Bausch Health Companies Investor Conference Presentation Deck

Bausch Health 3Q21 Update

Bausch Pharma4

11

BAUSCH- Health

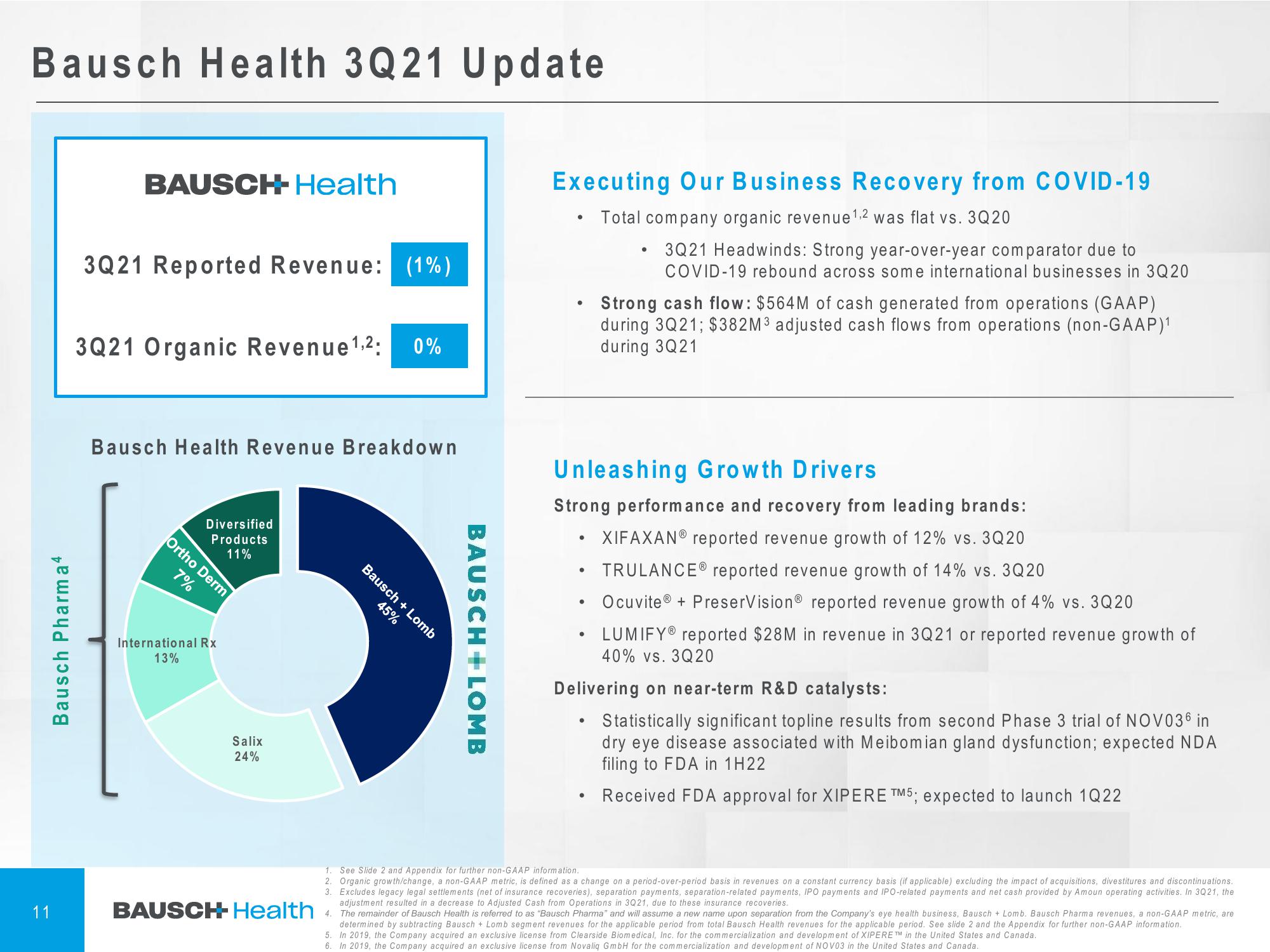

3Q21 Reported Revenue: (1%)

3Q21 Organic Revenue ¹,2: 0%

Bausch Health Revenue Breakdown

Diversified

Products

11%

Ortho Derm

7%

International Rx

13%

Salix

24%

BAUSCH Health

BAUSCH+ LOMB

Bausch + Lomb

45%

Executing Our Business Recovery from COVID-19

Total company organic revenue ¹,2 was flat vs. 3Q20

●

●

Unleashing Growth Drivers

Strong performance and recovery from leading brands:

XIFAXAN® reported revenue growth of 12% vs. 3Q20

TRULANCE® reported revenue growth of 14% vs. 3Q20

Ocuvite® + PreserVision® reported revenue growth of 4% vs. 3Q 20

LUMIFY® reported $28M in revenue in 3Q21 or reported revenue growth of

40% vs. 3Q20

●

●

●

3Q21 Headwinds: Strong year-over-year comparator due to

COVID-19 rebound across some international businesses in 3Q20

●

Strong cash flow: $564M of cash generated from operations (GAAP)

during 3Q21; $382M³ adjusted cash flows from operations (non-GAAP)¹

during 3Q21

Delivering on near-term R&D catalysts:

Statistically significant topline results from second Phase 3 trial of NOV036 in

dry eye disease associated with Meibomian gland dysfunction; expected NDA

filing to FDA in 1H22

Received FDA approval for XIPERE TM5; expected to launch 1022

●

1. See Slide 2 and Appendix for further non-GAAP information.

2. Organic growth/change, a non-GAAP metric, is defined as a change on a period-over-period basis in revenues on a constant currency basis (if applicable) excluding the impact of acquisitions, divestitures and discontinuations.

3. Excludes legacy legal settlements (net of insurance recoveries), separation payments, separation-related payments, IPO payments and IPO-related payments and net cash provided by Amoun operating activities. In 3Q21, the

adjustment resulted in a decrease to Adjusted Cash from Operations in 3Q21, due to these insurance recoveries.

4.

The remainder of Bausch Health is referred to as "Bausch Pharma" and will assume a new name upon separation from the Company's eye health business, Bausch + Lomb. Bausch Pharma revenues, a non-GAAP metric, are

determined by subtracting Bausch + Lomb segment revenues for the applicable period from total Bausch Health revenues for the applicable period. See slide 2 and the Appendix for further non-GAAP information.

5. In 2019, the Company acquired an exclusive license from Clearside Biomedical, Inc. for the commercialization and development of XIPERETM in the United States and Canada.

6. In 2019, the Company acquired an exclusive license from Novaliq GmbH for the commercialization and development of NOV03 in the United States and Canada.View entire presentation