Evercore Investment Banking Pitch Book

Process Considerations

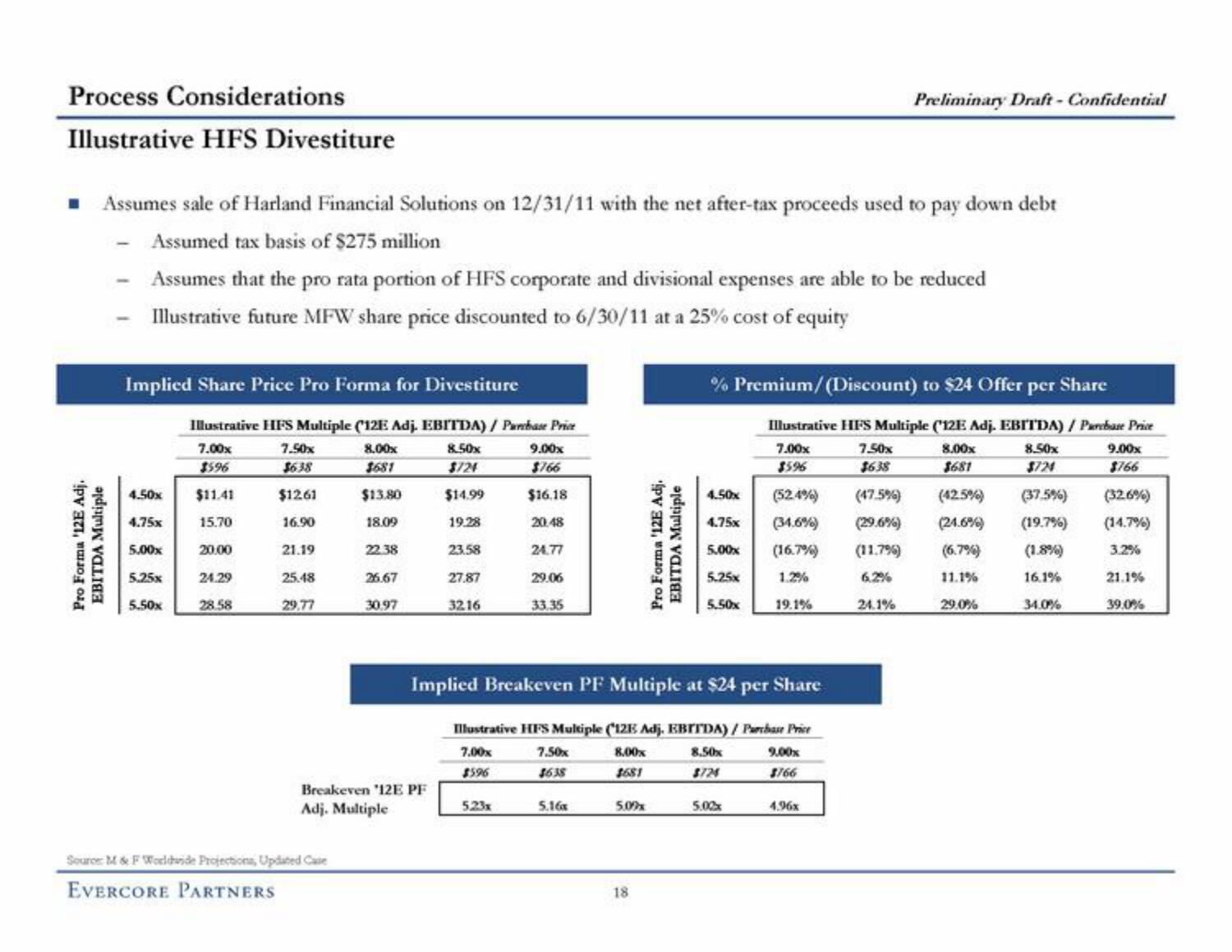

Illustrative HFS Divestiture

Assumes sale of Harland Financial Solutions on 12/31/11 with the net after-tax proceeds used to pay down debt

Assumed tax basis of $275 million

Assumes that the pro rata portion of HFS corporate and divisional expenses are able to be reduced

Illustrative future MFW share price discounted to 6/30/11 at a 25% cost of equity

Pro Forma '12E Adj.

EBITDA Multiple

Implied Share Price Pro Forma for Divestiture

Illustrative HFS Multiple (12E Adj. EBITDA) / Parbase Price

7.00x

8.00x

8.50x

$596

$681

$724

4.50x $11.41

$13.80

$14.99

4.75x

15.70

18.09

19.28

5.00x

20.00

22.38

23.58

5.25x

5.50x

24.29

28.58

7.50x

$6.38

$12.61

16.90

21.19

25.48

29.77

26.67

30.97

Source: M & F Worldwide Projections, Updated Case

EVERCORE PARTNERS

Breakeven '12E PF

Adj. Multiple

27.87

32.16

9.00x

$766

$16.18

20.48

24.77

5.23x

29.06

33.35

7.50x

$638

5.16

Implied Breakeven PF Multiple at $24 per Share

Illustrative HFS Multiple (12E Adj. EBITDA)/ Parchase Price

7.00x

8.00x

8.50x

$596

$681

$724

5.09

Multiple

Pro Forma '12E Adj.

EBITDA

18.

% Premium/(Discount) to $24 Offer per Share

4.50x

4.75x

5.00x

5.25x

5.50x

5.00x

Illustrative HFS Multiple (12E Adj. EBITDA) / Parebase Price

7.00x

8.00x

8.50x

$596

$681

(47.5%)

(42.5%)

(29.6%) (24.6%)

(11.7%)

(6.7%)

6.2%

11.1%

24.1%

(52.4%)

(34.6%)

(16.7%)

1.2%

19.1%

Preliminary Draft - Confidential

9.00x

3766

4.96x

7.50x

$638

29.0%

(37.5%)

(19.7%)

(1.8%)

16.1%

34.0%

9.00x

$766

(32.6%)

(14.7%)

3.2%

21.1%

39.0%View entire presentation