Affirm Results Presentation Deck

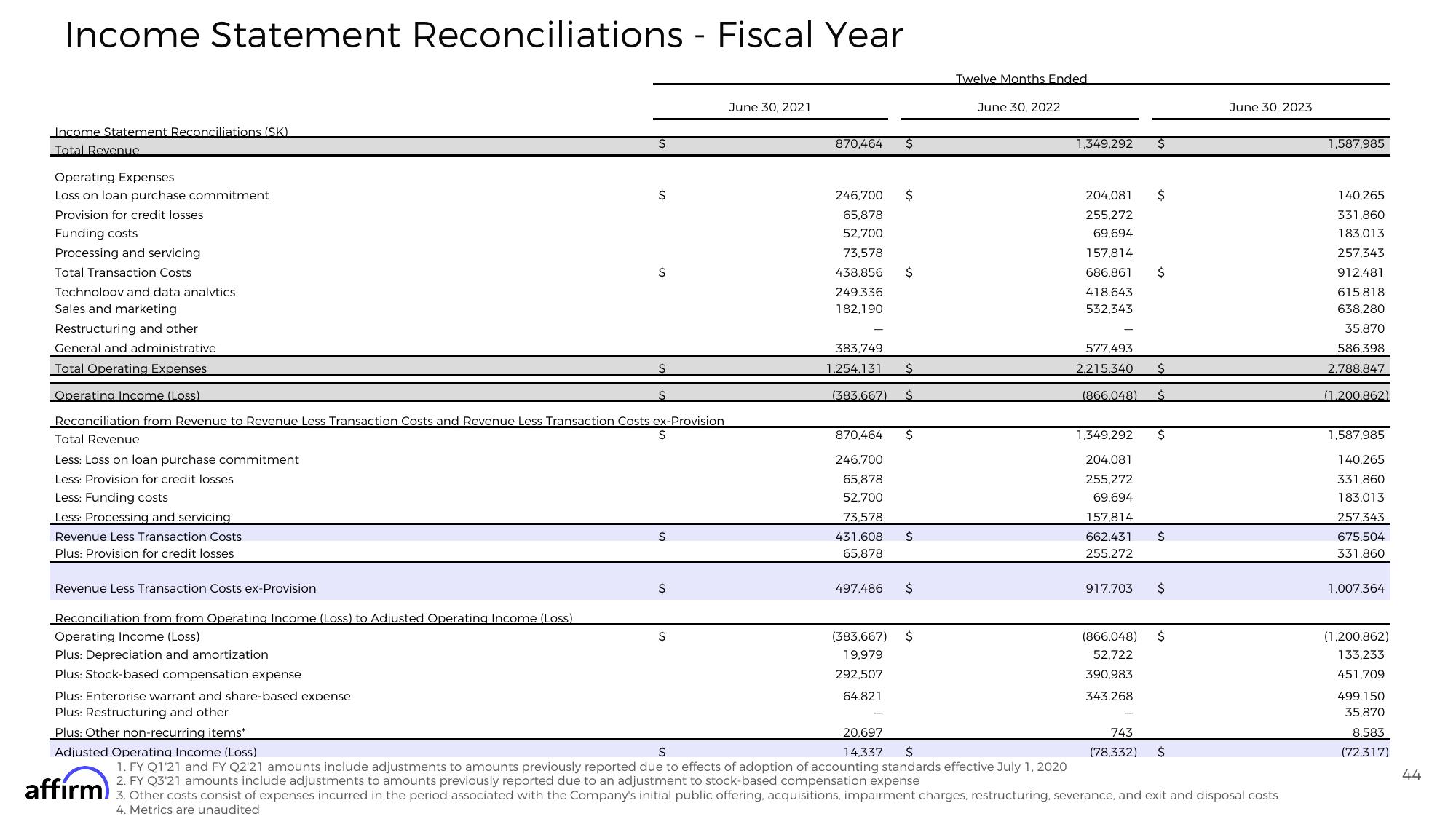

Income Statement Reconciliations - Fiscal Year

Income Statement Reconciliations (SK)

Total Revenue

Operating Expenses

Loss on loan purchase commitment

Provision for credit losses

Funding costs

Processing and servicing

Total Transaction Costs

Technoloav and data analvtics

Sales and marketing

Restructuring and other

General and administrative

Total Operating Expenses

Operating Income (Loss)

Revenue Less Transaction Costs

Plus: Provision for credit losses

Revenue Less Transaction Costs ex-Provision

Reconciliation from Revenue to Revenue Less Transaction Costs and Revenue Less Transaction Costs ex-Provision

Total Revenue

$

Less: Loss on loan purchase commitment

Less: Provision for credit losses

Less: Funding costs

Less: Processing and servicing

Reconciliation from from Operating Income (Loss) to Adjusted Operating Income (Loss)

Operating Income (Loss)

Plus: Depreciation and amortization

Plus: Stock-based compensation expense

$

Plus: Enterprise warrant and share-based expense

Plus: Restructuring and other

Plus: Other non-recurring items*

$

$

Ś

Ś

$

$

June 30, 2021

870,464

246,700 $

65,878

52,700

73,578

438,856

249.336

182,190

383,749

1,254,131

(383,667)

497.486

$

67)

19,979

292,507

64.821

$

Ś

870,464

246,700

65,878

52,700

73,578

431.608 Ś

65,878

$

$

Twelve Months Ended

June 30, 2022

1,349,292 $

204,081

255,272

69,694

157,814

686,861

418.643

532,343

577,493

2,215,340

(866,048)

1,349,292

204,081

255,272

69,694

157,814

662.431

255,272

917,703

(866,048)

52,722

390,983

343.268

$

$

$

$

$

$

$

743

(78.332) $

June 30, 2023

20,697

14,337 $

Adjusted Operating Income (Loss)

$

1. FY Q1'21 and FY Q2'21 amounts include adjustments to amounts previously reported due to effects of adoption of accounting standards effective July 1, 2020

2. FY Q3'21 amounts to amounts due to an

to

affirm) 3. Other costs consist of expenses incurred in the period associated with the Company's initial public offering, acquisitions, impairment charges, restructuring, severance, and exit and disposal costs

4. Metrics are unaudited

1,587,985

140,265

331,860

183,013

257,343

912,481

615.818

638,280

35,870

586,398

2,788,847

(1,200,862)

1,587,985

140,265

331,860

183,013

257,343

675.504

331,860

1,007,364

(1,200,8

133,233

451,709

499.150

35,870

8,583

(72,317)

44View entire presentation