Sotheby's Investor Presentation Deck

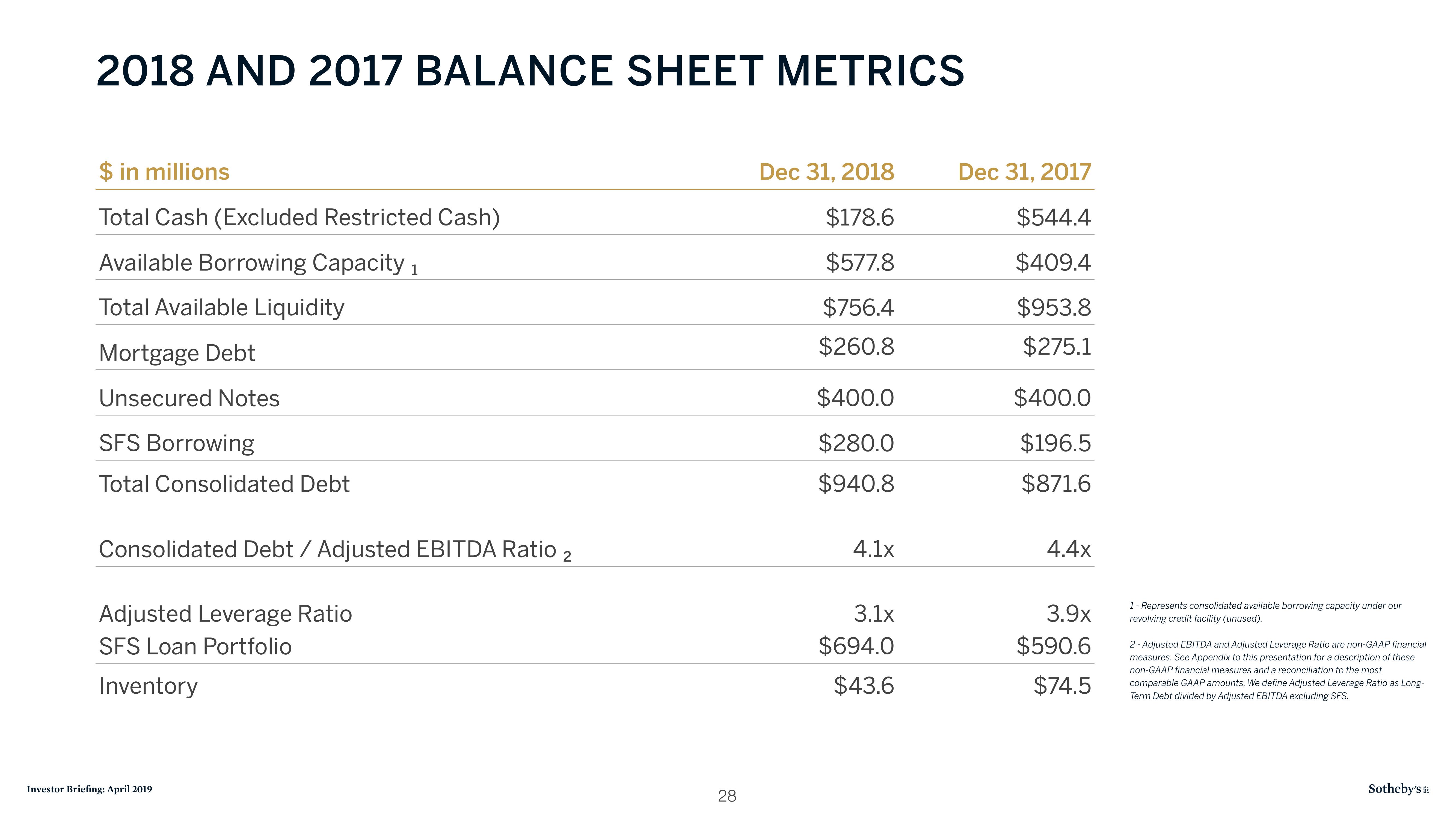

2018 AND 2017 BALANCE SHEET METRICS

$ in millions

Total Cash (Excluded Restricted Cash)

Available Borrowing Capacity 1

Total Available Liquidity

Mortgage Debt

Unsecured Notes

SFS Borrowing

Total Consolidated Debt

Consolidated Debt / Adjusted EBITDA Ratio

Adjusted Leverage Ratio

SFS Loan Portfolio

Inventory

Investor Briefing: April 2019

2

28

Dec 31, 2018

$178.6

$577.8

$756.4

$260.8

$400.0

$280.0

$940.8

4.1x

3.1x

$694.0

$43.6

Dec 31, 2017

$544.4

$409.4

$953.8

$275.1

$400.0

$196.5

$871.6

4.4x

3.9x

$590.6

$74.5

1- Represents consolidated available borrowing capacity under our

revolving credit facility (unused).

2-Adjusted EBITDA and Adjusted Leverage Ratio are non-GAAP financial

measures. See Appendix to this presentation for a description of these

non-GAAP financial measures and a reconciliation to the most

comparable GAAP amounts. We define Adjusted Leverage Ratio as Long-

Term Debt divided by Adjusted EBITDA excluding SFS.

Sotheby'sView entire presentation