sndl Investor Presentation

Income Statement

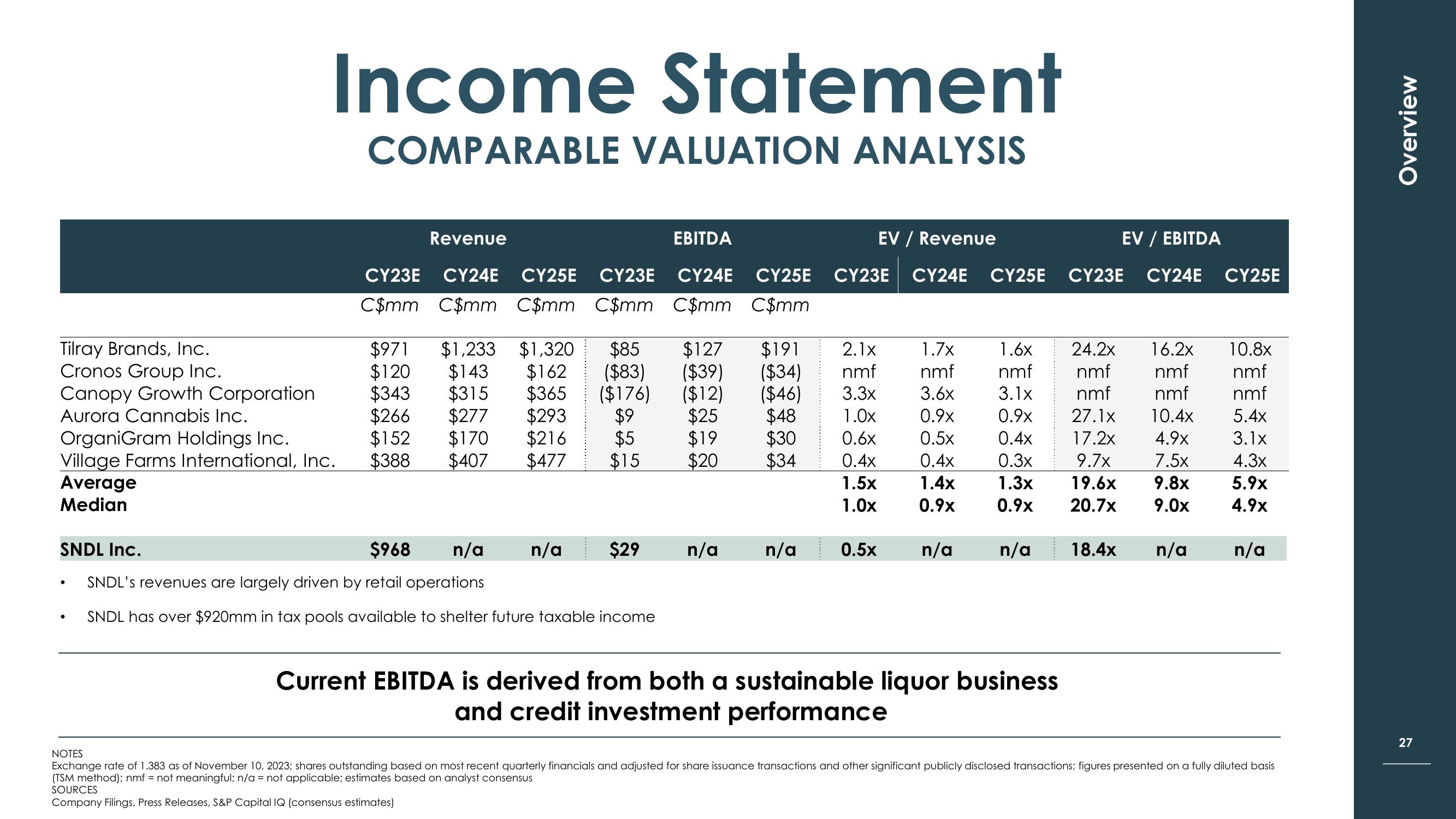

COMPARABLE VALUATION ANALYSIS

Tilray Brands, Inc.

Cronos Group Inc.

Canopy Growth Corporation

Aurora Cannabis Inc.

OrganiGram Holdings Inc.

Village Farms International, Inc.

Average

Median

●

Revenue

EBITDA

EV / Revenue

CY23E CY24E CY25E CY23E CY24E CY25E CY23E CY24E CY25E

C$mm C$mm C$mm C$mm C$mm_ C$mm

$971 $1,233 $1,320 $85 $127

$120

$343

$266

$152

$388 $407 $477

SNDL Inc.

$968

SNDL's revenues are largely driven by retail operations

SNDL has over $920mm in tax pools available to shelter future taxable income

$191

$143 $162 ($83) ($39) ($34)

$315 $365 ($176) ($12)

$277 $293 $9

$170 $216 $5

($46)

$25

$48

$19

$30

$15

$20

$34

n/a n/a

SOURCES

Company Filings, Press Releases, S&P Capital IQ (consensus estimates)

$29 n/a

2.1x

nmf

3.3x

1.0x

0.6x

0.4x

1.5x

1.0x

1.7x

1.6x

24.2x 16.2x

nmf

nmf

nmf

nmf

3.6x

3.1x

nmf

nmf

0.9x

0.9x 27.1x 10.4x

0.5x

0.4x

17.2x 4.9x

0.4x

0.3x

7.5x

9.7x

19.6x 9.8x

1.4x

1.3x

0.9x 0.9x

20.7x 9.0x

n/a 0.5x n/a

n/a

Current EBITDA is derived from both a sustainable liquor business

and credit investment performance

EV / EBITDA

CY23E CY24E CY25E

18.4x n/a

10.8x

nmf

nmf

5.4x

3.1x

4.3x

5.9x

4.9x

n/a

NOTES

Exchange rate of 1.383 as of November 10, 2023; shares outstanding based on most recent quarterly financials and adjusted for share issuance transactions and other significant publicly disclosed transactions; figures presented on a fully diluted basis

(TSM method); nmf = not meaningful; n/a = not applicable; estimates based on analyst consensus

Overview

27View entire presentation