Tronox Holdings plc

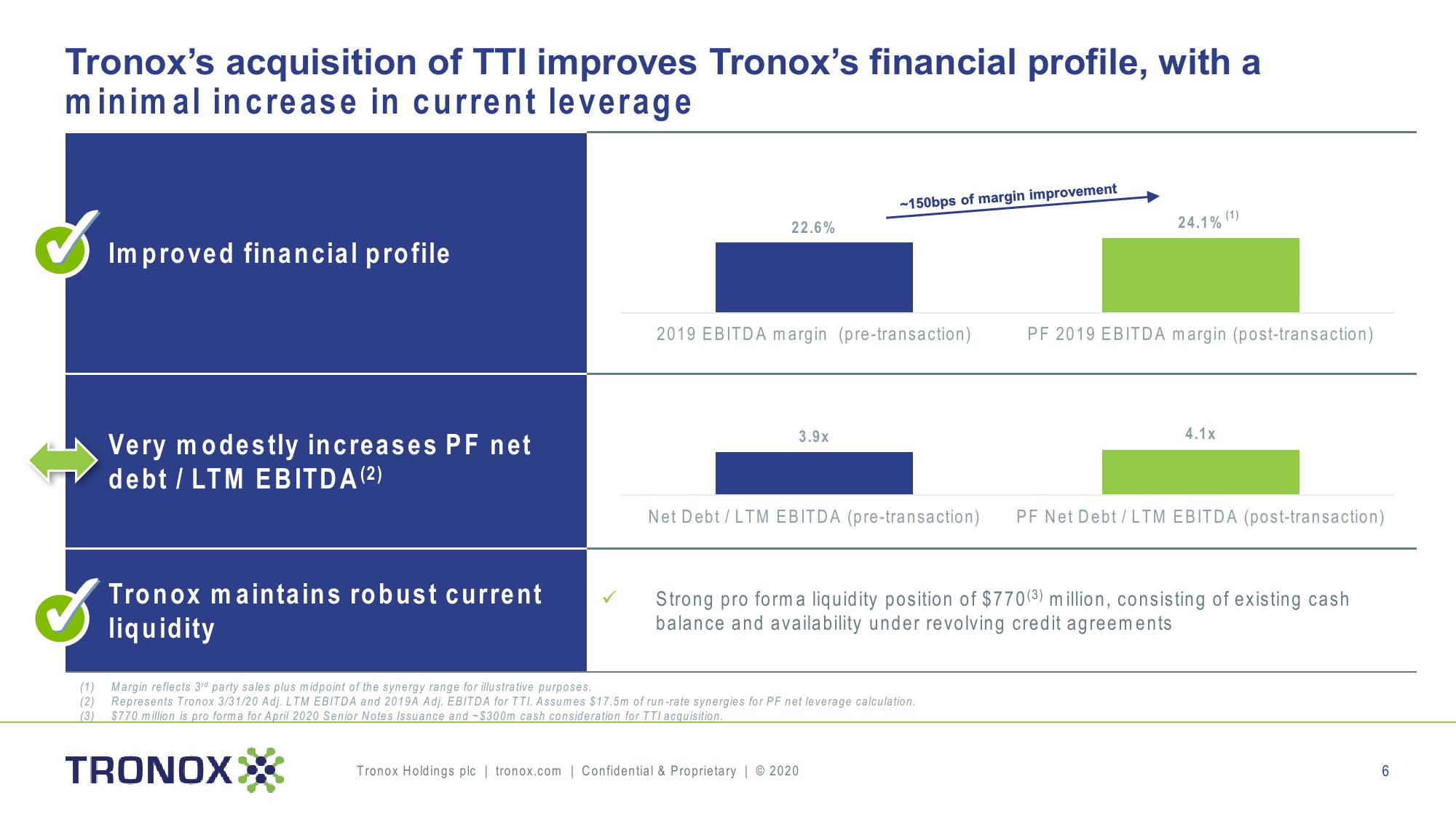

Tronox's acquisition of TTI improves Tronox's financial profile, with a

minimal increase in current leverage

(1)

(2)

(3)

Improved financial profile

Very modestly increases PF net

debt / LTM EBITDA (²)

Tronox maintains robust current

liquidity

22.6%

2019 EBITDA margin (pre-transaction)

3.9x

-150bps of margin improvement

Net Debt / LTM EBITDA (pre-transaction)

Margin reflects 3rd party sales plus midpoint of the synergy range for illustrative purposes.

Represents Tronox 3/31/20 Adj. LTM EBITDA and 2019A Adj. EBITDA for TTI. Assumes $17.5m of run-rate synergies for PF net leverage calculation.

$770 million is pro forma for April 2020 Senior Notes Issuance and -$300m cash consideration for TTI acquisition.

TRONOX

Tronox Holdings plc | tronox.com | Confidential & Proprietary | © 2020

24.1%

(1)

PF 2019 EBITDA margin (post-transaction)

4.1x

Strong pro forma liquidity position of $770(3) million, consisting of existing cash

balance and availability under revolving credit agreements

PF Net Debt/LTM EBITDA (post-transaction)

6View entire presentation