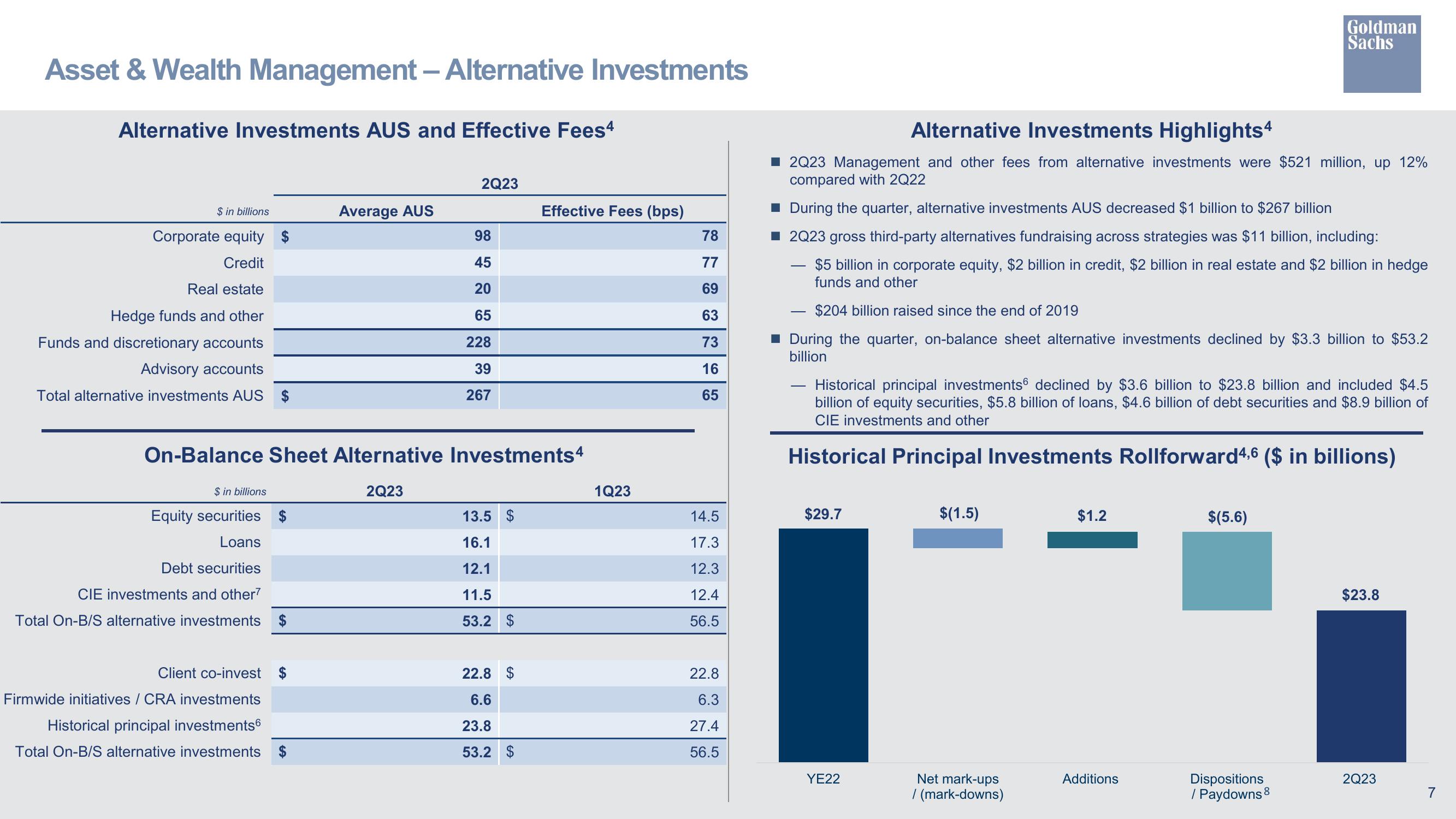

Alternative Investments AUS and Effective Fees4

$ in billions

Corporate equity

Credit

Real estate

Hedge funds and other

Funds and discretionary accounts

Advisory accounts

Total alternative investments AUS $

$ in billions

Equity securities

Loans

Debt securities

CIE investments and other7

Total On-B/S alternative investments

Average AUS

Client co-invest

Firmwide initiatives / CRA investments

Historical principal investments

Total On-B/S alternative investments

2Q23

On-Balance Sheet Alternative Investments4

2Q23

98

45

20

65

228

39

267

13.5 $

16.1

12.1

11.5

53.2 $

Effective Fees (bps)

22.8 $

6.6

23.8

53.2 $

1Q23

78

77

69

63

73 16 65

14.5

17.3

12.3

12.4

56.5

22.8

6.3

27.4

56.5

Alternative Investments Highlights4

2Q23 Management and other fees from alternative investments were $521 million, up 12%

compared with 2Q22

■ During the quarter, alternative investments AUS decreased $1 billion to $267 billion

2Q23 gross third-party alternatives fundraising across strategies was $11 billion, including:

$5 billion in corporate equity, $2 billion in credit, $2 billion in real estate and $2 billion in hedge

funds and other

$204 billion raised since the end of 2019

During the quarter, on-balance sheet alternative investments declined by $3.3 billion to $53.2

billion

Historical principal investments6 declined by $3.6 billion to $23.8 billion and included $4.5

billion of equity securities, $5.8 billion of loans, $4.6 billion of debt securities and $8.9 billion of

CIE investments and other

Historical Principal Investments Rollforward 4,6 ($ in billions)

$29.7

YE22

$(1.5)

Net mark-ups

/ (mark-downs)

$1.2

Additions

Goldman

Sachs

$(5.6)

Dispositions

/ Paydowns 8

$23.8

2Q23

7View entire presentation