IGI SPAC Presentation Deck

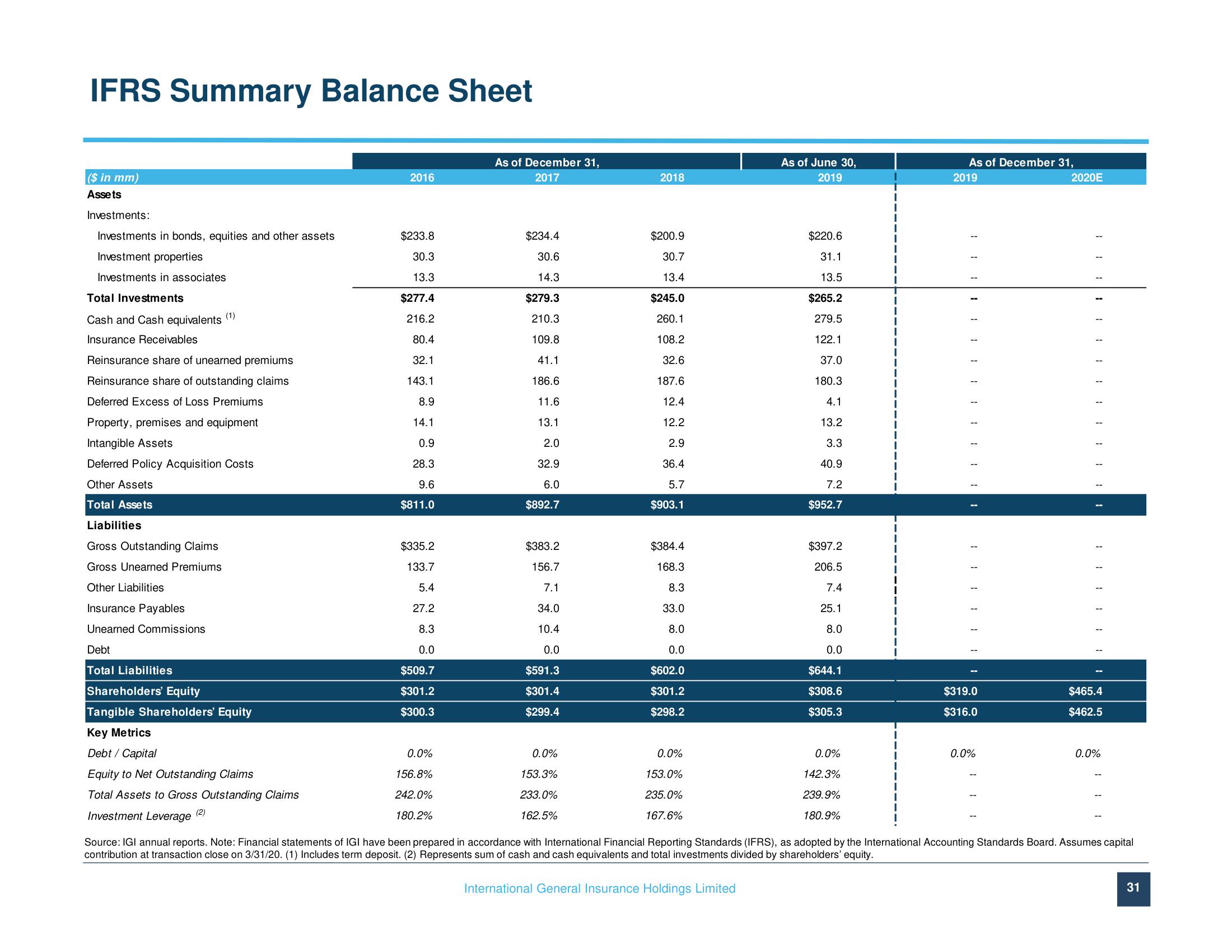

IFRS Summary Balance Sheet

($ in mm)

Assets

Investments:

Investments in bonds, equities and other assets

Investment properties

Investments in associates

Total Investments

Cash and Cash equivalents (1)

Insurance Receivables

Reinsurance share of unearned premiums

Reinsurance share of outstanding claims

Deferred Excess of Loss Premiums

Property, premises and equipment

Intangible Assets

Deferred Policy Acquisition Costs

Other Assets

Total Assets

Liabilities

Gross Outstanding Claims

Gross Unearned Premiums

Other Liabilities

Insurance Payables

Unearned Commissions

Debt

Total Liabilities

Shareholders' Equity

Tangible Shareholders' Equity

Key Metrics

Debt / Capital

Equity to Net Outstanding Claims

Total Assets to Gross Outstanding Claims

(2)

2016

$233.8

30.3

13.3

$277.4

216.2

80.4

32.1

143.1

8.9

14.1

0.9

28.3

9.6

$811.0

$335.2

133.7

5.4

27.2

8.3

0.0

$509.7

$301.2

$300.3

0.0%

156.8%

242.0%

180.2%

As of December 31,

2017

$234.4

30.6

14.3

$279.3

210.3

109.8

41.1

186.6

11.6

13.1

2.0

32.9

6.0

$892.7

$383.2

156.7

7.1

34.0

10.4

0.0

$591.3

$301.4

$299.4

0.0%

153.3%

233.0%

162.5%

2018

$200.9

30.7

13.4

$245.0

260.1

108.2

32.6

187.6

12.4

12.2

2.9

36.4

5.7

$903.1

$384.4

168.3

8.3

33.0

8.0

0.0

$602.0

$301.2

$298.2

0.0%

153.0%

235.0%

167.6%

As of June 30,

2019

$220.6

31.1

13.5

$265.2

279.5

122.1

37.0

180.3

4.1

13.2

3.3

40.9

7.2

$952.7

$397.2

206.5

7.4

25.1

8.0

0.0

$644.1

$308.6

$305.3

0.0%

142.3%

239.9%

180.9%

As of December 31,

2019

$319.0

$316.0

0.0%

2020E

$465.4

$462.5

0.0%

Investment Leverage

Source: IGI annual reports. Note: Financial statements of IGI have been prepared in accordance with International Financial Reporting Standards (IFRS), as adopted by the International Accounting Standards Board. Assumes capital

contribution at transaction close on 3/31/20. (1) Includes term deposit. (2) Represents sum of cash and cash equivalents and total investments divided by shareholders' equity.

International General Insurance Holdings Limited

31View entire presentation