Summer 2023 Solar Industry Update

Direct Payment of Tax Credits Guidance

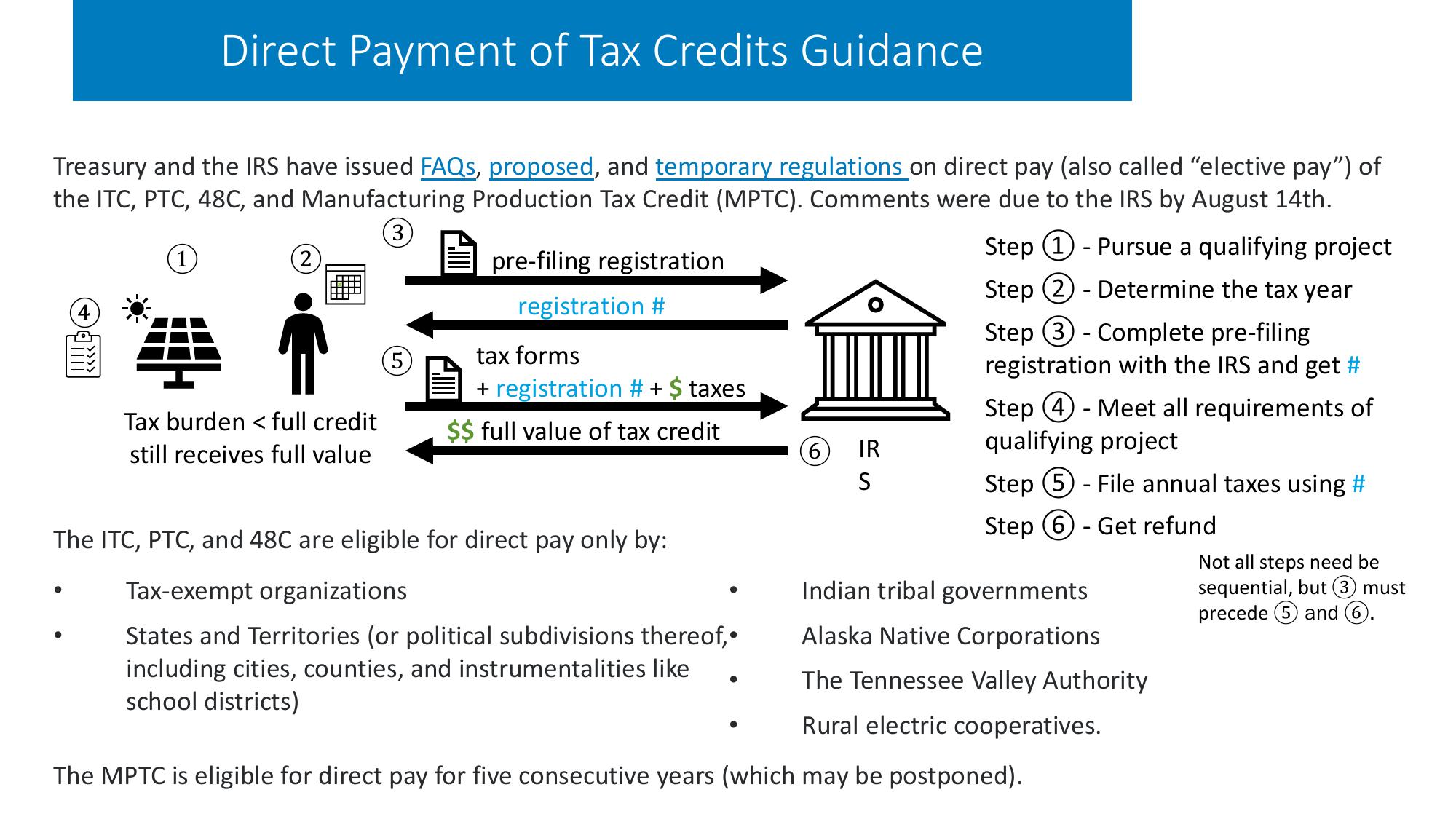

Treasury and the IRS have issued FAQs, proposed, and temporary regulations on direct pay (also called "elective pay") of

the ITC, PTC, 48C, and Manufacturing Production Tax Credit (MPTC). Comments were due to the IRS by August 14th.

•

3

2

pre-filing registration

registration #

5

tax forms

+ registration # + $ taxes

Tax burden < full credit

still receives full value

$$ full value of tax credit

6

IR

SE

Step 1 - Pursue a qualifying project

Step ②Determine the tax year

Step 3 - Complete pre-filing

registration with the IRS and get #

Step ④Meet all requirements of

qualifying project

Step ⑤- File annual taxes using #

Step 6 - Get refund

Indian tribal governments

The ITC, PTC, and 48C are eligible for direct pay only by:

Tax-exempt organizations

States and Territories (or political subdivisions thereof,⚫

including cities, counties, and instrumentalities like

school districts)

Alaska Native Corporations

.

The Tennessee Valley Authority

Rural electric cooperatives.

The MPTC is eligible for direct pay for five consecutive years (which may be postponed).

Not all steps need be

sequential, but ③ must

precede 5 and ⑥.View entire presentation